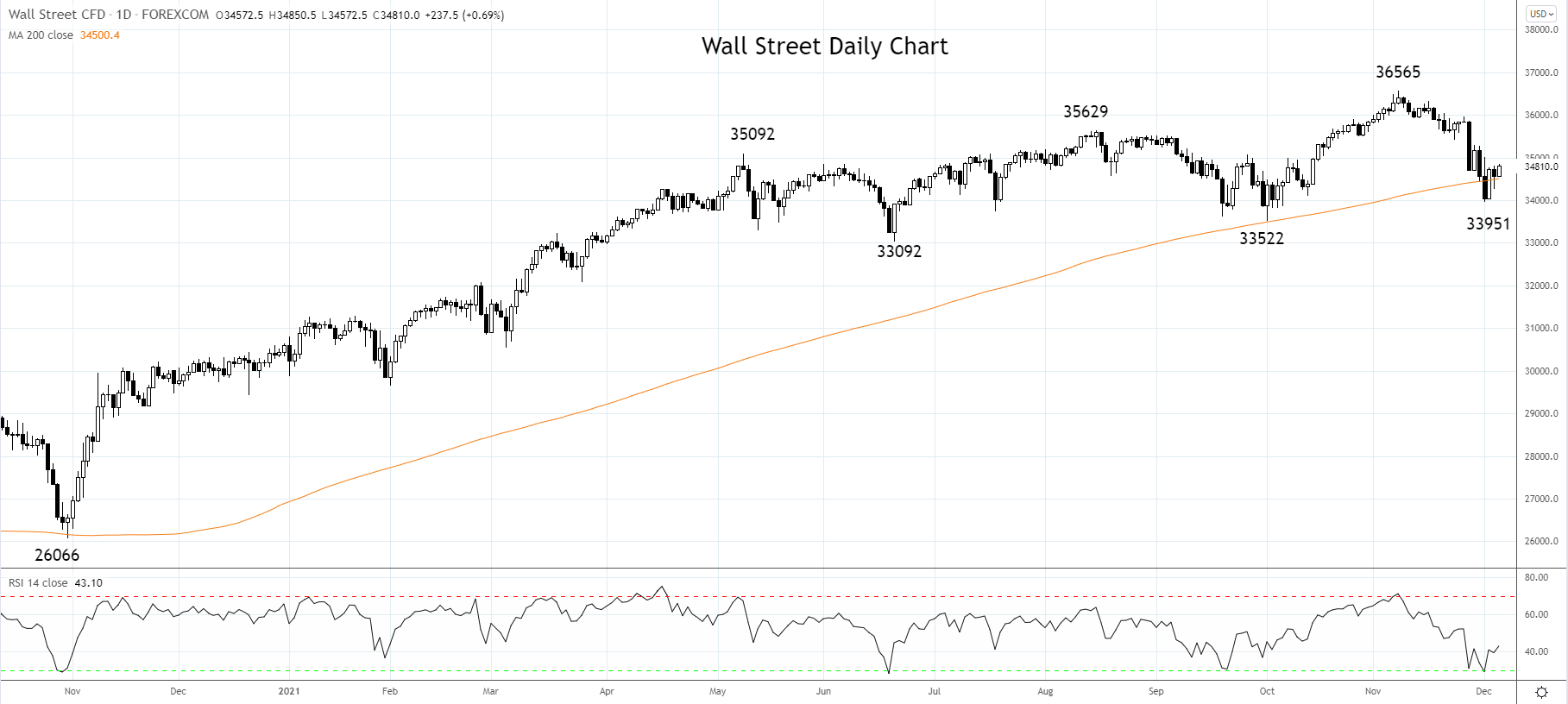

The optimism that was the hallmark of the first ten months of 2021 has been replaced by pessimism and fear of a rerun of December 2018.

Back then, a similar toxic mix of a hawkish Fed into slowing growth (from U.S. – China trade tensions) was behind a13% fall in the Wall Street in early December, before a dovish back flip by the current Fed Chair Powell prompted a belated Christmas recovery that extended until 2020.

If a Christmas rally in the Wall Street is going to play out in 2021, it is unlikely to be the result of a dovish backflip from Fed Chair Powell. This time around it will be the result of medical and scientific research that confirms early reports that Omicron is more transmissible than Delta but results in milder cases.

In this situation, the Wall Street will likely brush off last week’s hawkish Fed Pivot and springboard higher, potentially from the support provided by the 200-day moving average and recent lows near 34,500/34,000 where the Wall Street appears to be attempting to base.

To take advantage of this we would go long the Wall Street on a daily close (stop entry) above the November 29th 35,302 high. The protective stop loss would be placed below last week’s 33,951 low and the target for the trade is initially a retest of the early November 36,565 high, before 37,000.

Aware that the reason for using a stop entry is to allow for another few days of uncertainty as the market awaits more details around the Omicron variant, and to take advantage of “good” Omicron news presuming it arrives as hoped for, to spark an end of year Wall Street rally.

Source Tradingview. The figures stated areas of December 6th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade