- The US dollar Index (DXY) suffered its largest fall of 2023 earlier this week

- Large USD moves often coincide with turning points for broader markets

- Gold and S&P 500 are two markets heavily exposed to dollar fluctuations

USD turning point?

If Tuesday was a significant turning point on the outlook for US inflation, interest rates and dollar, it may have major ramifications for assets such as gold and the S&P 500.

Call it an overreaction or justified, the 1.5% plunge in the US dollar index was hard to miss earlier this week with the buck brutalised by a benign inflation report for October. While you should be careful reading too much into the price performance for a single day, declines of this magnitude in the world’s reserve currency are unusual, often acting as a turning point for broader financial markets given so many assets are priced in dollars.

The question many will be asking is whether this was such a turning point? On face value, it’s easy to argue it was with market attention seemingly turning from inflation to the economy and jobs market. Essentially, with inflation controlled, it’s now whether the Fed can stick the soft economic landing, a precondition that will almost certainly be required to spark further upside in asset prices over the near to medium-term.

Gold likes dollar weakess

Gold is one asset that will likely stand to benefit from a softer US dollar given it’s one of the two key longer-term drivers of price performance, the other being real, inflation adjusted bond yields which are also falling fast.

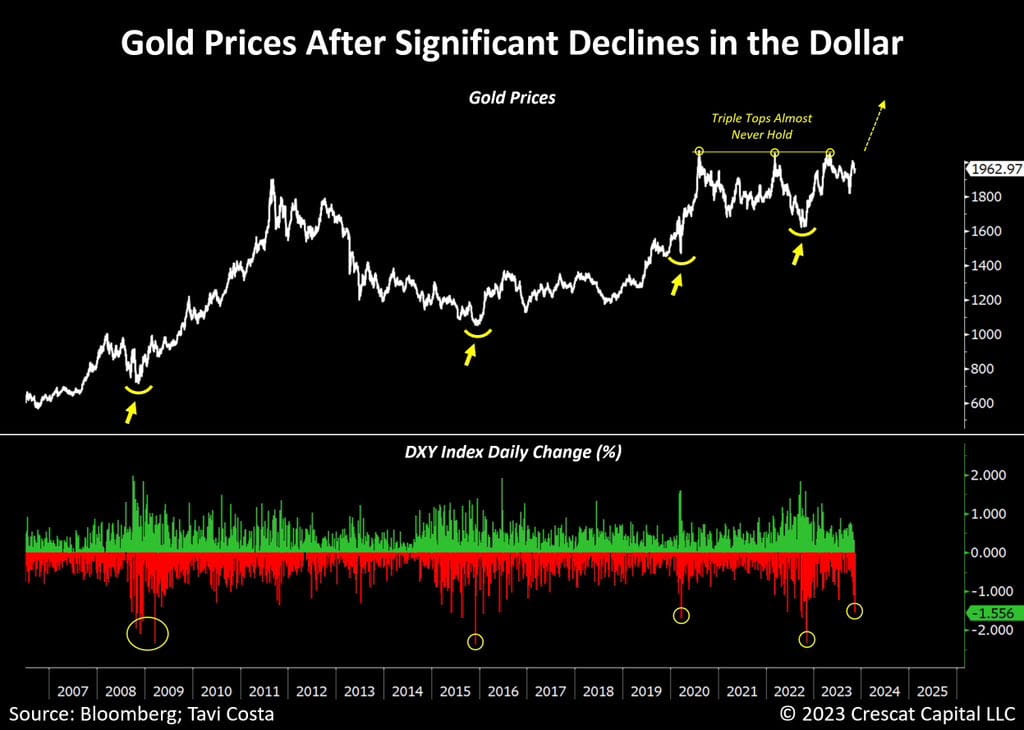

This chart from Otavio Costa posted on X underlines why the dollar’s plunge may have far greater ramifications if it was a turning point. Based on large moves in the past, it often marks the start of longer bullish trends.

S&P earnings impacted by dollar fluctuations

While there’s no guarantee we’ll see a similar outcome on this occasion, a sustained softening in the dollar would not just benefit gold but other assets whose valuation is impacted by currency fluctuations. The S&P 500, loaded with massive companies who derive earnings from all over the world, is another market which has a similar reaction function to gold when it comes to dollar movements, as seen in chart below.

Source: Refinitiv

Like gold, it’s not a perfect indicator but it makes sense that a weaker dollar would benefit US large cap stocks, flowing through to revenues, earnings and analyst upgrades thanks to favourable FX conversion rates.

Corrective gold episode may have run its course

Looking at gold on the daily chart, the corrective episode from above $2000 looks like it may have run its course with the price testing and bouncing strongly from the 200-day moving average, busting through resistance at $1946 in the process. With RSI and MACD not signalling a shift in momentum, it doesn’t come across as a compelling long trade just yet. However, with the heat coming out of the dollar and bond yields, pullbacks towards $1946 would improve the risk-reward dynamics, allowing for a stop to be placed either below the level or 200DMA.

On the topside, resistance is located at $1980 and again from $2005. A break of the latter would start getting bulls thinking about potential record highs just below $2100.

S&P 500 a buy-on-dips play despite looking stretched near-term

For the S&P 500, the index looks stretched like a rubber band after such a pronounced rally from the recent lows, especially with the inverted hammer candle produced on Wednesday after an attempt to break another resistance level at 4520 failed. That suggests there’s scope for a potential short-term short trade. However, having cleared so many key levels on the way up, it’s hard to argue the index is anything other than a buy-on-dips prospect in the absence of a stark deterioration in the macroeconomic landscape.

Support is located at 4440 and again at 4386 with resistance kicking in at 4520 and just below 4600. A break of the latter would open the door for potential record highs above 4800, should it occur.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade