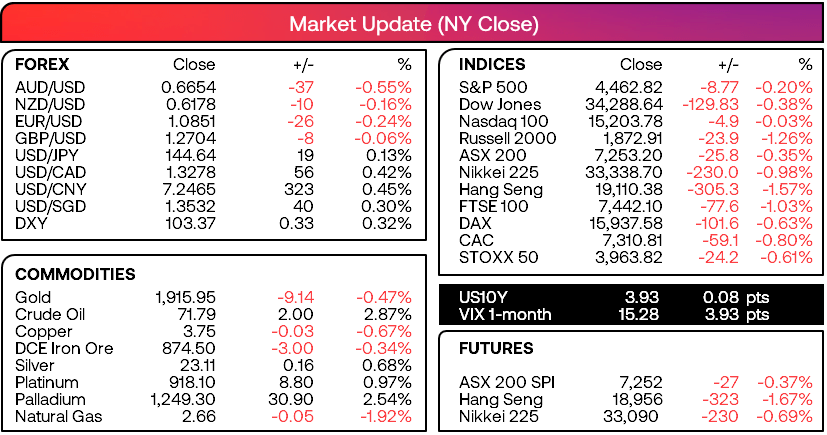

Market summary

- The FOMC minutes showed that members were not as ‘unanimous’ for a pause as previously indicated, as some supported a 25bp increase and “almost all” agreed more tightening was likely needed

- Fed fund futures now suggest am 88.7% probability of a 25bp Fed hike this month, and a 47.7% chance of another hike in November

- With markets now deeming the Fed to be more hawkish than previously thought, the US dollar was the strongest major as it tracked bond yields higher and Wall Street indices were slightly

- EUR was the weakest major and closed beneath 1.0900 with a bearish engulfing day, a bullish outside day formed on USD/CAD and AUD/USD rolled over from its 200-day EMA to close at the low of the day

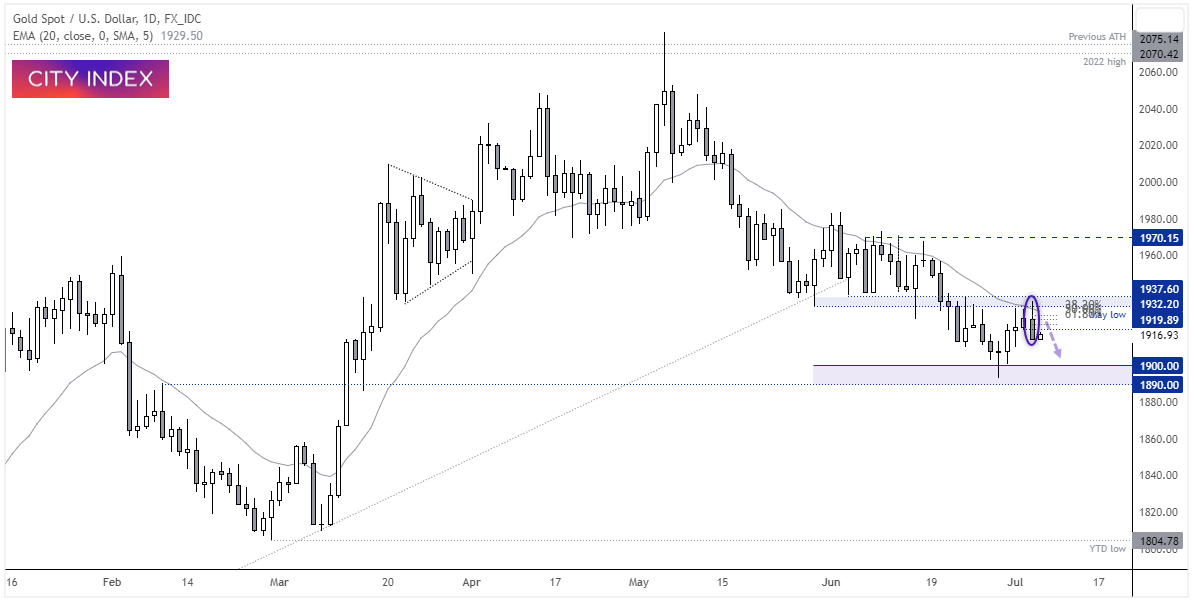

- Gold felt the strain of the hawkish minutes and higher yields, forming a bearish engulfing / outside day with its high in the 1932-1938 resistance zone

- With market coming around to a more hawkish Fed, they may be more sensitive to stronger US data – so any strength in tonight’s US employment figures or ISM services report could send gold back towards 1900

- There was a risk-off tone towards the end of yesterday’s Asian session leading into Europe as China’s services PMI data showed the economy continues to lose momentum

- Services PMI expanded, but at its slowest pace in five months at 53.9 which was down -3.2 points m/m – its fastest pace in nine months

- European indices fell for a third day with its pace accelerating, brining into doubt whether the prior two-day was merely a pullback (the DAX has now erased all of Friday’s but is holding just above 15,900)

Events in focus (AEDT):

- 11:30 – Australian trade data

- 21:00 – US job cuts, 22:50 – ADP employment, 10:30 – jobless claims

- 23:45 – Services PMI

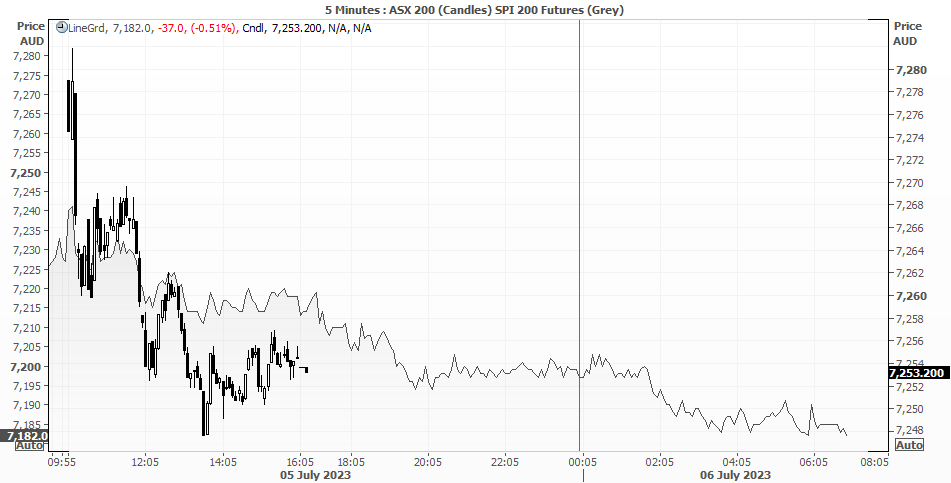

ASX 200 at a glance:

- The ASX 200 snapped a 3-day winning streak due to weak PMI data from China

- A bearish inside candle formed on the daily chart A weak lead from Wall Street and lower SPI futures points to a soft open of around -0.5%

- 7253.2 could be a pivotal level today (Tuesday’s low, 5th June high)

- Today’s bias is bearish as the ASX could be weighed down by bearish sentiment from Asian indices

Gold daily chart:

The bearish engulfing / outside day closed at the low of the day, and its high met resistance at the 50-day EMA and May lows. Prices are retreating slightly higher, so bears could seek to fade into any minor rallies within the lower third / half of yesterday’s range to anticipate a potential break of yesterday’s low, with a view for it to move towards 1900. A strong set of US employment data or ISM survey could help push gold lower.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM