- Gold and silver analysis: Metals remains supported on hopes Fed may cut rates sooner in 2024

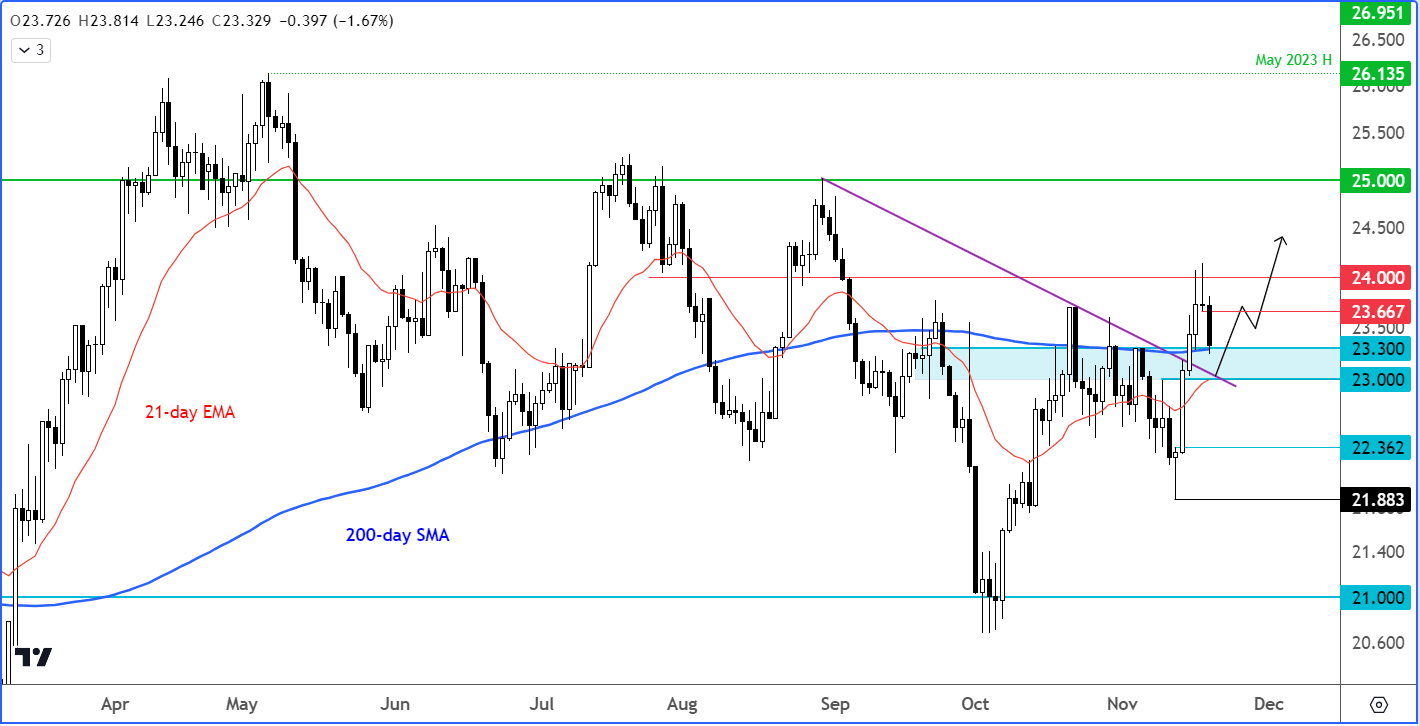

- Silver technical analysis: grey metal testing 200-day average as support

- Gold in bullish consolidation below $2000

Video: Silver analysis

Gold and silver should remain supported on the dips amid peak interest rates narrative, with the latter likely to be more active given that we are in a positive market environment with stocks also rising. Precious metals investors are hoping that the next interest rate move in the US will be a cut, possibly as early as the second quarter as signs emerge of inflation being on a consistent path of easing towards the Fed’s 2% average target in the long term. Silver was looking to bounce back after a two-day fall as it tested the 200-day average at the time of writing, near $23.30.

Gold and silver analysis: Peak interest rates narrative could get louder

Silver is likely to find support for as long as the US dollar remains weaker. The greenback has started the new week lower, extending its losses from the week before when the Dollar Index had slumped nearly 1.9%. The bulk of last week’s losses came in on Tuesday when US CPI came in weaker than expected. Even before the CPI data, speculation had been rife that the Federal Reserve had reached the end of its rate-hiking cycle. But following the cooler inflation data last week, the focus has shifted to when the Fed will start cutting rates again. Previously, the market was speculating this to start after the middle of next year at the earliest. But now, the market is attaching about a 30% chance of a first Fed rate cut taking place in March. For what it is worth, I think that view is quite optimistic, but the Fed is likely to cut sooner than it had projected in its dot plots at the September meeting.

Along with the dollar, US bond yields slumped last week after US CPI fell more than expected, cementing expectations that the Fed (and other central banks) will no longer raise rates further. When yields fall, they tend to boost the appeal of low and zero-yielding assets, including the Japanese yen, gold and silver. In short, the louder the “peak interest rates” narrative gets, the more support we are likely to see for gold and silver prices.

Silver technical analysis: 200-day average being tested as support.

Silver’s price action over the last several days has been beautiful, unless you are bear of course. The precious metal formed a hammer candle on Monday, which correctly indicated more gains would follow. It has found strong follow-through buying momentum after that hammer candle was followed by the formation of a three-bar bullish reversal pattern. Silver then broke above a key prior resistance area in the zone between $23.30 to $23.60, where we also had the 200-day moving average converging. At the start of this week, the precious metal has dipped back within this zone, now testing the 200-day average from above at $23.30ish. Formerly resistance, this area could turn into support moving forward.

I will maintain a bullish view on silver, with $25 now a realistic short-term objective, for as long as silver now holds above the 200-day average.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade