FOMC Meeting Key Points

- The FOMC left interest rates unchanged in the 5.25-5.50% range as expected.

- With few changes to the policy statement and little in the way of notable developments in the press conference, markets are consolidating.

- Watch resistance near 107.25 in the US Dollar Index.

FOMC Interest Rate Decision

As expected, the FOMC left interest rates unchanged in the 5.25-5.50% range.

FOMC Monetary Policy Statement

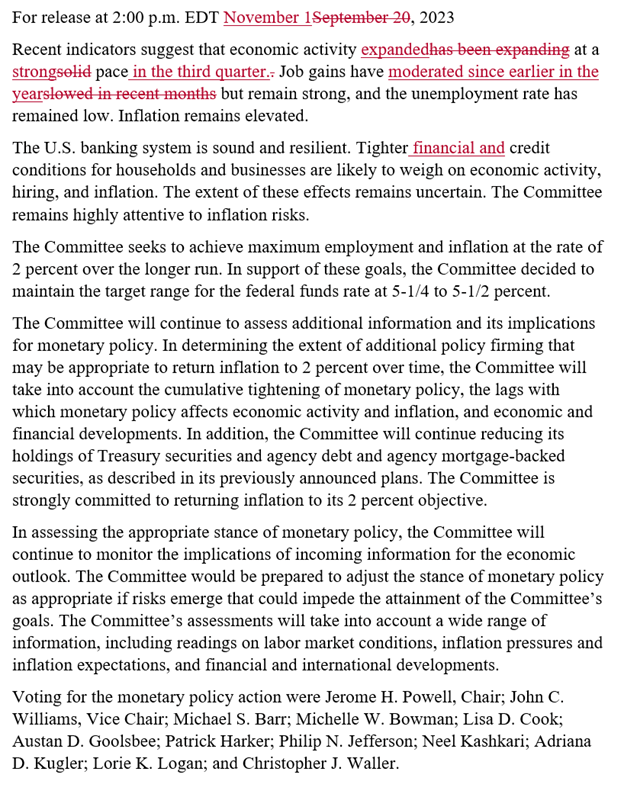

The central bank made relatively few tweaks to its monetary policy statement:

- Economic activity “expanded at a strong pace” (vs. “has been expanding at a solid pace” previously)

- Job gains have “moderated sine earlier in the year” (vs. “slowed in recent months”)

- Added “financial conditions” as a factor that may weigh on economic activity

The mention of financial conditions suggests that the recent increase in market-based interest rates may have done some of the central banks work for it, but the FOMC nonetheless left its comment about “remaining highly attentive to inflation risks” in the statement, suggesting that one more interest rate hike is still on the table.

Source: Federal Reserve, StoneX

Fed Chairman Powell’s Press Conference

Jerome Powell is still wrapping up his comments as we go to press, but so far, he has done little to rock the proverbial boat. As the headlines below show, the Fed Chairman is loath to explicitly rule out additional rate hikes, but he’s also not saying they’re particularly likely either:

- FULL EFFECTS OF TIGHTENING YET TO BE FELT

- ECONOMY HAS EXPANDED WELL ABOVE EXPECTATIONS

- NOMINAL WAGE GROWTH HAS SHOWN SOME SIGNS OF EASING

- A FEW MONTHS OF GOOD INFLATION DATA 'ONLY THE BEGINNING' OF WHAT IT WILL TAKE

- COULD WARRANT FURTHER INTEREST RATE HIKES

- WE ARE NOT CONFIDENT POLICY IS SUFFICIENTLY RESTRICTIVE

- WE ARE ATTENTIVE TO INCREASE IN LONGER TERM YIELDS

- TIGHTER CONDITIONS WOULD NEED TO BE PERSISTENT

- EVIDENCE OF ABOVE-POTENTIAL GDP COULD WARRANT HIKE

- WE ARE NOT THINKING OR TALKING ABOUT RATE CUTS

- THE QUESTION WE ARE ASKING IS, SHOULD WE HIKE MORE

- STILL LIKELY THAT WE WILL NEED TO SEE SOME SLOWER GROWTH, SOFTENING IN LABOR MARKET TO RESTORE PRICE STABILITY

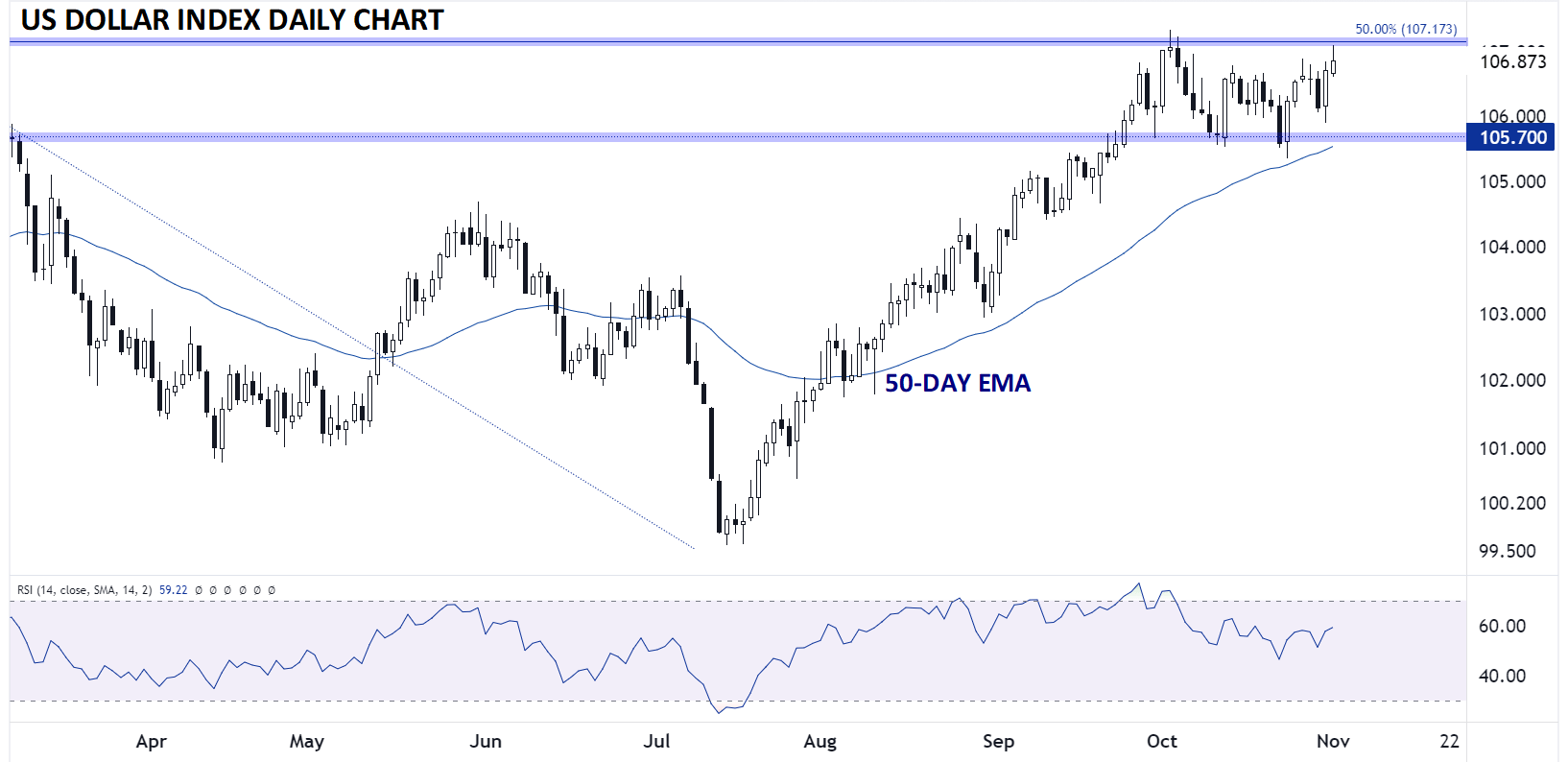

US Dollar Index Technical Analysis – DXY Daily Chart

Source: TradingView, StoneX

The US dollar dipped a quick 10 pips on the release of the mostly as-expected statement before recovering to essentially unchanged at the start of the press conference. As we go to press, the greenback is still consolidating just below the 107.00 level, with other major assets like US bonds, stock indices, and gold all showing little in the way of volatility either, with maybe a slight bias toward a more dovish reaction (stocks ticking up, yields edging lower, etc).

We’ll keep an eye out for any late bombshells from Mr. Powell, but so far, if his goal was to move markets as little as possible, he’s succeeding with flying colors. Watch for a potential break above resistance in the 107.20-25 zone to signal another potential leg higher in the US dollar index if Powell says anything hawkish.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX