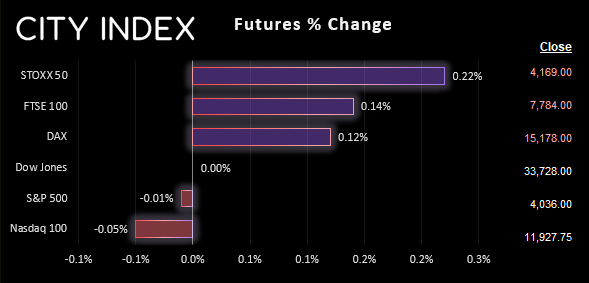

UK and Europe:

- UK's FTSE 100 futures are currently up 10.5 points (0.14%), the cash market is currently estimated to open at 7,795.17

- Euro STOXX 50 futures are currently up 9 points (0.22%), the cash market is currently estimated to open at 4,159.82

- Germany's DAX futures are currently up 18 points (0.12%), the cash market is currently estimated to open at 15,120.95

US Futures:

- DJI futures are currently up 3 points (0.01%)

- S&P 500 futures are currently down -4.75 points (-0.04%)

- Nasdaq 100 futures are currently down 0 points (0%)

Business confidence contracted for a third month in Australia, according the NAB survey. Whilst the report noted continued price increases for inputs and outputs, it noted a weaker trend which suggests inflationary pressures may have peaked. And that helped the ASX 200 push to a fresh 9-month high on hopes of a softer CPI print tomorrow.

Liquidity was lower overnight due to key exchanges in China, Hong Kong and Singapore being closed to celebrate the lunar new year.

S&P global release their final PMI readings for Europe, UK and the US – which also include the composite and services data. The general consensus is for sectors to contract at a slightly faster pace, which further cement beliefs that the Fed will pivot sooner. Whilst I disagree with this sentiment (and expect the Fed to hold rates higher for longer than many suspect), the fact is it is this view that is shaping price action and supporting equity prices. Therefore, bad news could be good news for Wall Street is US PMI’s contract – and also gold prices.

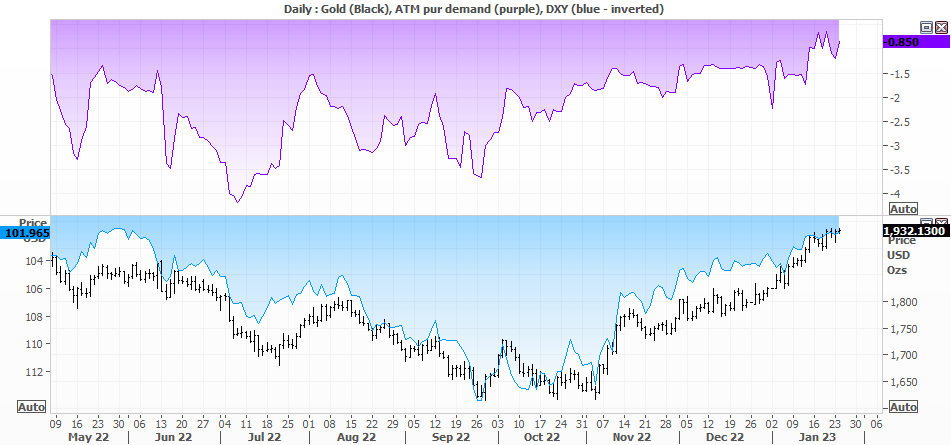

Gold put remand continues to fall:

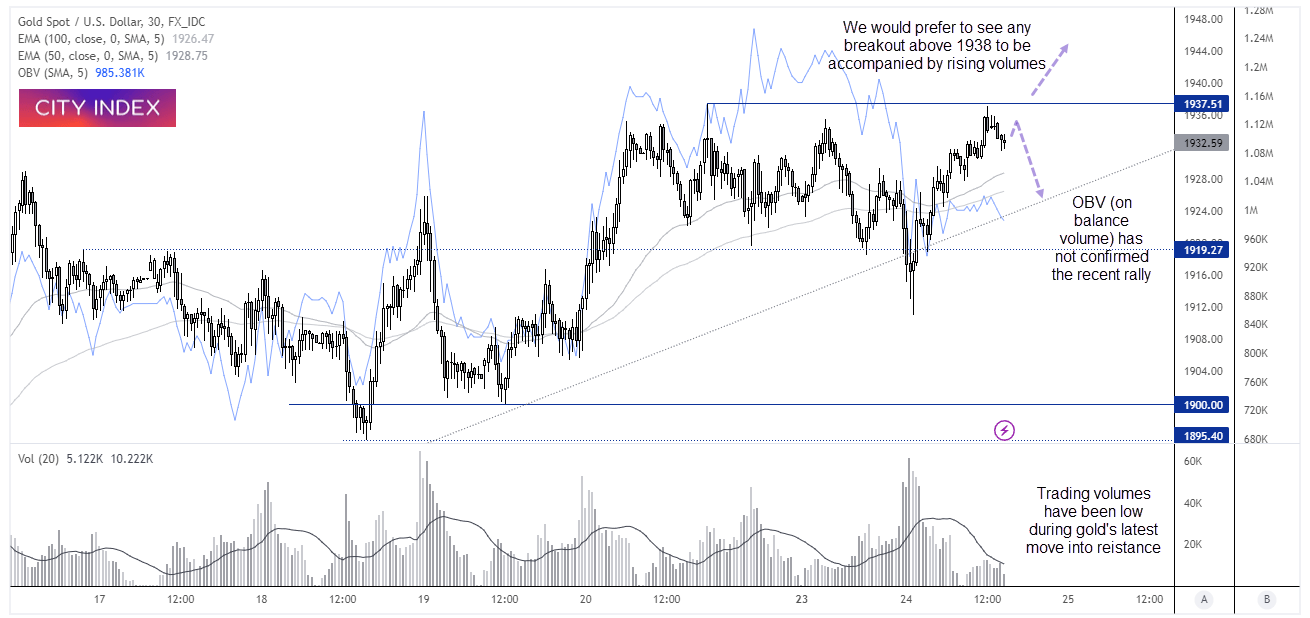

Gold prices considered a break to a fresh 9-month high overnight before pulling back later in the session. But the rise into resistance was not accompanied by rising volumes, which remain very low over the China lunar new year. Whilst we see it potential to have another crack at the highs, I’m conscious of lack of buying power and for it to produce a deeper pullback towards 1920 – 1930 before breaking higher. We would like to see a breakout above 1938 accompanied with above-average volume to confirm any such break.

Whilst the US dollar has been a factor behind gold’s strength, gold has done well to rise given yields were up for three days in a row. But it is also receiving safe haven flows on the theme of a weaker US economy and less-aggressive Fed tightening cycle. Also note that put demand has been notably lower whilst prices have risen and is close to moving above zero which shows call demand outstripping put demand.

Further out, gold looks like it could hold above 1900 ahead of US data between now and Thursday, with disappointing numbers likely to help gold climb above 1960. But I doubt it will simply break through $2000 on its first attempt, given the significance of the number.

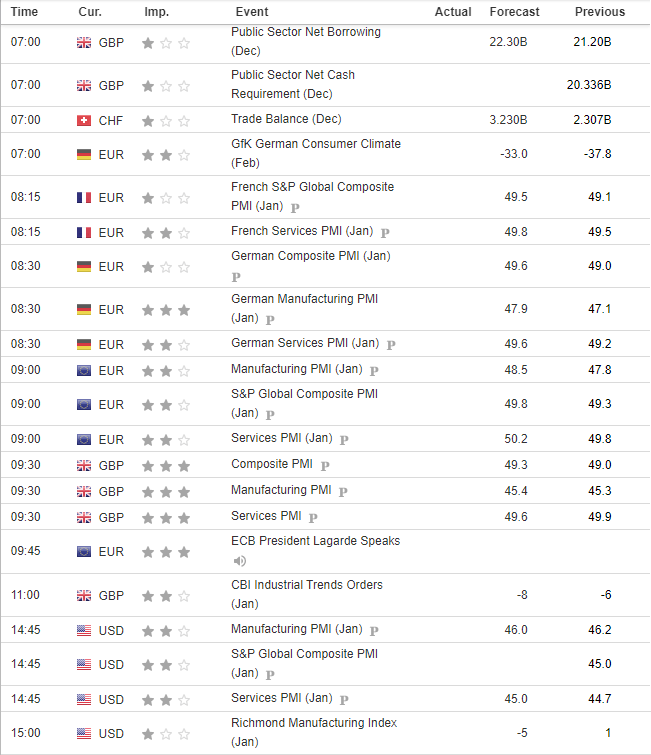

Economic events up next (Times in GMT)