Asian Indices:

- Australia's ASX 200 index fell by -8 points (-0.11%) and currently trades at 7,247.70

- Japan's Nikkei 225 index has fallen by -6 points (-0.1639%) and currently trades at 29,105.79

- Hong Kong's Hang Seng index has fallen by -91.9 points (-0.47%) and currently trades at 19,670.30

- China's A50 Index has fallen by -2.69 points (-0.02%) and currently trades at 13,177.98

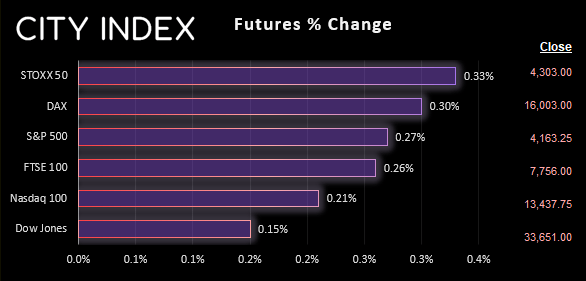

UK and Europe:

- UK's FTSE 100 futures are currently up 19.5 points (0.25%), the cash market is currently estimated to open at 7,760.83

- Euro STOXX 50 futures are currently up 14 points (0.33%), the cash market is currently estimated to open at 4,320.76

- Germany's DAX futures are currently up 49 points (0.31%), the cash market is currently estimated to open at 15,945.23

US Futures:

- DJI futures are currently up 45 points (0.13%)

- S&P 500 futures are currently up 10.75 points (0.26%)

- Nasdaq 100 futures are currently up 26.5 points (0.2%)

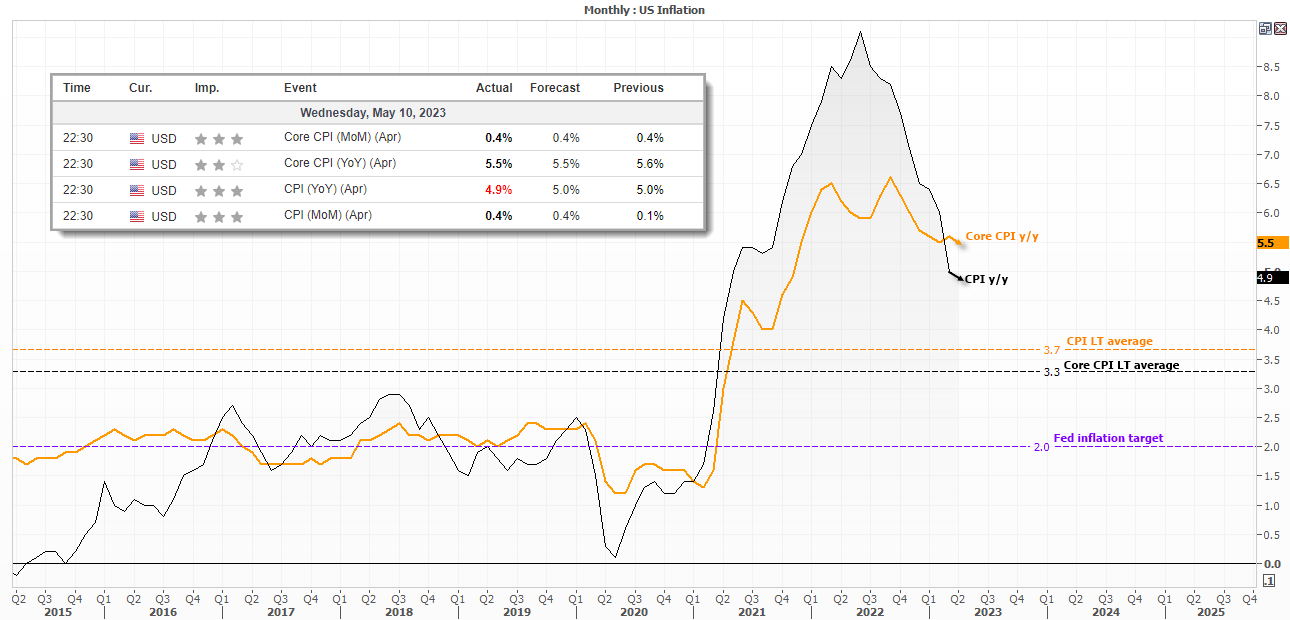

Whilst US inflation remains elevated, services less energy may have topped

Headline US inflation was to 4.9% y/y (5.5% forecast) or 0.4% m/m as expected, whilst core CPI also matched estimates at 5.5% y/y or 0.4% m/m. More importantly, services less energy CPI may have topped which should please the Fed, even if it remains elevated at 6.8% y/y.

Ultimately, there were no clear winners from the US inflation report because, even if headline inflation was a touch lower than expected, it remains elevated by historical standards and to the Fed’s 2% target.

Whilst this does little to change the Fed’s stance of a pause in June, the conviction from Fed Fund Futures pricing to stand pat increased to 94.5% from 78.7% the previous day. US producer prices are also released today at 13:30, although looking at the mixed responses from yesterday’s inflation report

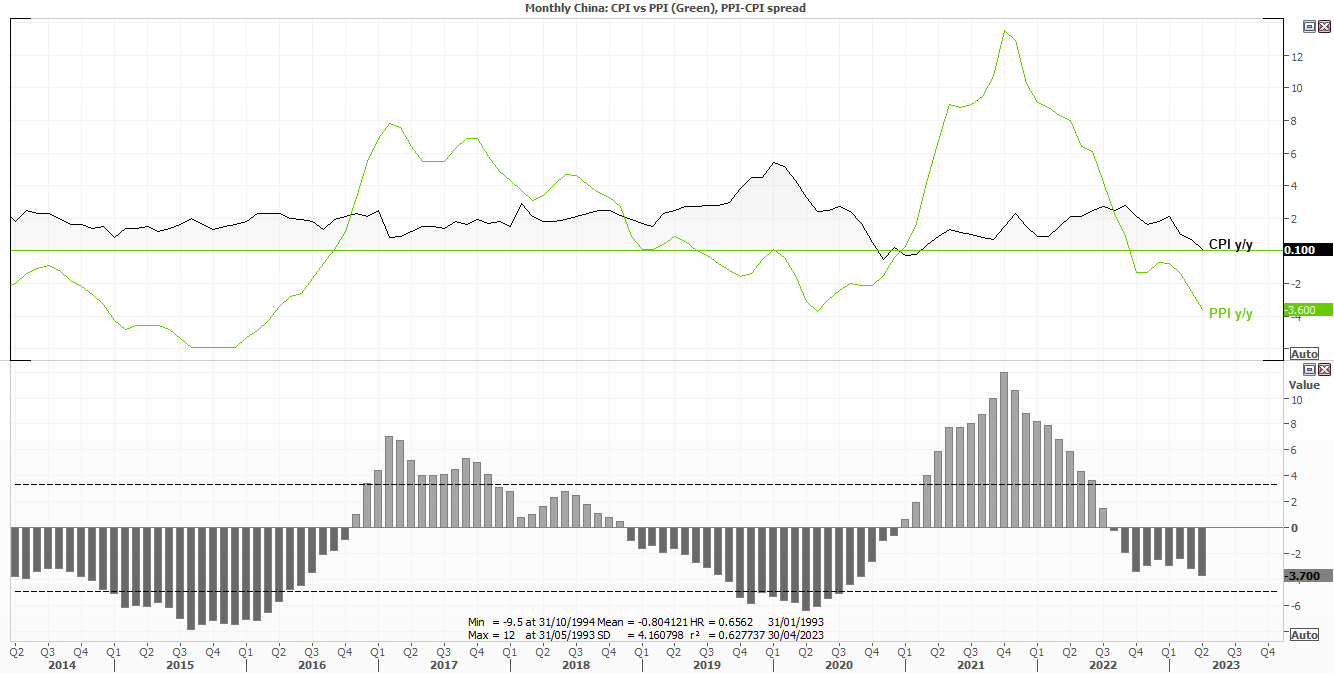

China’s (dis)inflation is the envy of the west

China’s consumer prices barely rose at just 0.1% y/y – a dream come true for most central banks – but it points towards slower growth

China’s consumer prices rose at their slowest rate in 26-month of just 0.1% y/y whilst producer prices deflated at -3.6% y/y – its fastest contraction in 7 years. For many central banks this would be a dream come true, but it poses a problem for China’s path to growth of around 5% this year and therefore becomes a concern for global growth. This week’s trade data points to slower growth, as does their PMI reports with most of them entering contraction. So it looks increasingly likely that China’s government will seek new ways to stimulate their economic recovery.

On the upside (or downside, depending on how you look at it), lower prices in China should help lead deflation lower with export nations.

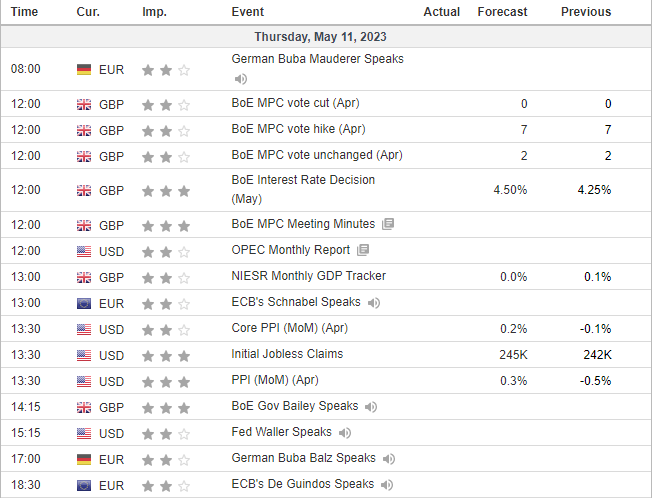

The BOE announce their interest rate decision today 12:00

The Bank of England (BOE) are set to announce their monetary policy decision at 12:00 where a 25bp hike is widely expected. It could be down to any forward guidance (if any) the BOE provides, or whether they remain confident (or not) that consumer prices are still on track to fall sharply, as to how the pound reacts.

BOE governor Bailey speech at 14:15 may well provide the greater market reaction as he gets to fine-tune the BOE’s message for future meetings. But with GBP having performed so well this year and remaining near cycle highs against several currencies, the more volatile reaction for GBP traders could be if the BOE deliver a dovish surprise and send the pound broadly lower

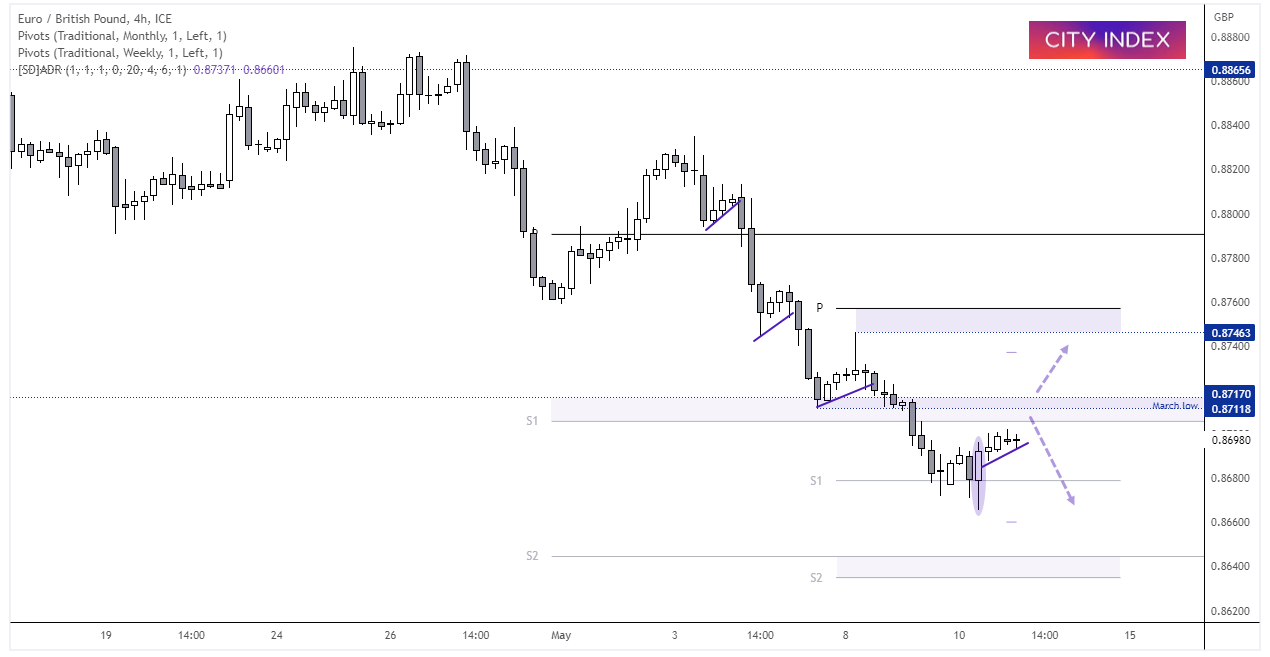

EUR/GBP 4-hout chart:

EUR/GBP reached a fresh 5-month low yesterday having surpassed our bearish target on Tuesday. The 4-hour chart remains within an established downtrend, which has provided several downside breaks of retracement lines. However, several candles failed to hold beneath the weekly S1 pivot near the cycle low and a bullish engulfing candle formed ahead of a retracement higher.

- The cross is in the hands of the BOE meeting as to whether we’ll see a deeper retracement or momentum realigns with the bearish trend.

- If the BOE deliver a hawkish hike, bears could seek to fade into rally below/around the monthly S1 pivot / March low with an initial target around the weekly S1 (0.8680).

- A dovish hike could send EUR/GBP back above the March high and head for the

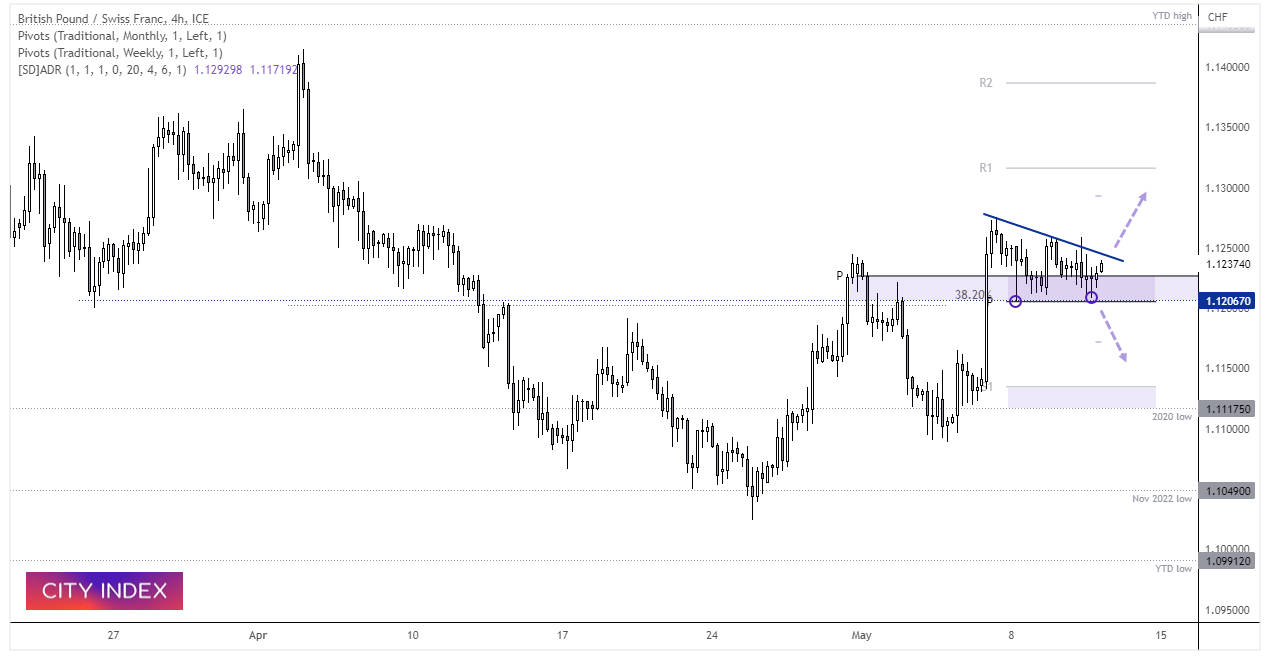

GBP/CHF 4-hour chart:

Price action on GBP/CHF seems a bit cleaner for bulls as a double bottom has formed around the weekly pivot point, and prices are now back above the monthly pivot point. 1.1200 therefor provides a decent area to decide between bullish or bearish setups, as a break beneath it invalidates the bullish bias and could open up a run lower. Otherwise, the bias remains bullish above 1.1200 and for a run towards 1.1300 / upper ADR (average daily range).

Economic events up next (Times in GMT+1)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade