So, there are still no signs of peak inflation in Eurozone as CPI climbed to a fresh record high of 8.1% in May and with oil prices back around $120 per barrel, things could unfortunately get worse. Rising price levels presents a massive dilemma for the ECB: should it need to act more aggressively to tackle inflation or keep policy loose because the already-struggling Eurozone economy will need as much support as it can get? Surging inflation and oil prices will only exacerbate economic woes for businesses and households in the months ahead. This will likely result in lower economic output, regardless of the ECB’s response, even if raising interest rates back above zero looks like a certainty. Against this backdrop, European stocks are likely to struggle to sustain a positive trend.

Brent oil prices climbed to $120 per barrel after EU leaders finally approved to ban Russian oil imports, thus restricting global supplies further, while optimism about China re-opening from lockdowns simultaneously boosted the demand outlook.

Rising oil prices will continue to filter through the economy, raising costs for households and businesses further. There are no signs of inflation peaking just yet as Eurozone CPI jumped to 8.1% y/y in May vs. 7.7% expected and up from 7.4% in April. Higher inflation rates will raise serious question marks about the ECB’s viewpoint on whether gradual rate increases will be enough to deal with such high price growth. Investors are starting to project a faster pace of tightening from the ECB, which could be another factor holding stocks back. Money markets are now expecting a 115 basis points worth of tightening by the ECB by year-end, up from 110 bps at the end of last week. There are 40% odds of a 50-bps rate hike in July.

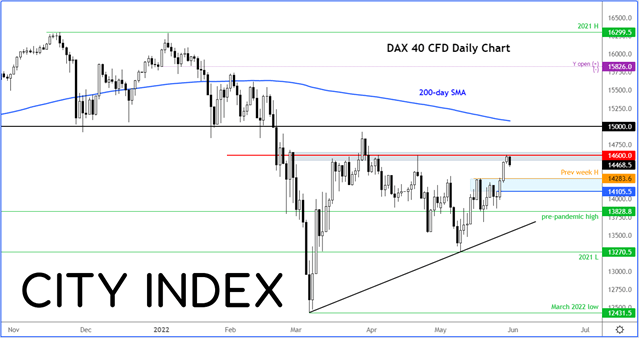

So, it is worth watching European stocks and indices such as the DAX for potential weakness as worries about economic outlook intensify and ECB turns even more hawkish.

The German index has reached resistance at 14600 and has reacted by going down about 150 points from there. This level was previously resistance. After three days of decent gains, it is hardly surprising to see the weakness today, in what still is a bear trend. The first line of key support is around 14280, last week’s high. Below that 14105 is the head of the hammer/doji candle created last Wednesday.

Get used to continued choppy price action as we transition to June and towards the summer months. I don’t think we will see sustained periods of intense buying like last year or years before. This time, inflation is the difference and central banks’ hands are tied.

How to trade with City Index

You can trade with City Index by following these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade