After Tuesday’s sharp recovery off the lows, crude oil prices have pushed higher, erasing much of the post OPEC dump. As prices reverse, this continues to bolster the short-term crude oil outlook.

Providing support to oil prices was an unexpected 0.5 million barrel drop in weekly US crude oil inventories, as the EIA reported earlier. Notably, the refinery utilization was 2.7%, much higher than expected as refineries worked overtime to build product inventories ahead of the summer driving season.

But softer data from Eurozone and China is continuing to keep the bulls largely at bay, preventing prices from responding more positively to the OPEC+ cuts. We saw China’s exports drop 17% and imports dropped 7%, highlighting worries over the recovery in the world’s second largest economy.

Can oil prices to new weekly highs?

Yesterday saw WTI bounce back to make good a 2.5% drop from earlier, and today prices have tacked on an additional 2% worth of gains. Though prices haven’t reached the high made in the Asian session on Monday, prices could get there as we move forward.

Traders are thinking twice about shorting oil, after Saudi took the matters into its own hands. After threatening short sellers will be ‘ouching’ last month, Saudi has followed through on its warning by voluntarily cutting its oil output by a million barrels a day from July.

However, it is not the first time we have seen this sort of price action only for the rally to run out of steam.

The market needs some assurance that the other cartel members won’t be taking advantage of Saudi and will be complying fully. Russia could be the main culprit, as Moscow needs to sell as much oil as it can to finance its ongoing war in Ukraine.

Crude oil outlook: downside risks limited

We are looking at a tighter oil market in the second half of the year, as the OPEC+ cuts filter through. As a reminder, the group announced in April that it would cut production by an additional 1.1 million barrels per day until the end of this year, adding to the big cuts announced in November of last year. They have now extended those cuts until the end of 2024.

Given that crude oil demand is price-inelastic, as it is a supply-driven market, we are looking at a much tighter market as we move into H2 and beyond. That’s unless demand elsewhere absolutely collapses (like Covid-like lockdown), we see non-compliance from big OPEC+ producers, or there a big upsurge in non-OPEC supply. All these scenarios seem unlikely to me.

Crude oil outlook: Technical analysis on WTI

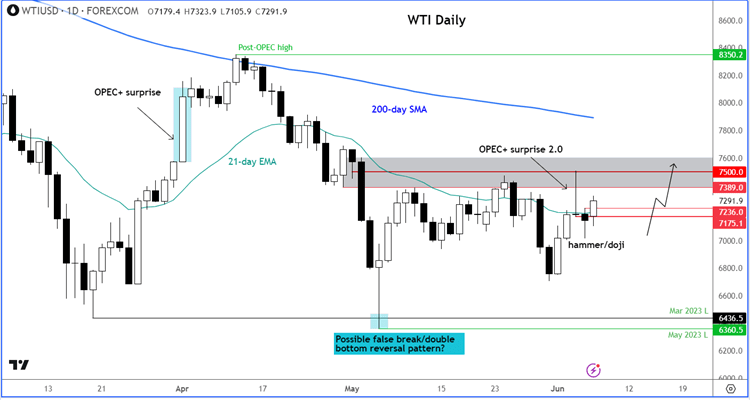

With WTI showing some bullish follow-through after Tuesday’s bullish price action, this has further reduced oil’s bearish characteristics, adding to the recent signs of stabilization.

The bulls will now want to see WTI close above Tuesday’s high as that would further squeeze the bears, who sold oil on the back of Monday’s “gravestone doji” pattern. If that happens, we could then see a quick move up to a new high on the week above $75.00 to take out liquidity from those trapped bears.

However, if oil holds givens back all of today’s gains, then this would be a sign of weakness and in that case the bulls must await further price action before pouncing.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade