Can US PMI surveys and employment reports sway bonds? The Week Ahead

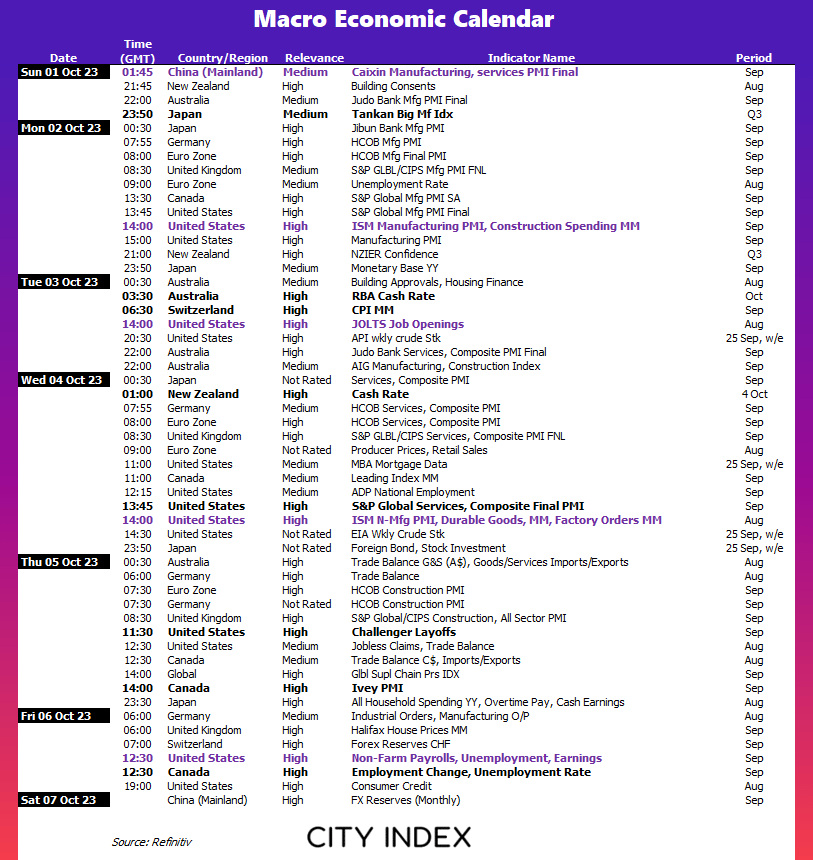

Last week we noted that bond yields could trump economic data this week, and for the most part they did. We can also extend that comment into next week, especially if they continue to retreat and loosen their grip on bearish sentiment and allow risk assets to rebound. With China on holiday all next week the trading volumes may be lower than usual (and the faltering gold market may find it has fewer buyers to support it than usual). With that said, notable economic events in next week’s calendar include the monthly Nonfarm payroll and ISM PMI reports, RBA and RBNZ monetary policy meetings, the quarterly Tankan survey for Japan and Canada’s employment report.

The week that was:

- US bond yields continued to surge in the first half of the week with the long end of the curve leading the way (otherwise known as a bear steepener, as bond prices at the long end were falling the fastest)

- A multitude of concerns including higher oil prices, hawkish Fed comments, expectations of higher-for-longer Fed rates and rising risks of a US government shutdown fuelled the bond rout and sent the US dollar to YTD highs

- Kashkari hinted at a 60% chance of a soft landing for the US economy, a backing for another 25bp hike with a risk that they may need to hike further

- Global bonds followed the US and the rise of Australian yields saw the RBA’s cash rate futures imply a 96% chance of a 25bp hike by June 2024

- Yet what could have simply been profit-taking triggered a pullback on the US dollar and yields on Thursday, which allowed risk assets such as Wall Street indices and AUD/USD recoup some losses from their cycle lows

- The Swiss National Bank (SNB) reiterated their commitment to no further tightening in their quarterly bulletin, saying that their “significant tightening of monetary policy over recent quarters” is reigning in inflation

- The DAX fell to a 6-month low following another weak Ifo business sentiment report

The week ahead (calendar):

This content will only appear on City Index websites!

Earnings This Week

Look at the corporate calendar and find out what stocks will be reporting results in Earnings This Week.

The week ahead (key events and themes):

- USD strength, bond rout

- US employment (Nonfarm payroll, JOLTS job openings, jobless claims)

- ISM manufacturing, services PMI

- Canadian employment data

- Japan Tankan

- RBA and RBNZ cash rate decisions

- China PMIs (manufacturing, services, composite – Caixin)

- China public holiday (all week)

US data: (ISMs, PMIs, NFP, jobless claims, job layoffs and openings)

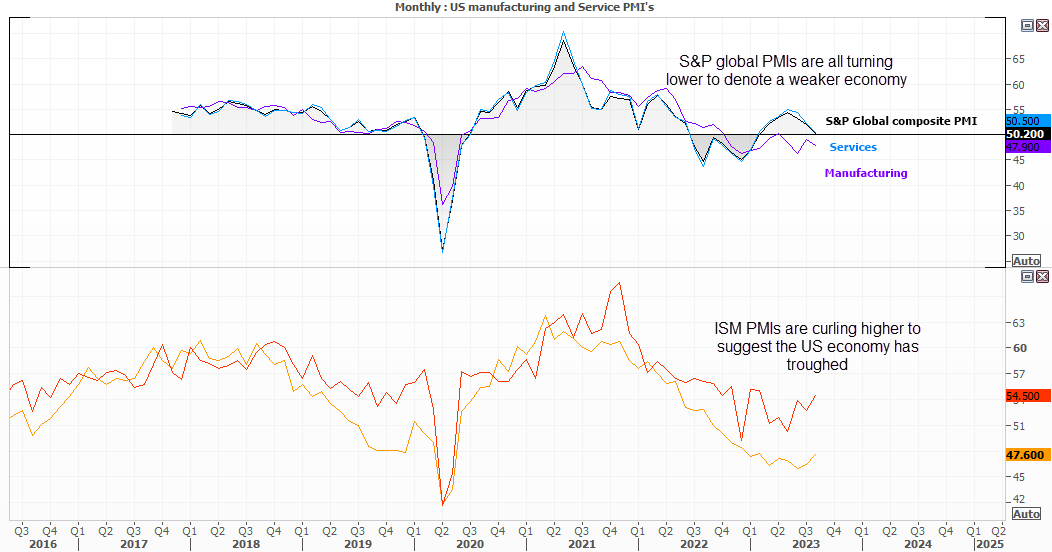

The key US data point can be split into two main groups; employment and business surveys. S&P global release their final revisions of their PMIs, all of which are pointing lower to show a soft economy. The Composite and services are on the cusp of joining manufacturing in contraction (below 50) which is at odds with the ISM surveys. The ISM services expanded at its fastest pace in six months whilst ISM manufacturing is curling higher and contracting at a slower pace. So which one is correct?

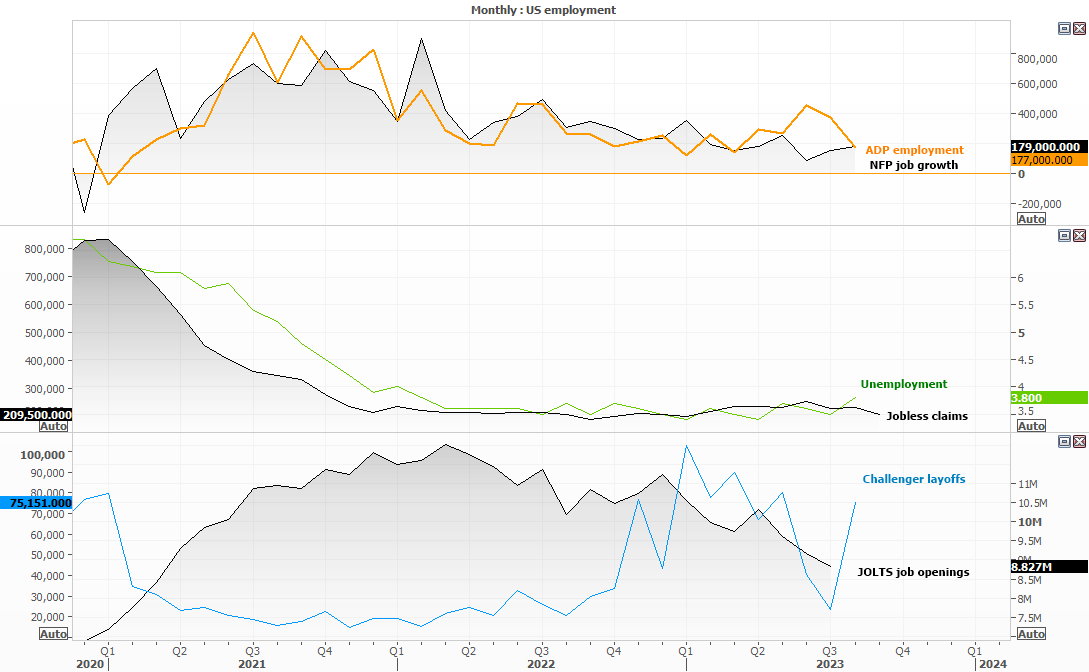

The US employment situation is also providing slightly missed signals. NFP Job growth is trending lower yet remains at healthy ‘expansive’ levels, and whilst unemployment has curled high it remains historically low at 3.8%. Job openings fell to a 48-month low, yet significantly elevated relative to its long-term average, and whilst layoffs rose over 50k last month it still pales in comparison to the times of covid. Overall, employment is remains tight but slightly softer and we’re going to have to see some surprisingly soft figures to bring the ‘higher for longer’ narrative into question. And if employment remains firm but business surveys pick up, if anything it could further fuel the bond rout and send yields and the US dollar higher.

Market to watch: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

RBA and RBNZ cash rate decisions

It’s unlikely we’ll see the RBA or RBNZ change their policy next week, although it will be the first meeting for the new RBA governor Michell Bullock. It’s difficult to say whether she’ll make a mark, given there is only the joint statement of the board members to go off of. But perhaps it leaves more wriggle room for it being less of a ‘cut and paste’ job.

With markets having now prices in a 96% chance of a 25bp RBA hike by June thanks to rising bond yields, it will be interesting to see if the RBA somehow tip their hat towards it and give away another “further tightening” clue. But with household spending and retail sales pointing lower, it’s difficult to justify a hike this year.

The RBNZ are likely to change policy given their forecasts have essentially confirmed the peak rate a 5.5%.

Market to watch: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

China PMIs (manufacturing, services, composite – Caixin)

With China’s PMIs being released over the weekend and China on a public holiday all next week, the data really serves for sentiment outside of the region. And is the case with most data out of China this year, it likely requires an upside surprise for it to be considered a surprise at all.

Market to watch: USD/CNH, USD/JPY, S&P 500, Nasdaq 100, Dow Jones, VIX, AUD/JPY

Canadian employment data

The Bank of Canada (BOC) may have another hike up their sleeve given the return of inflation, at already elevated levels. And another hot employment report could tip them over the edge. That it is released alongside US nonfarm payrolls makes USD/CAD a candidate for unhealthy levels of volatility, but traders can also consider crosses such as CAD/JPY for a potentially cleaner move.

Market to watch: USD/CAD, CAD/JPY, NZD/CAD, AUD/CAD

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade