During a joint press conference with the European Commission President two weeks ago, Joe Biden announced a plan to “reduce Europe’s dependence on Russian energy”. This is all well and good, but it remains debatable as to whether they replenish the gap left if they cease to use Russian oil by a large enough margin to not see prices skyrocket.

Russia currently supplies roughly 40% of Europe’s gas. And Russia threatened to turn off the gas tap if the West continues to sanction Russia due to the invasion of Ukraine. Clearly, this puts Europe in a tight spot and literally in short supply of an adequate energy supply if they simply ban Russia’s imports (or Russia stops exporting).

Replacing Russian energy is not so easy

The joint venture with the US and EU aims to reduce any such shortfall by setting a goal to deliver 15 billion cubic meters (BCM) of LNG (liquified natural gas) to the EU this year. This goal would then move up to 55 bcm by 2030. Russia currently supplies around 155 bcm per year, their current goal (if achieved) accounts for just 9.6% of what Russia currently supplies. That’s a big shortfall.

Furthermore, LNG experts have warned that weather is a key factor to where LNG ends up. If Asia experiences another cooler winter then the 15 bcm goal appears unrealistic, let alone the 50 bcm target further out. Still, the IEA (International Energy Agency) estimate they can source around 20 bcm of LNG (liquified natural gas) across global markets which might bump it up to 35 bcm. Yet even then it only accounts for around one fifth of the Russian supply, and this shortfall is a key reason as to why prices have continued to rally.

However, it’s not all about gas as oil plays a big part. And yesterday the IEA announced that 31 of its member nations are set to release 120 million barrels of oil from emergency reserves to counter tightening supply, 60 of which will come from the US. This saw oil prices fall around -5% yesterday and weigh broadly on the energy sector. In turn, natural gas futures have stalled at a critical level.

Natural gas falters at key resistance

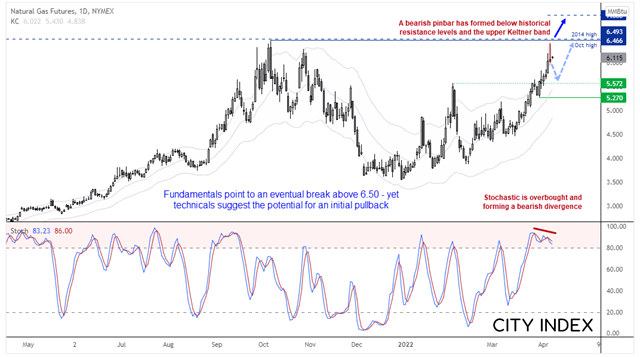

We can see on the daily chart that natural gas prices have regained bullish momentum since the middle of March. Yet news of the IEA flooding the market with oil helped natural gas reverse form its 6-month high and close the day with a bearish pinbar. The candle also faltered as its upper Keltner channel, whilst the stochastic oscillator is both oversold and producing a bearish divergence with prices. But more importantly, the rally has stalled just beneath the October high (6.466) and February 2014 high (6.493) which makes it an important pivotal level over the near-term.

Ultimately there are several clues that the upside move is exhausted over the near-term, just beneath a key resistance level. As things stand the fundamentals favour an eventual break above 6.50 over the coming week/s against the backdrop of no clear plan for Europe to replenish any Russian energy shortage. But we know that oil and natural gas can correlate on a daily basis, so weaker oil prices could help natural gas correct before its next leg higher. A break beneath yesterday’s low confirms the bearish pinbar and paves the way for a retracement. But we would then seek evidence of a swing low around or above support levels to anticipate the end of any such correction (however minor it may be).

A threat to its uptrend would likely require a solid plan to fully replace Russian oil. But until that happens, an eventual break above 6.50 appears likely.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade