The Reserve Bank of Australia (RBA) is all but finished with rate hikes despite retaining a conditional tightening bias in September, rolling out a lengthy list of domestic and international uncertainties, most of them skewed to the downside. With the RBA on the sidelines, it means external factors will continue to drive movements in the AUD, ASX 200 and Australian bond futures for the foreseeable future.

“Significant” uncertainties pressure AUD/USD

In a decision that surprised no one, the RBA kept the cash rate unchanged at 4.1% in September, justifying the decision given “significant” uncertainties such as the trajectory for services inflation, the evolution in domestic wage pressures and pressure households from tighter finances. For the first time this cycle, it also cited risks from the Chinese economy due to “ongoing stresses in the property market.”

Curiously, the RBA removed commentary about household consumption slowing substantially ahead of Australia’s Q2 GDP report tomorrow which may show an outright contraction in real household spending over the quarter. Changes in the remainder of the September statement were largely cosmetic in nature.

The RBA retained its conditional tightening bias, noting “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks.” The “will continue” part of the statement was new, hinting it doesn’t believe the tightening bias will be removed anytime soon.

As for whether the RBA will follow thorough with an actual rate hike, traders, collectively, have already cast their vote, continuing to price in the next move being a cut late next year.

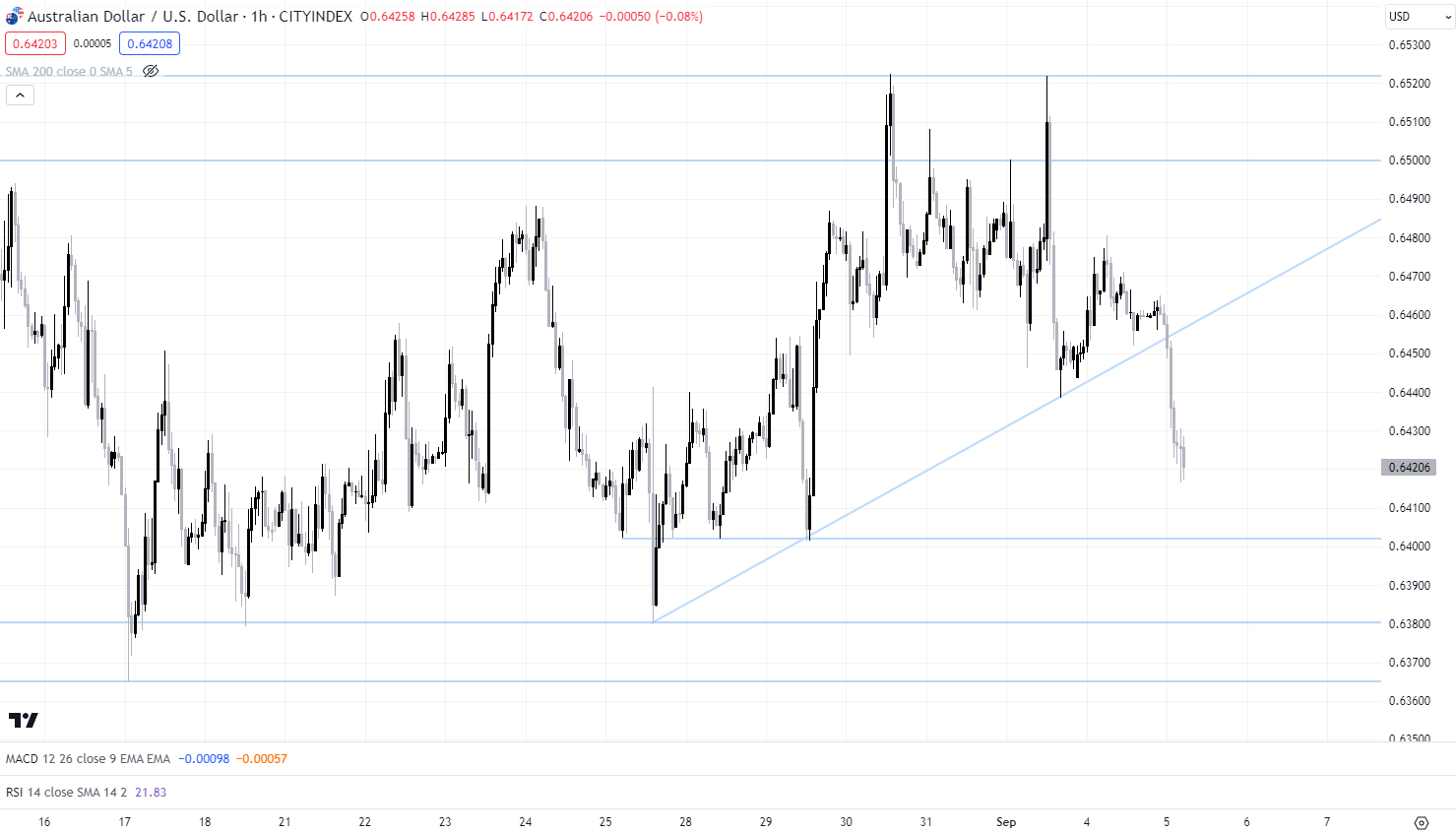

AUD/USD bounce broken, downtrend resumes

Given the September decision was entirely expected, movements in Australian financial markets have been negligible following its release.

The AUD/USD is struggling on renewed concerns about China’s economic outlook following a slowdown in services sector activity in the latest Caixin PMI survey. Having failed on four separate occasions to push convincingly above .6500 since late August, AUD/USD is breaking down again, tumbling through uptrend support following the Chinese data. On the downside, support may be found at .6400, .6380 and again at .6365. A break below that level will beckon move back towards the lows struck last year.

Source: Trading View

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade