- Australia’s ASX 200 is on track for its highest close since February

- Between the close on December 18 and year-end, the index has finished higher in 15 of the past 20 years

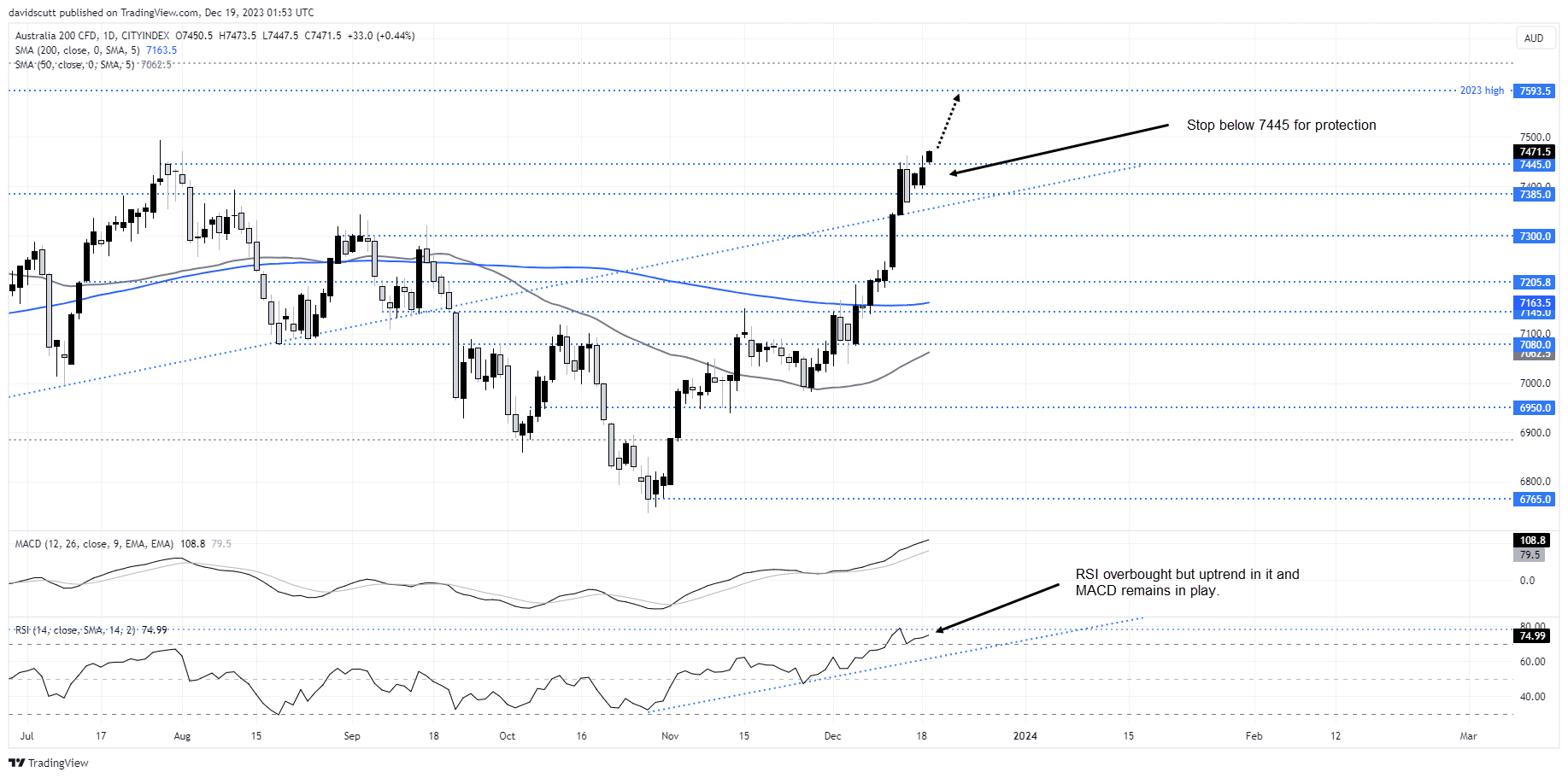

Australia’s ASX 200 is on track for its highest close since February, extending its rally from the lows hit in late October to over 10%. Entering what’s traditionally been a strong period over the past two decades, the combination of seasonality and bullish technicals may see the index retest the highs hit in February.

Santa rally seasonal stats

Going back two decades, from the close on December 18 (or nearest date depending on weekends) through to year-end, the ASX 200 has finished higher on 15 occasions, logging an average increase of 2.25%. Of the five down years, the average loss was 1.63%. Of note, despite the strong seasonal picture over the longer-term, the index has fallen in three of the past four years. So, the ‘Santa Rally’ effect is evident, just not reliably so in recent years.

Looking at the daily chart, the ASX 200 remains on track to close at the highest level since February on Tuesday. Having tried on six separate occasions to finish above 7445 this year, including in three of the past four sessions, a close above today may provide a launchpad for bulls to attempt a retest of the 2023 highs just below 7600 set in February. While RSI sits in overbought territory, the uptrend in both it and MACD is nowhere close to be threatened, underlining momentum is entirely to upside right now.

Should the index close above 7445, those contemplating potential longs could set stops below targeting a move towards 7593.5. Should the index reverse into the close, levels to watch on the downside include 6400 – where it found buyers in each of the past two sessions – along with 7385 and former uptrend support around 7350.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade