There has been no obvious catalyst for the fall in yields. However, it is notable that the decline has been global. For example, overnight long end yields in Germany and the U.K. declined by 8-11bp while U.S. treasury yields declined by 4-7bp as U.S. 30 year yields reached their lowest level since July.

The fall has been more pronounced in the real yield space (the interest rate adjusted for inflation). This week, U.S. 30 year real yields traded to a record low, and U.S. 10 year real yields broke below the bottom of a well-established range at -100bp, to close overnight at -117 bp, within touching distance of their -119bp low from August of this year.

The decline in yields is more surprising because economic data has been encouraging of late and inflation concerns remain. Most likely, the move is in response to traders unwinding positions after key central banks' meetings last week were dovish compared to market expectations.

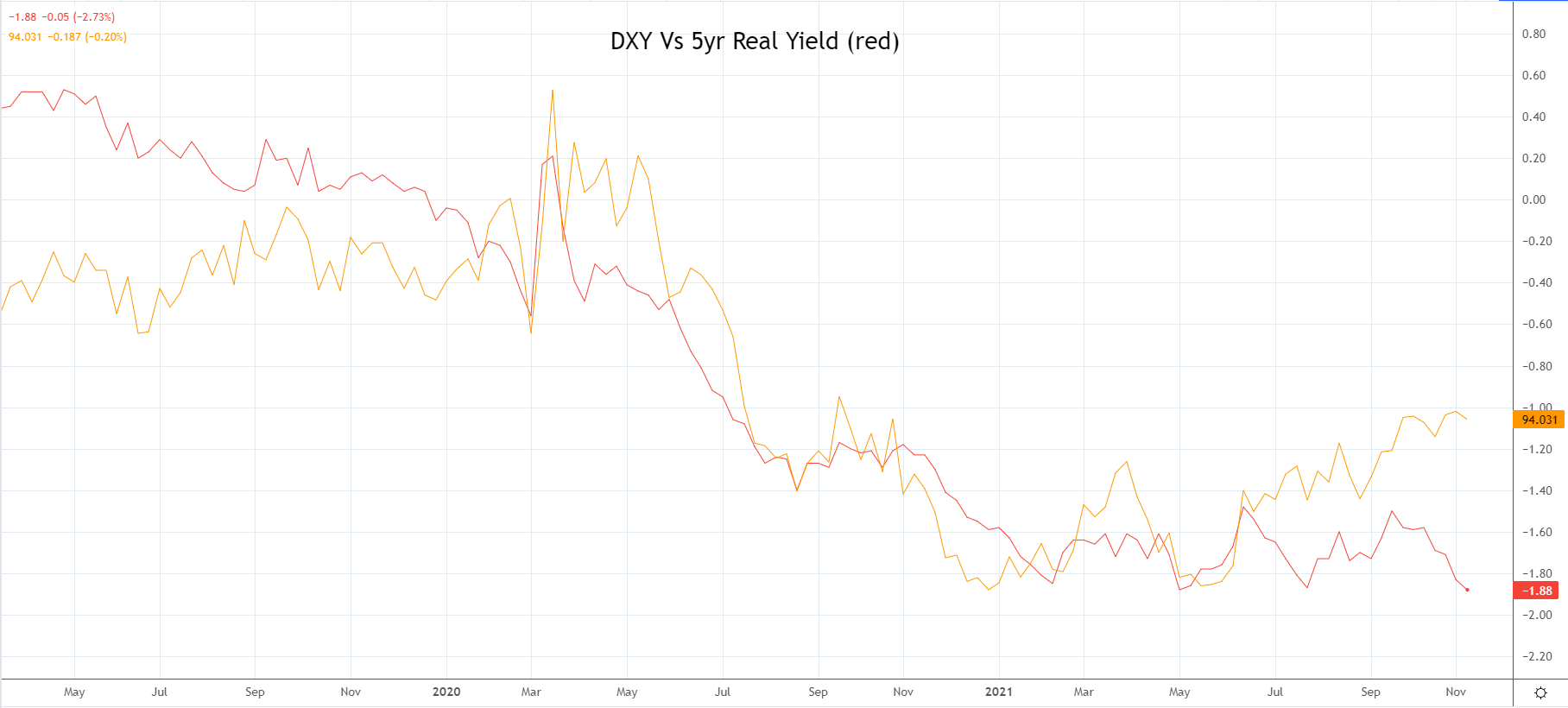

Aside from gold, the decline in yields has the potential to impact the FX space. As can be viewed on the chart below the U.S. dollar index, the DXY has closely tracked the move in real yields. It currently appears almost 2% overvalued at its current price of 94.00.

If the DXY index breaks uptrend support at 93.50 coming from the May 89.53 low, it increases the risk of a deeper pullback in the DXY index towards the support provided by the 200 day moving average of 92.00.

Source Tradingview. The figures stated areas of November 10th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.