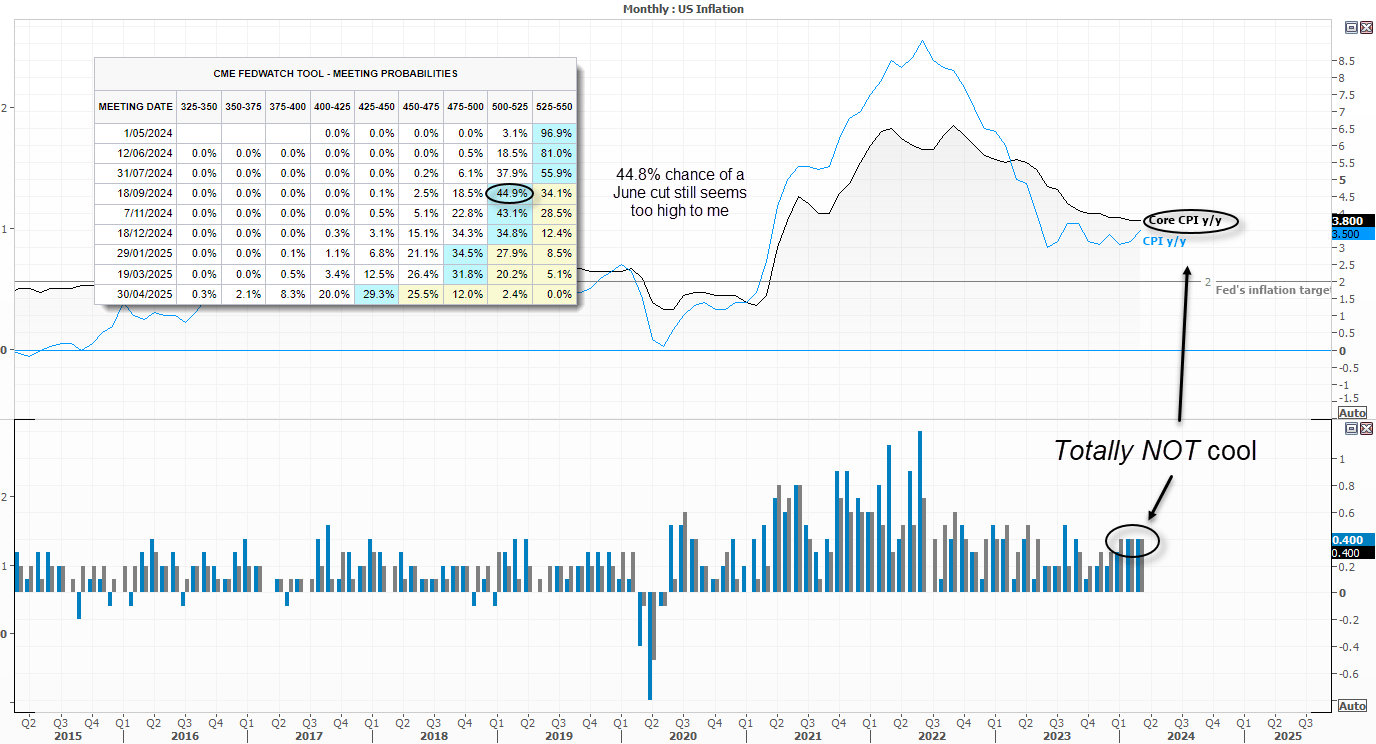

Another day, another hotter-than-expected inflation report from the US. The monthly and annual CPI and core reads were all above expectations, with hopes of a June cut having all but evaporated. Fed Fund futures pricing in just a 44.9% chance of a 25bp cut in June, or a 34.8% chance of a cut this year following last week’s strong nonfarm payrolls figures and yesterday’s CPI report.

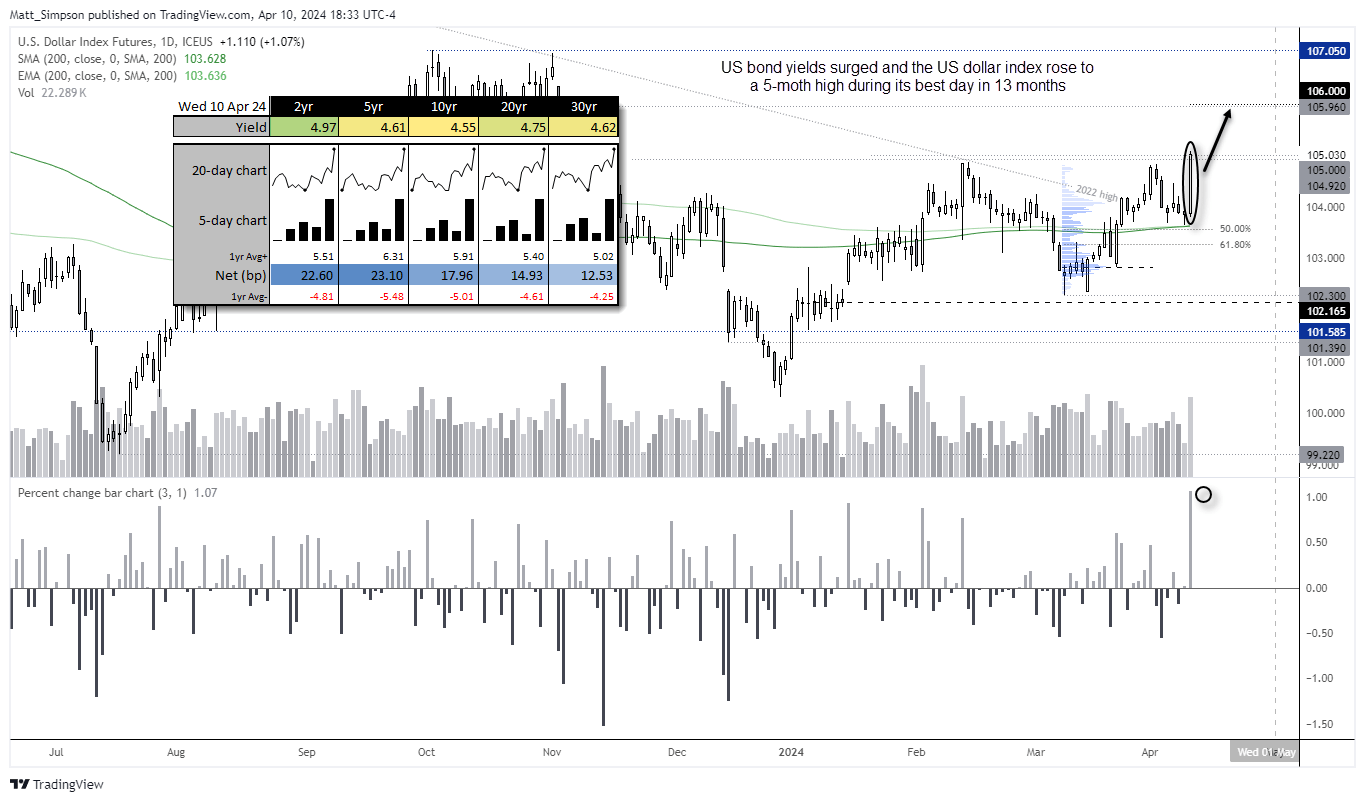

This completely overshadowed the FOMC minutes, and again brings into question why Fed members favoured three cuts this year when they’re not even on track for one. US yields surged across the curve, rising 3-4 times their usual amount for a positive day in basis points. The US dollar index was quick to break to a 5-month high during its best day in 13 months and brings 106 into view for bulls.

- USD/JPY finally broke above 152 for the first time since 1990 and now trade just 7 pips below 153

- Whilst there is no word yet from Japanese officials, traders would be wise to be on guard for some jawboning of the yen today

- EUR/USD quickly met our downside target around 1.08 after crashing through its 200-day MA , and continued lower before stopping just shy of the December low

- USD/CHF closed convincingly above 0.9100 in line with yesterday’s bias

- AUD/USD was the weakest FX major (-1.7%), followed by NZD/USD (-1.3%)

- USD/CAD enjoyed its best day in 12 months, helped by the BOC saying that a June cut is possible if inflation continues to ease

- Gold fell -0.8% during its worst day in 21, although in the grand scheme of things it held up quite well from its record high

- Wall Street was lower during a risk-off session, led by the Dow Jones (-1.1%) which fell to a 6-week low, although the S&P 500 and Nasdaq managed to hold above recent swing lows ahead of key earnings reports

Economic events (times in AEST)

US producer prices are released today, and as they also beat expectations last month then traders would be wise to expect the same today. Also note that several Fed members will be speaking, which leaves the potential for some hawkish comments – as any dovish commentary with such high inflation levels would surely do them more damage than good, in terms of credibility.

And should China’s inflation figures rise, it could spark further concerns of inflation round two and weigh further on appetite for risk.

- 09:50 – Japan’s foreigner bond/stock purchases, M2 money supply

- 11:30 – Australian building approvals

- 11:30 – China CPI, PPI

- 18:00 – China loan growth, M2 money stock

- 22:15 – ECB interest rate decision

- 22:30 – US PPI

- 22:45 – FOMC member Williams speaks

- 22:45 – ECB press conference

- 00:00 – FOMC member Barkin speaks

- 00:15 – ECB member Lagarde speaks

- 02:00 – Fed member Collins speaks

- 03:30 – Fed member Bostic speaks

US dollar technical analysis:

The US dollar index surged just over 1 %, 70% of which was in the first hour of the US inflation report. The rally was seen on strong volume, which was presumably a combination of short covering and fresh longs, which saw the US dollar index close marginally above 105 for the first time since November.

I suspect we’ll see another spurt higher in early Asian trade, but it is extremely rare to see such a bullish maintain such levels of momentum the following day. Therefore bulls may want to refer to much lower timeframes, or wait for a pullback on the daily chart and seek evidence of a swing low. But with odds favouring a maximum of one hike (or no hikes at all) this year, 106 looks like the next stop for the US dollar index.

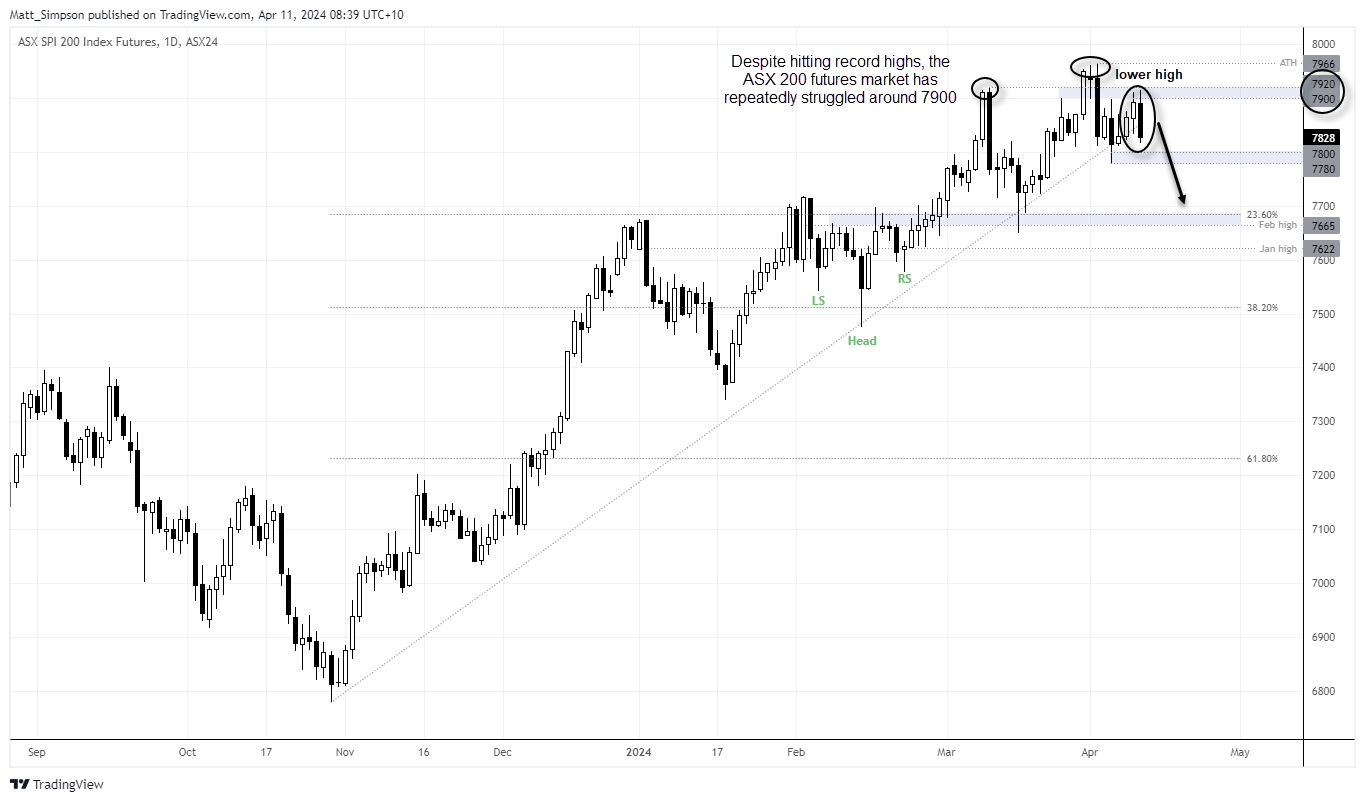

ASX 200 technical analysis:

Sadly, I do not get to say this enough – but I nailed the top on the ASX 200 futures market yesterday by seeking a false move to the 7900-7920 zone ahead of the CPI report. Like all markets against the US dollar, the ASX 200 futures market sank like a stone overnight, which means the ASX cash market is set for quite a gap lower. As always this may leave the potential for the gap to be filled today, although with appetite for risk on the ropes then I doubt any bounce will have legs. But there is the potential for some bearish follow through today as Asian markets respond to the prospects of ‘higher for longer rates’ form the Fed.

The daily chart shows that the ASX 200 futures chart is trying to form a bearish outside day, which itself would be a lower high. Prices closed beneath the trendline, and a move to at least 7780 – 7800 now appears to be on the cards. A break below 7780 assumes a deeper retracement, with 7700 making the next viable target on the daily chart for bears.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade