USD/JPY rises ahead of a big week for the Fed, BoJ

- Japan’s PPI cooled to 5.1%

- BoJ official warns not to expect policy change this week

- USDJPY trades in a symmetrical triangle

USD/JPY is edging lower at the start of the week after cooler-than-expected Japanese PPI and dovish comments from a BoJ official, and as investors look ahead to the central bank bonanza this week.

Japan’s PPI cooled to 5.1% YoY, in May, down from 5.8% in the previous month and below forecasts of 5.5%. This marked the fifth consecutive month that PPI cooled. PPI is often considered a lead indicator for CPI, suggesting that consumer prices could start easing from the current 4-decade high.

The data comes ahead of the BoJ meeting on Friday. BoJ’s Deputy Governor Masazumi Wakatable ruled out any policy change, warning not to expect change from the BoJ this month’s meeting.

Meanwhile, the USD is rising against its major peers after losses last week. The Federal Reserve will announce its rate decision on Wednesday. The market is pricing in a 70% probability that the US central bank will skip a June hike after a slew of weaker-than-expected data, including ISM services PMI, jobless claims, and factory orders.

Looking ahead, both the US and the Japanese economic calendar are quiet. Attention will turn to US inflation data tomorrow, which is expected to see CPI cool to 4.1%, but core CPI rises to 5.3%.

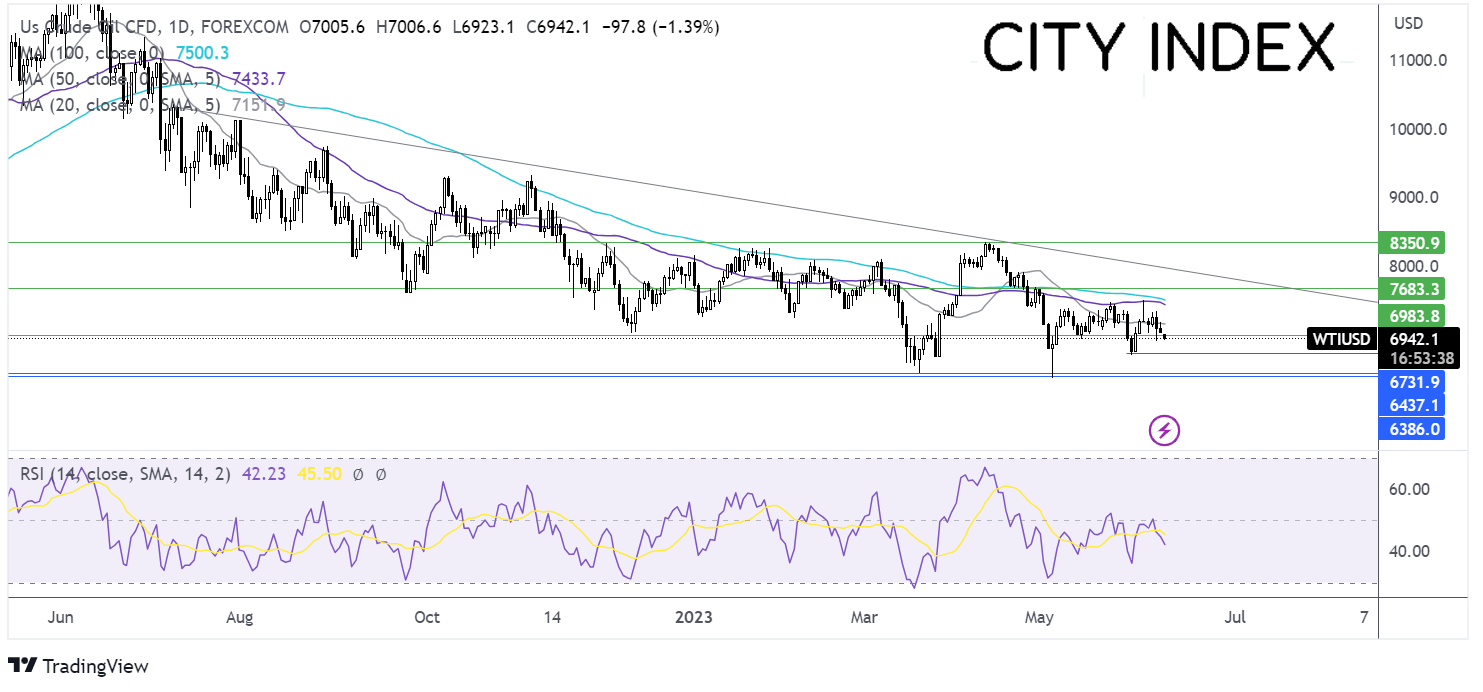

USD/JPY outlook -technical analysis

USD/JPY trades within a two-week symmetrical triangle pattern, with buyers looking for a break above 140.00 to ring 140.95 the 2023 high into play.

Sellers could look for a breakout below 138.80, to test 138.40, the June low. A break below here exposes the multi-month rising trendline support at 137.20.

Oil falls below $70

- Oil slips ahead of this week’s Fed meeting

- Iran’s nuclear deal in focus

- WTI oil trades rangebound 74.50 – 67.00

Oil has fallen below $70 at the start of the week as investors look ahead to the Fed rate decision and amid concerns over China’s demand and rising Russian supply.

Oil fell last week after disappointing Chinese data raised concerns over the strength of the recovery of China, the world’s largest importer of oil. This offset the production cut of 1 million barrels a day announced by Saudi Arabia.

Also, on the supply side, Russia’s oil exports to China and India have grown despite the EU restrictions and G7 price cap mechanism, which started in December. Goldman Sachs cut its oil price forecasts citing higher supplies from Russia and Iran.

Comments from Iran’s supreme leader that the country was open to reviving the 2015 nuclear deal have also pulled oil lower. Should a nuclear deal be agreed upon, sanctions on Iranian oil could be lifted, with oil flooding back into the market. However, the White House denied that progress was being made in talks.

Oil markets are now looking to the Fed rate decision, where the Fed is expected to keep rates on hold after raising rates by 500 bps over the past year. Inflation is still well above the central bank’s 2% target, but surprise hikes from the RBA as the BoC last week add to the hawkish narrative.

Growing global recession fears continue to drag on the demand outlook, so central bank decisions and economic data this week will remain in focus.

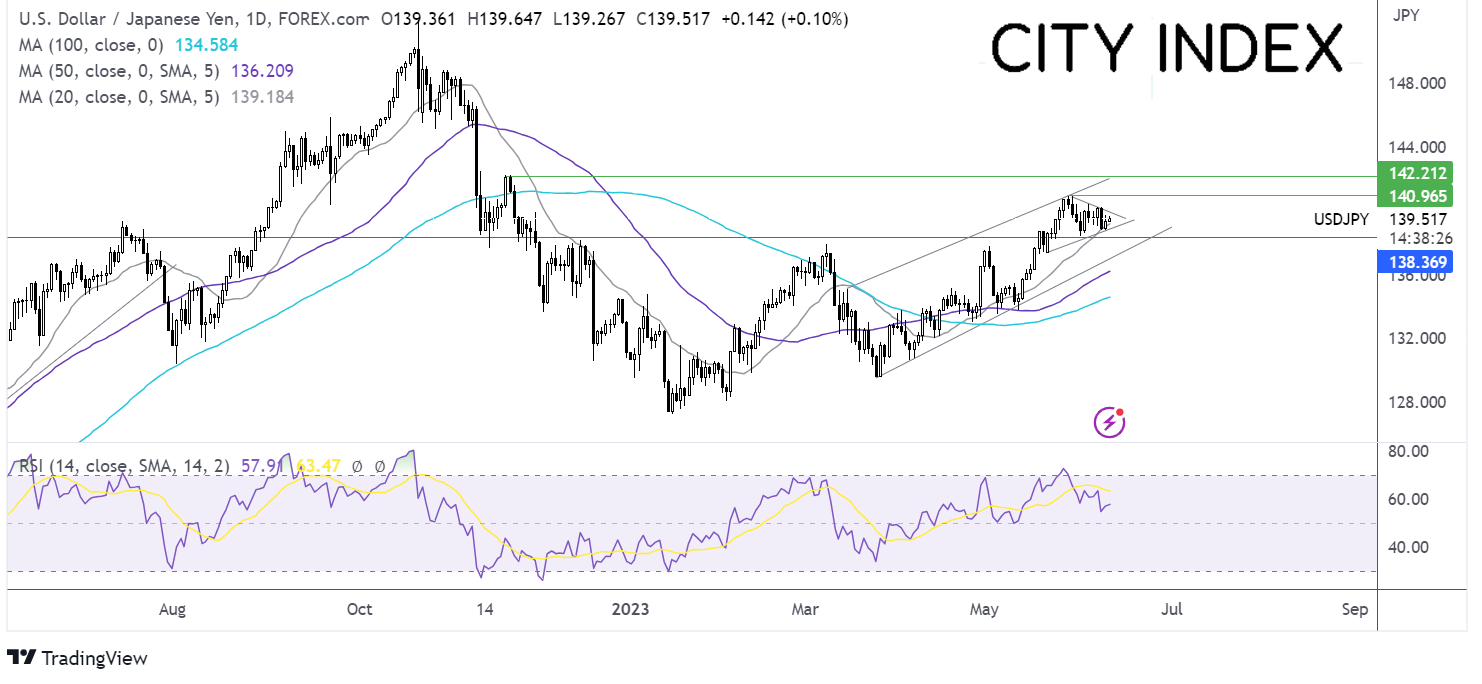

Oil outlook – technical analysis

Oil remains relatively range-bound, capped on the upside by the 50 sma at 74.50 and on the downside by 67.00. The fall below 70.00 and the RSI below 50 keep sellers hopeful of a break to the downside.

Below 67.00 64.20, the 2023 low comes into play. On the upside, a break over 70.00 and 74.50 opens the door to 77.80 the May high.