USD/CAD rises ahead of Canadian jobs data

- USD rises on recession fears

- Canadian unemployment to rise to 5.1%

- USDCAD need to rise over 100 sma to alter bearish outlook

USD/CAD is rising for a third straight day, rebounding a from a 7-week low ahead of the Canadian jobs data and as oil prices recede.

Oil is falling away from the 10-week high hit on Tuesday after a series of weaker-than-forecast US data fuels recession fears, hurting the oil demand outlook.

This week US ISM manufacturing, non-manufacturing, and factory orders have missed estimates. Cracks also are appearing in the jobs market. JOLTS job openings and ADP payrolls were weaker than expected.

Those same recession fears are boosting safe haven flow to the USD, which has rebounded from a 2-month low.

Attention now turns to Canadian jobs data, which is expected to show 12k new jobs added, down from 21.8k. Unemployment is expected to rise to 5.1%, up from 5%.

The data comes ahead of the BoC rate decision next week, The central bank was among the first to pause its rate hiking cycle last month. Weak jobs data could add to evidence that the economy is slowing, pulling on the CAD. However, stronger data could raise questions as to whether the BoC would resume rate hikes.

US jobless claims are also due.

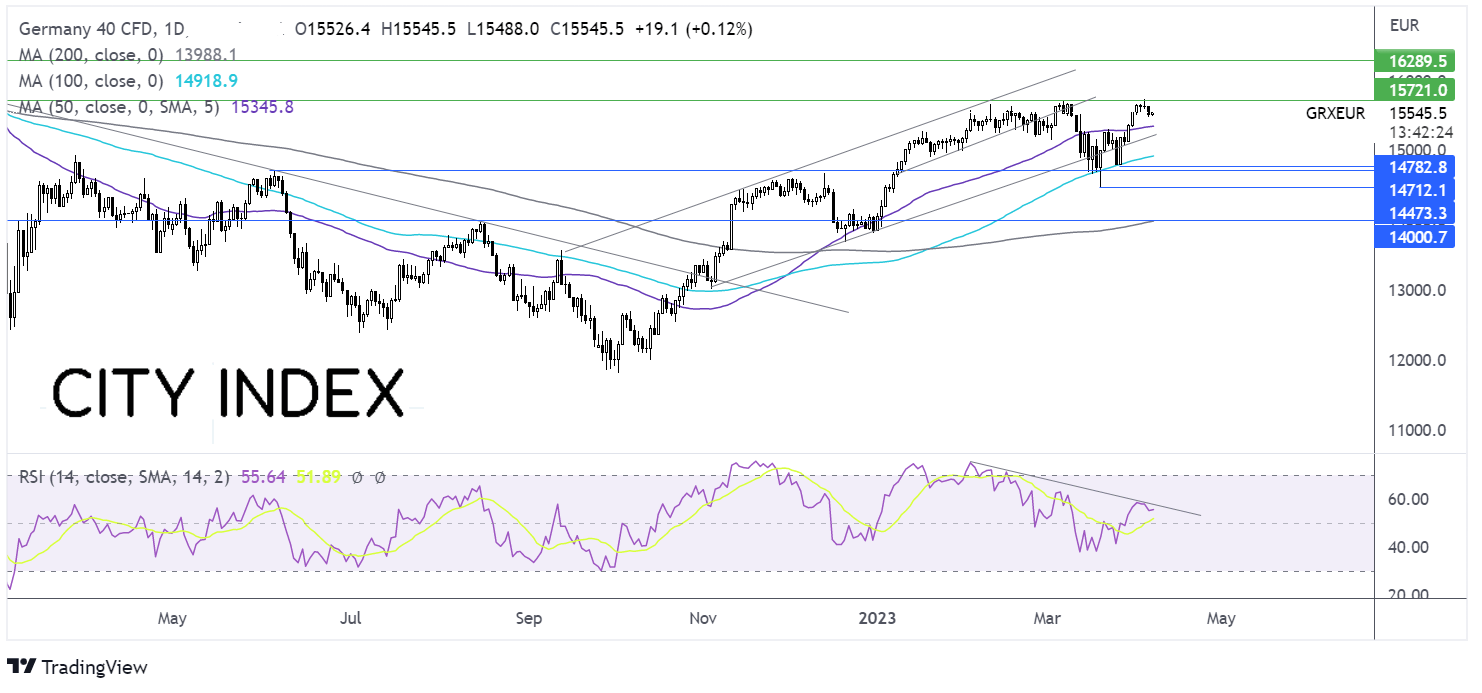

Where next for USDCAD?

USD/CAD is rebounding from 1.34, the April low. Bulls would need to rise above the 1.3525 the 100 sma to alter the bearish outlook. Above here, resistance can be seen at 1.3665, the February high.

Sellers would look for a break below 1.34 to extend the bearish, exposing the 200 sma at 1.3385. Below here, the February low of 1.3265 comes into focus.

DAX edges higher in cautious trade, German industrial output rises

- German industrial production rises 2% MoM

- Upbeat EZ data but US recession fears rise

- DAX needs to rise above 15740 to extend bullish run

DAX is set to open slightly higher amid a cautious market mood as investors wait for further clues from the US to assess the likelihood of a recession in the world’s largest economy.

Recent German data has been encouraging. German industrial production jumped 2% MoM in February, ahead of the 0.1% increase forecast. The data comes after German factory orders jumped 4.8% MoM. The eurozone composite PMI also rose to a 10-month high.

Germany is expected to dodge a recession in 2023. Leading German economic institutes, including the IFO institute, said on Wednesday that the German economy would likely grow by 0.3% this year, avoiding a recession. However, they only expect inflation to cool to 6%.

Looking ahead attention will be on US jobless claims for further clues into the health of the US economy. Data this week has shown cracks starting to appear in the US labour market.

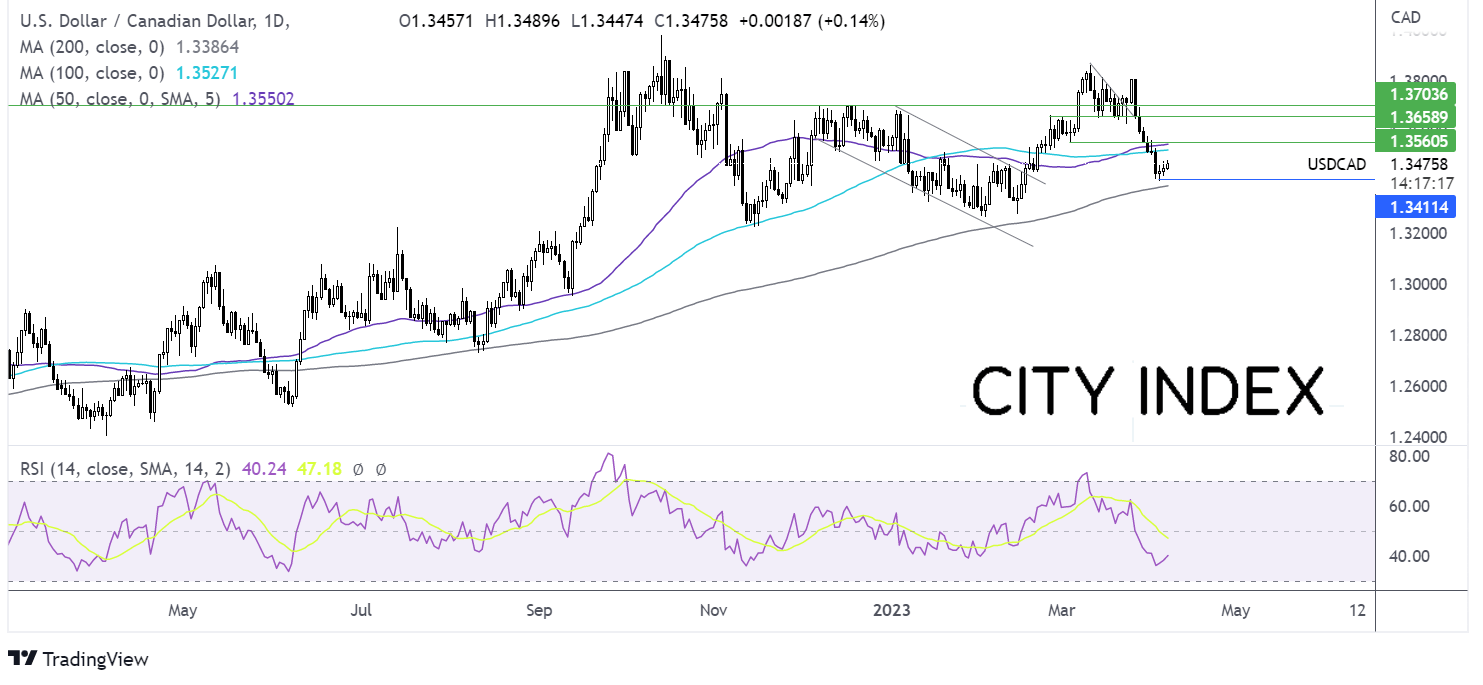

Where next for the DAX?

After failing at resistance at 15740, the DAX is consolidating above 15500. The bearish RSI divergence suggests that the DAX may struggle to push above 15740.

It would take a move below the 100 sma at 15340 to negate the near-term uptrend, opening the door to 15200 the rising trend line support. A break below here exposes the 100 sma at 14900 and a break below 14800 would create a lower low.

On the upside, buyers need to rise above 157040 to extend the bullish trend towards 16000.