- USD/JPY continued to sideways range trade, with bullish fundamentals offset by the threat of BOJ intervention

- US CPI and PPI reports, the ECB interest rate decision and geopolitics loom as the key drivers for USD/JPY this week

- Near-term bias remains to sell rallies in USD/JPY rather than buying dips

The overview

USD/JPY sits in a narrow trading range, sandwiched by bullish fundamentals and threat of intervention from the Bank of Japan to support the yen. The latter has reduced the odds of near-term upside for USD/JPY despite the release of important inflation updates in the United States this week.

Unless the Japanese government softens its public stance towards weakness in the yen, the preference is to sell rallies rather than buy dips or breaks. Geopolitical tensions in the Middle East are another wildcard for traders to navigate.

Key events for USD/JPY

There’s no need to reinvent the wheel when it comes to the likely USD/JPY drivers this week with the US interest rate outlook and geopolitics the key areas to focus on. As the latter is impossible to predict, what we as traders can do is look at the events that are likely to have the largest impact, taking into consideration positioning and technical factors.

Over the week, three such events stand out: the US consumer price inflation report on Wednesday, the US Producer price inflation report on Thursday and the ECB interest rate decision, also on Thursday. While the Fed speaking calendar is extremely busy, they key point to remember is the tone will be heavily influenced by these events, along with last Friday’s blockbuster US non-farm payrolls report.

There’ll be plenty of headlines to navigate, including from the FOMC minutes on Wednesday, but the vast majority will be noise and not impact USD/JPY meaningfully.

US CPI preview

Having topped market expectations at the headline and underlying level in the first two months of the year, markets may receive greater clarity as to whether the inflation acceleration is the start of a new trend or simply a seasonal anomaly.

Both headline and core CPI are forecast to lift 0.3%, down a tenth from February. While a deceleration, both would be incompatible with inflation returning to the Fed’s 2% inflation mandate in a timely manner.

The core services ex-housing figure, known simply as “supercore” inflation, will be influential given the Fed has nominated it as something it’s watching. It decelerated noticeably in February, minimising the damage to the dovish rates case despite the heat in other readings.

Potential USD/JPY market reactions

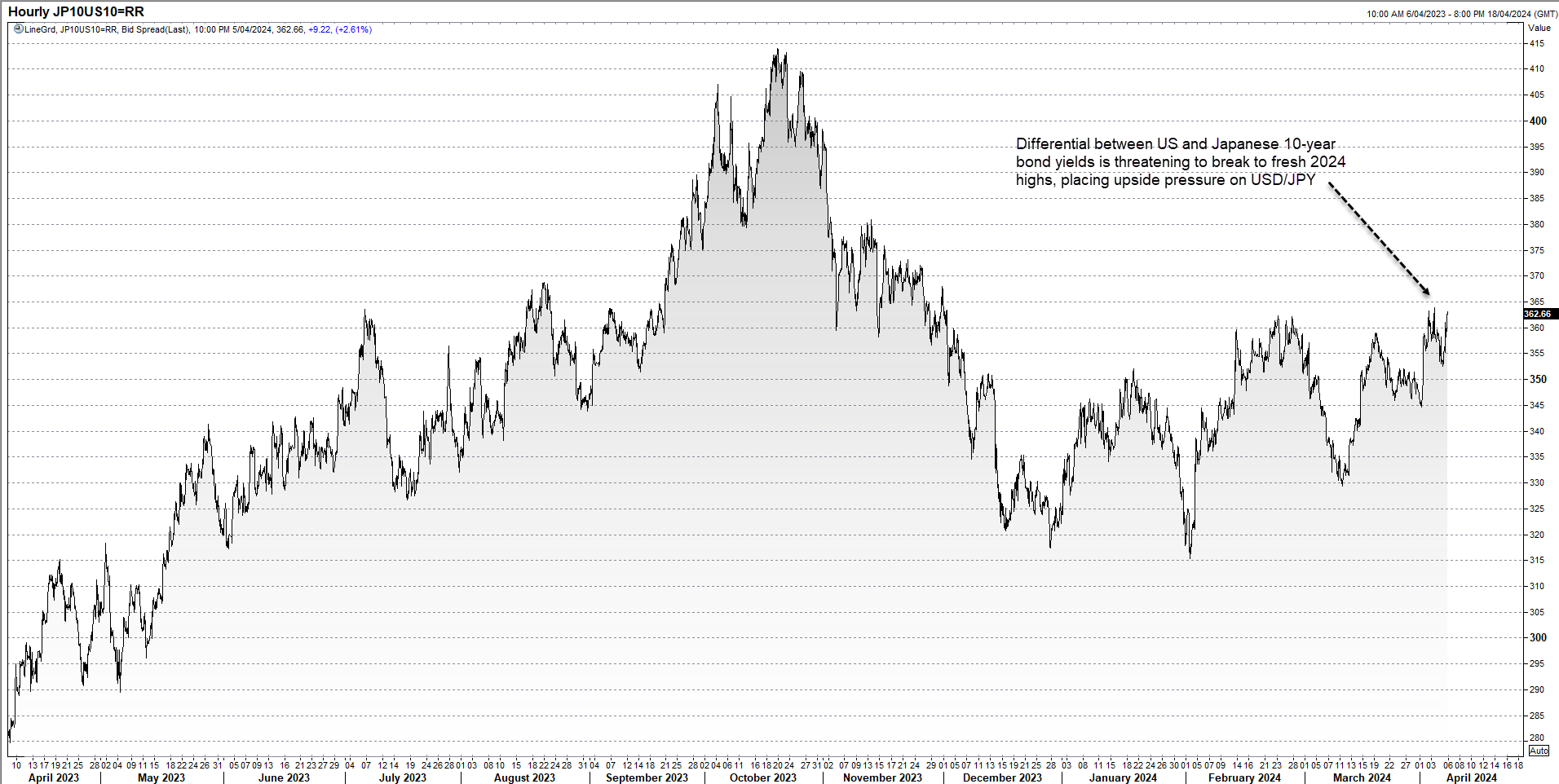

If that happens and we see no upside surprise in the core or headline inflation rates, it’s likely US front-end bond yields will decline, dragging back-end rates lower with it. That should narrow the yield differential between the US and Japan and weigh on USD/JPY. However, if we see another upside surprise, especially at the core level, USD/JPY and yields would likely lift, reflecting the diminishing case for Fed rate cuts in 2024.

Source: Refinitiv

US PPI, ECB rates decision in focus

The same approach applies for Thursday’s producer price inflation report with a hotter reading likely to lift USD/JPY, and vice versus if cold. A 0.3% gain is expected.

The ECB monetary policy meeting is the other key event simply because the euro is the largest weight in the US dollar index, making its fluctuations influential on other G10 FX names, including the yen. While no change in policy rates is expected, there is a growing risk it may signal the likely timing of its first rate cut will be brought forward from June. If that eventuates, EUR would likely weaken against the USD, dragging JPY along with it.

As for geopolitics, the rule of thumb is that if the tensions in the Middle East are subsiding, it should boost USD/JPY. If they escalate significantly, the likely repatriation of capital to Japan would weigh heavily on USD/JPY.

USD/JPY technical setup

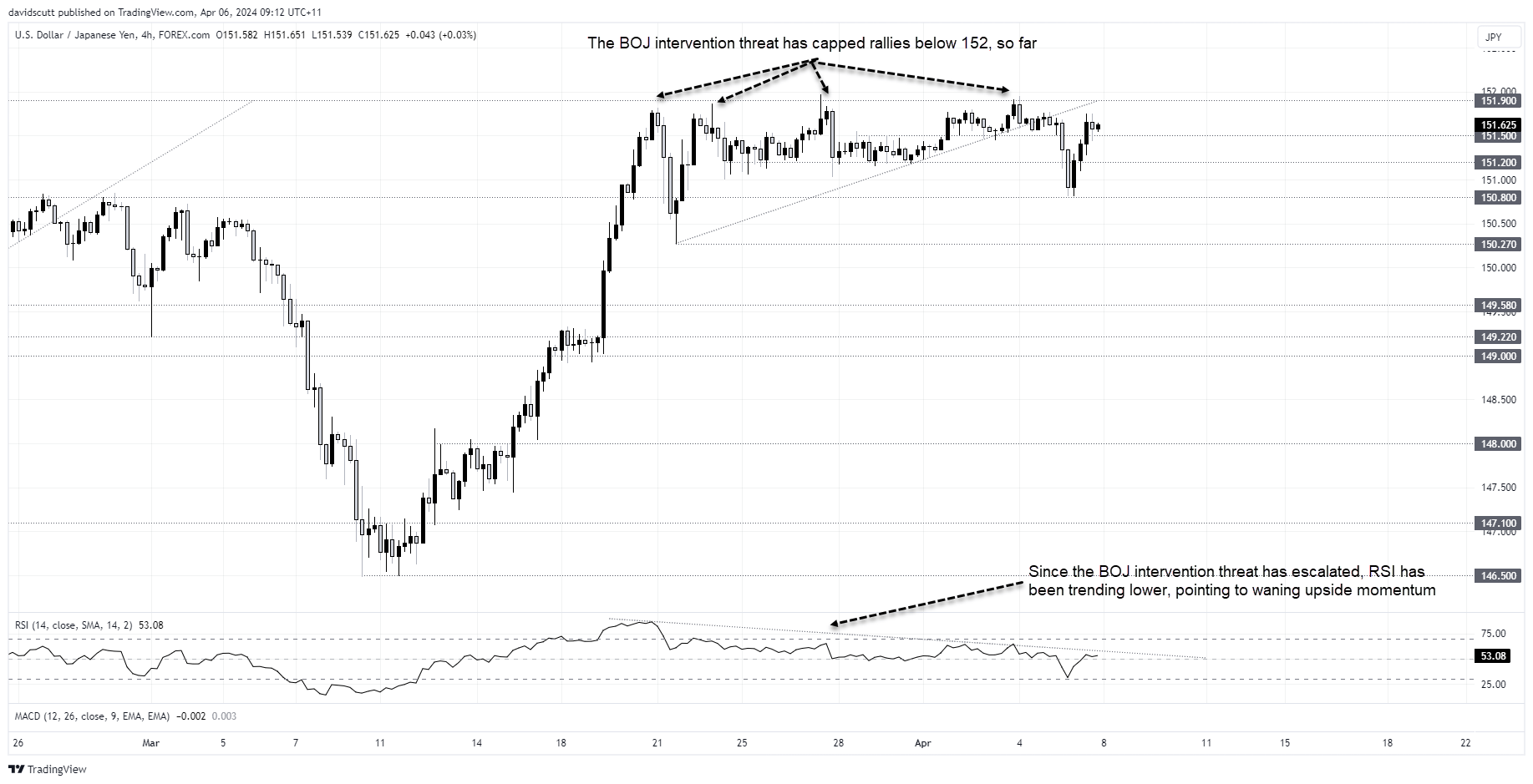

With markets continued to pare rate cut expectations from the Fed, widening interest rate differentials with Japan, fundamentals suggest the bias for USD/JPY should be higher heading into the US inflation reports this week. However, with the threat of intervention from the BOJ elevated, rallies continue to suffocate on pushes towards resistance at 152, creating what I’ve described previously as a stalemate scenario.

With USD/JPY sandwiched by the intervention threat and bullish fundamentals, I’ll direct you to recent trade ideas that remain valid and have already worked since written. They can be accessed here and here.

The one overriding message is that while the technical picture looks bullish for USD/JPY, with a break of 152 pointing to the potential for substantial gains, the threat of BOJ intervention has greatly reduced the odds we’ll see significant upside should a topside break occur.

That suggests there’s limited reward and ample risk of going long on pushes toward 152. If the BOJ were to intervene, or even just signal such a move was imminent, USD/JPY could fall hundreds of pips in the space of seconds. As such, unless the Japanese government’s stance towards the weaker yen shifts substantially, selling rallies, rather than buying dips or breaks, remains the preferred strategy.

Resistance is located just below 152 with support located at 151.50, 151.20, 150.80 and 150.27. A more pronounced support zone is located between 149.58 and 149.00. Good luck!

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade