- Buying USD/JPY right now screens as a low reward, high risk trade

- With the Japanese government on edge about a weaken yen, selling rallied comes across as a stronger strategy, especially considering how significant the US rates repricing has already been this year

- It will be difficult for US economic data to impress further given strength is now expected, limiting two key factors that have contributed to yen weakness

The overview

With the threat of BOJ intervention elevated and seemingly increasing, buying USD/JPY right now screens as high risk and low reward. Selling rallies ahead of 152 looks a far stronger trade setup, especially when you consider how significant the US rates repricing has been this year.

The background

As soon as Japan’s Ministry of Finance elevated the threat of market intervention from the Bank of Japan to support the Japanese yen last week, it immediately lowered the probability of meaningful USD/JPY upside over the short to medium-term.

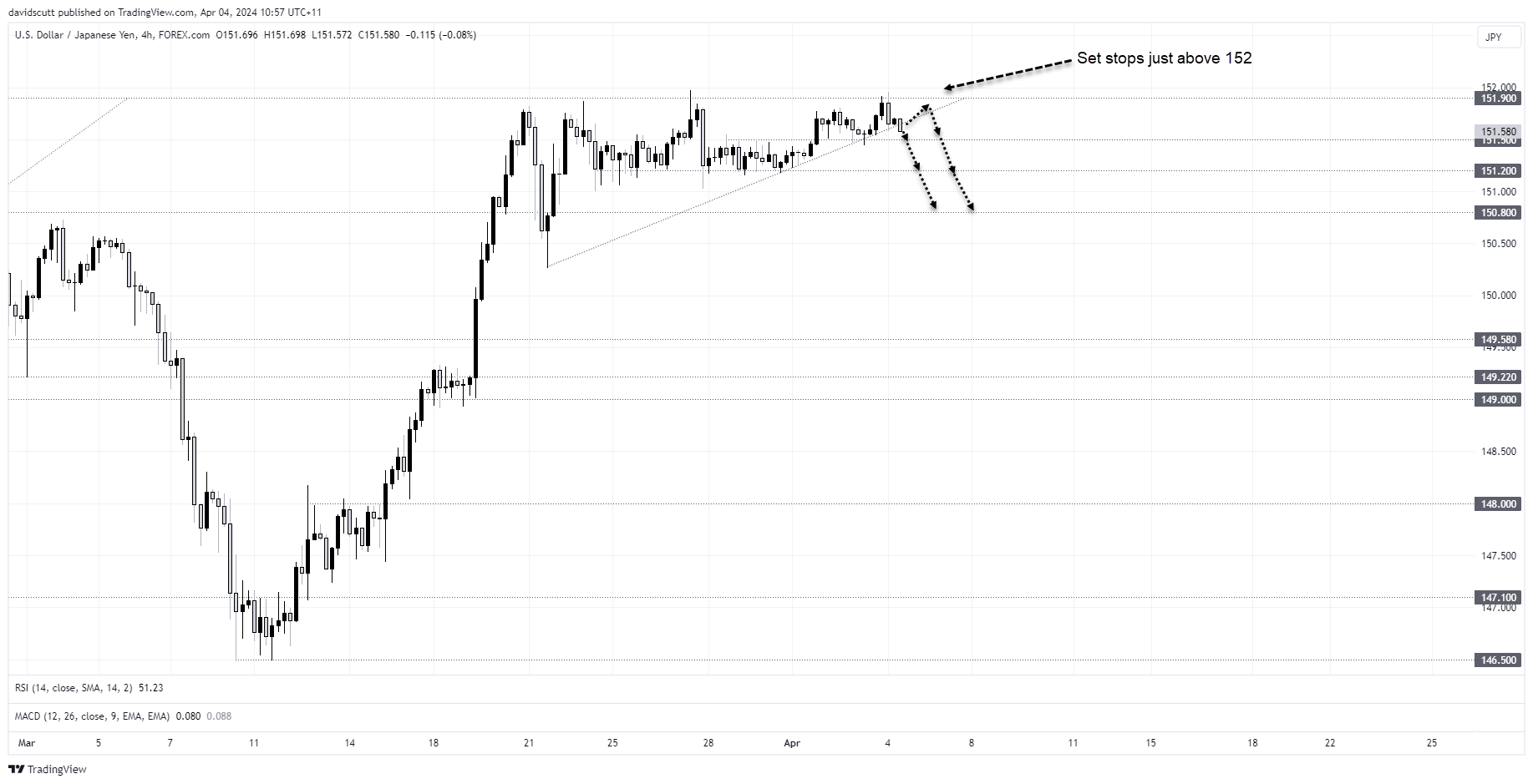

I described the development as the beginning of a stalemate, with a bullish breakout from a potential ascending triangle pattern thwarted by the threat posed of the BOJ pulling the trigger. Until it or the armada of US dollar bulls blinked first, it points to limited downside and upside for USD/JPY.

I get why yen bears don’t want to give up on the long USD/JPY trade – similar stalemate conditions ahead of 150 gave way last year despite the threat of BOJ intervention, paving the way for the latest push higher. But unless you believe the Japanese government will gladly step aside and let the yen unravel further, there are far easier trades out there.

Put simply, if the BOJ were instructed to buy yen aggressively, the rate check with Japanese banks alone would be enough to send USD/JPY tumbling by hundreds of pips. As such, long trades screen as low reward and high risk, the exact opposite setup to what you should be looking for.

It’s far easier to sell rallies ahead of 152, not only because of the BOJ intervention threat but also the enormous repricing of the US rates outlook that has seen markets strip out more than 100 basis point of cuts from the Fed in 2024, limiting the potential for yield differentials and carry trade flows to blossom further.

That’s important given it’s two main factors that have pressured the yen in recent years.

The trade setup

Sell rallies ahead of 151.96 with a tight stop above 152 for protection. It’s as simple as that if the price gets back there. If you get it wrong it might cost you a handful of pips, but if you get it right you stand to make significantly more, especially if the BOJ goes bang.

Fitting with the stalemate that’s been created, levels are now clustered close together, with 151.50 and 151.20 potential near-term targets. A break of 150.80 would be more significant, opening the door to more pronounced downside.

If you are itching to go long up here, you could set positions above any of those levels should the price fail to beak through, allowing for stops to be placed below for protection. But again, unless you’re scalping intraday, the longer-term risk-reward screens as weak.

The wildcards

If the Japanese government softens its stance towards the softer yen, reducing the threat of BOJ intervention, that would be more than enough excuse to abandon the sell-on-rallies mindset. A bullish break would point to the risk of substantial upside given how long the price has been coiling up.

Linked to the first point, the US economy may keep outperforming relative to expectations, resulting in the Fed having to meaningfully reassess the policy outlook, widening interest rate differentials with Japan. While possible, such an outcome appears unlikely with a shift from cuts to hikes likely to weigh on GDP growth and investor sentiment.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade