- The threat of BOJ intervention is capping upside in USD/JPY while fundamentals are limiting downside

- Selling rallies and buying dips favoured given potential stalemate

- Major BOJ intervention or significant shift in US rate expectations are risks that could dismantle the forecast

The overview

The threat of intervention from the BOJ has increased, likely limiting upside for USD/JPY in the near to medium-term. But extremely wide interest rate differentials and buoyant markets suggest USD/JPY shouldn’t be significantly lower.

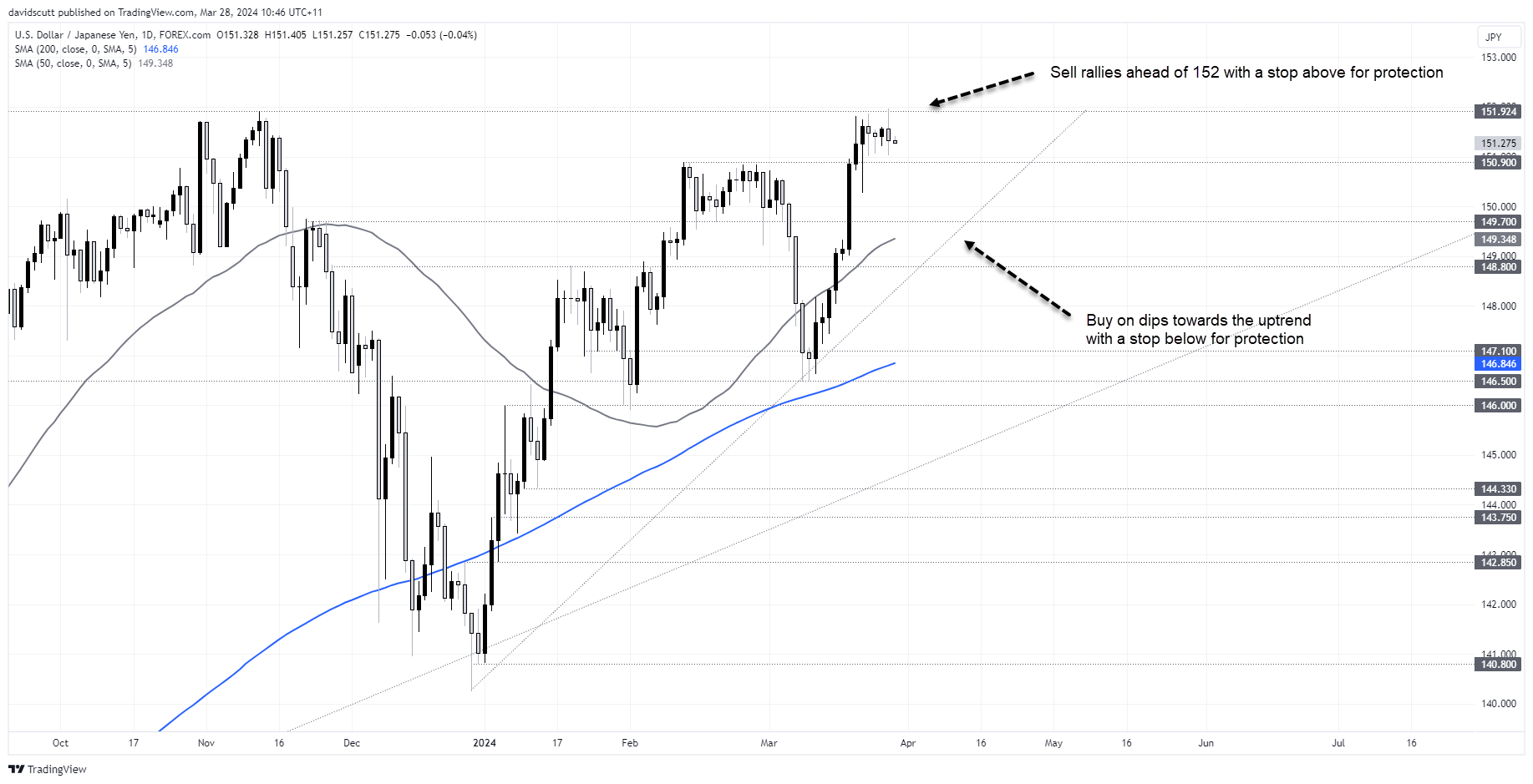

It points to a stalemate for yen bulls and bears but opens the door for traders to play existing ranges. Buying dips towards uptrend support and selling rallies towards 152 is favoured until we see a definite range break.

The background

There is little doubt the risk of Bank of Japan (BOJ) intervention to prop up the Japanese yen went up a notch on Wednesday, with the language and actions from the Japanese government signaling it’s moving closer to giving the BOJ the green light.

With warnings from Japan’s “currency Tsar” Masato Kanda and Finance Minister Shun'ichi Suzuki failing to discourage yen bears earlier in the week, news of an unscheduled meeting involving the government, BOJ and Japanese regulators on Wednesday was enough to elicit a strong response from markets, seeing USD/JPY pull back sharply from 34-year-highs struck earlier in the session.

Kanda told reporters again the government "wouldn’t rule out any steps to respond to disorderly FX moves."

Make no mistake; while the risk of BOJ intervention has escalated, the mere threat may be enough to deter traders from pushing USD/JPY towards Wednesday’s highs in the short-term, limiting the need for the bank to act. With positioning in the yen extremely short relative to historic norms, something my colleague Matt Simpson has covered extensively, traders should be aware that it won’t take much to elicit a substantial reaction in USD/JPY.

That means the risk of a topside break from the ascending triangle pattern USD/JPY has been sitting in since early 2022 has diminished in the near-term. But despite what Japanese officials continue to suggest, it’s difficult to argue the yen should be substantially stronger than these levels. Policy settings from the BOJ remain extremely accommodative relative to the rest of the developed world, leaving yield differentials extremely wide which is helping to export capital from Japan via carry trades.

On one hand the BOJ intervention threat is real and growing, but on the other fundamentals suggest USD/JPY shouldn’t be meaningfully lower. It points to a stalemate until either the Japanese government relents, or we see the US Fed start to cut rates aggressively, likely in response to a sudden or abrupt slowdown in the US economy.

Thankfully, we’ve been to this rodeo before.

There was similar stalemate late last year with USD/JPY trading in a narrow range until the Fed pivoted away from rate hikes, resulting in the pair eventually falling over ten big figures towards year-end.

Now, as then, the easiest path looks to trade existing ranges until we see a definitive break either to the topside or downside. Buy dip and sell rallies with tight stops for protection.

The trade setup

Having spent so long around these levels and given how respectful the price has been of established levels, traders have something of an existing blueprint to work with should the stalemate play out.

Key resistance is located just below 152, where rallies have stalled on multiple occasions dating back to 2022. Given recent events, USD/JPY may struggle to retest the level in the near-term, providing a setup where traders can sell ahead of 152 with a stop above for protection.

As for downside levels, 150.90 and 149.70 have acted as both support and resistance in the past, allowing traders to establish positions around depending on how the price interacts when it gets there. You can buy or sell depending on whether the price bounces or breaks, allowing for stops to be put on the opposite side for protection.

The 50-day moving average is another important level as the price often respects it. As for most likely location to buy dips before we start talking about a potential trend change, the uptrend dating back to late 2023 is another location where traders could establish long positions with a stop below for protection. Potential upside targets are the same as those listed above.

The wildcards

If the BOJ is instructed to intervene and go big when it does so, the range listed above may give way like a hot knife through butter. But the risk of a sustained intervention screens as unlikely given the stronger yen would eventually start to weigh on the Japanese economy and risk Japan may be labelled a currency manipulator by other nations.

If it intervenes with fundamentals working against it, traders will likely pile into longs once confident the action has concluded. That’s often what’s occurred in the past.

The US side of the USD/JPY equation is far more important than the Japanese side, with the US economic and rate outlook key to the underlying fundamental picture.

If the Fed is forced to scale back rate cut expectations for 2024, the likely widening in interest rate differentials should skew risks for USD/JPY higher. Conversely, if the Fed is forced to suddenly cut rates aggressively, it will likely result in a swift decline in USD/JPY without the need for BOJ intervention.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade