US futures

Dow futures +0.5% at 33100

S&P futures +0.2% at 4212

Nasdaq futures -0.35% at 13255

In Europe

FTSE +0.3% at 7170

Dax +1.4% at 13860

Euro Stoxx +1% at 3726

Learn more about trading indices

Nasdaq underperforms as yields rise

US stocks are set for a mixed start as Russian Ukraine peace talks resume and investors look ahead to the Federal Reserve monetary policy meeting.

More peace talks are taking place today. Hopes are growing that a diplomatic solution can be found. US Deputy Secretary of State Wendy Sherman said that Russia shows signs of wanting to progress negotiations.

The positive comment combined with the most optimistic assessments so far from both Ukraine and Russia over the state of talks is helping boost risk sentiment, lifting stocks cautiously higher after heavy losses last week. Oil prices are also heading lower.

The Nasdaq is underperforming its peers as attention also turns to the Federal Reserve rate decision later in the week. The Fed is expected to hike rates by 0.25% after inflation surged to 7.9% YoY in February.

In addition to Ukraine Russia talks, the US and China are also set to hold their first high-level talks since Russia’s invasion last month and amid reports that Russia asked China for military equipment at the start of its invasion.

Separately, China has seen COVID cases jump to a two-year high. The tech hub Shenzhen has been moved back into lockdown. While the Chinese stock market was hit on the news, in Europe and the US, Ukraine optimism overshadows the rapid spread of Omicron in the world’s second-largest economy.

There is no high-impacting US data due to be released today.

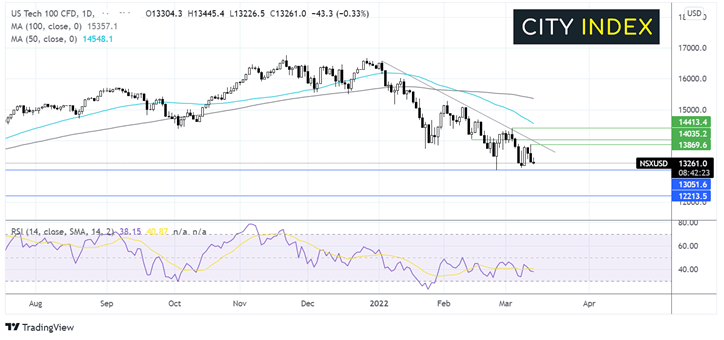

Where next for the Nasdaq?

The Nasdaq is edging lower on the day after failing to find acceptance at 13450. The long wick on the candle, combined with the bearish RSI, suggests that there could be more downside on the cards. Strong support can be seen at 13000 the round number and 2022 low. A break below here would be significant and open the door to 12200 the March 2021 low. Buyers will look for a move over 13850, the confluence of the falling trendline resistance and last week’s high ahead of 14000 round number and 14415, which is a move above here, changing the bias to bullish.

FX markets USD falls, EUR rises

USD is heading lower as risk sentiment returns. That said, any losses in the greenback could be capped by rising treasury yields ahead of Wednesday’s Fed rate decision.

EURUSD is rising, boosted by hopes of a diplomatic end to the Ukraine war, bringing 1.10 psychological level back into focus. Europe stands to gain the most from a quick resolution to the Ukraine crisis.

GBPUSD is falling despite the improved market mood. While it has picked up from the year-to-date low of 1.30, the price remains depressed. The BoE rate decision is due on Thursday, and expectations are for a rate hike back to pre-covid levels. However, growth is also set to slow, which is unnerving investors.

GBP/USD -0.1% at 1.3029

EUR/USD +0.38% at 1.0955

Oil tanks 5%

Oil prices fell 5% across last week and trade 5% lower just today as investors grew hopeful of diplomatic efforts to end the Ukraine crisis and COVID cases surge in China.

Russian and Ukraine negotiators are due to sit down again today for more peace talks after an upbeat assessment of weekend developments, at least round the table; fighting on the ground continues. Meanwhile, Russian exports will be closely monitored for signs of changes.

In addition to Ukraine hopes, a jump in COVID cases in China and strict new lockdown restrictions raise questions over the demand outlook. New daily infections have hit a two-year high in China, the world’s largest oil importer.

WTI crude trades -4.6% at $101.80

Brent trades +4.6% at $105.88

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.