US futures

Dow futures +0.5% at 34110

S&P futures +0.5% at 4377

Nasdaq futures +0.34% at 15081

In Europe

FTSE +1.5% at 7070

Dax +0.9% at 15447

Euro Stoxx +0.9% at 4135

Learn more about trading indices

Stock aim higher as risk sentiment rises

US stock are set to open higher on Wednesday as investors breathe a sigh of relief over the latest Evergrande developments and ahead of the Federal Reserve’s monetary policy announcement.

Evergrande defied expectations and announced that it will make a domestic coupon payment tomorrow. Whilst this is unlikely to be the end of the drama surrounding the Chinese real estate firm, the kicking of the Evergrande can down the road is allowing risk appetite to rebound.

Attention is now firmly on the Fed, which is set to release it’s statement in addition to new economic forecasts and the dot plot – the path of expected interest rate rises.

The Fed is broadly expected to provide further clues over the timing of its move to taper bond purchases. As a base case scenario, a formal announcement is likely to be made in November for a December start. The risk lies in the Fed not providing enough details on the timetable to taper which could help US equities higher whilst dragging on the US Dollar.

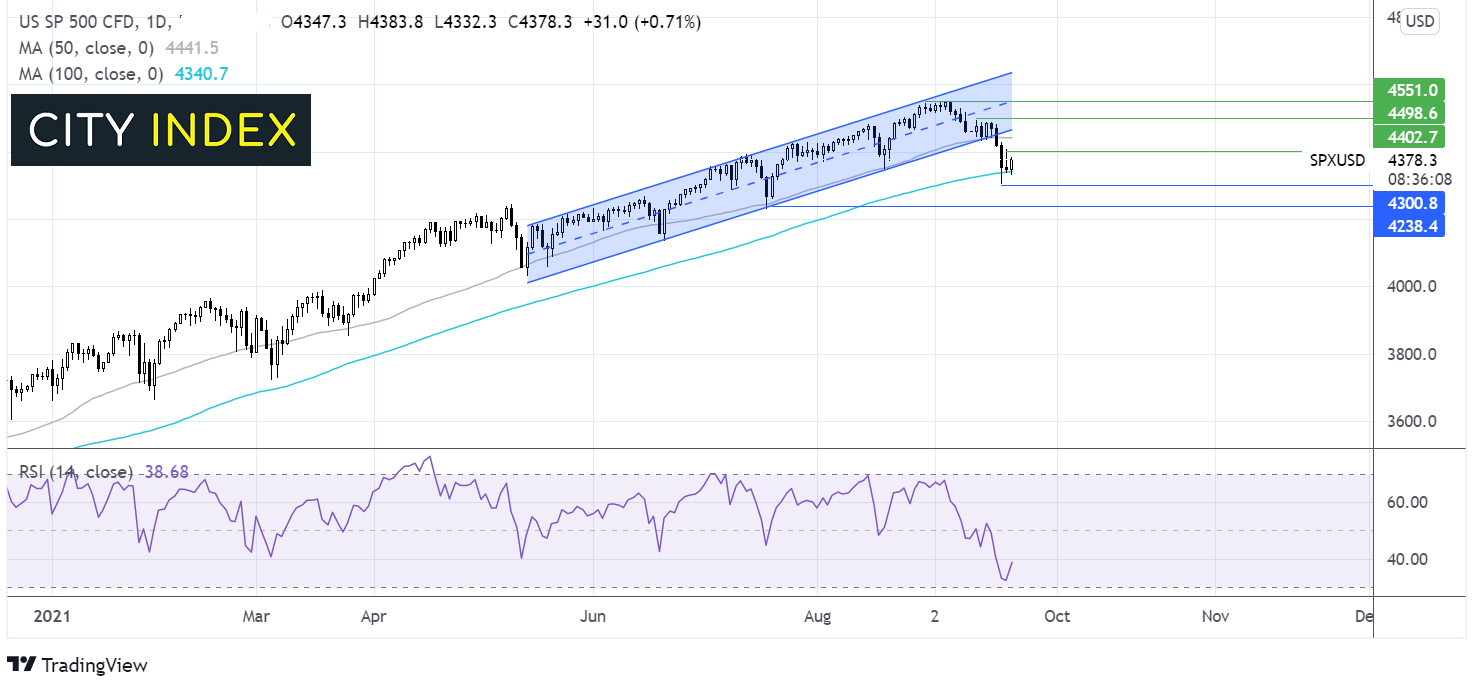

Where next for the S&P500?

The S&P500 is pushing higher after rebounding off the 100 sma on the daily chart overnight. The gains are bringing resistance at 4400 yesterday’s high and 4440 the 50 sma into focus. Failure to hold onto the gains post the Fed announcement could see the 100 sma retested at 4340. A break through the sma could open the door to a deeper selloff to 4300 the weekly low.

FX – USD eases, CAD extends gains

The US Dollar is holding steady for a second session ahead of the Fed rate announcement later today. Whilst the easing Evergrande situation is bosting risk sentiment, today it’s all about the Fed.

USD/CAD once again outperforming peers thanks to the rise in oil prices and a continues rally following on from the elections on Monday. Canadian voted to stick with the status quo.

USD/CAD -0.2% at 1.2780

GBP/USD -0.13% at 1.3640

EUR/USD +0.04% at 1.1730

Oil extends gains on larger stock pile draws

Oil prices are extending gains following a larger than expected draw in inventories amid tight US supply. The latest API crude stockpile data revealed a larger than forecast 6.1 million barrel draw last week. The data comes as supply in the US has been tight following the slow return of production in the Guld of Mexico after several hurricanes.

Between the energy crisis, tight US supply and the rising demand outlook, there are plenty of supportive factors in the oil market right now.

Attention will turn to the EIA official inventory data due later today. Also any movement in the US Dollar following the Fed announcement could also drive movement in dollar denominated oil prices.

WTI crude trades +1.5% at $71.50

Brent trades +1.3% at $74.71

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 US Existing home sales

15:00 EZ Consumer confidence

15:30 EIA weekly crude oil stock pile data

19:00 Fed rate decision

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.