If you look at the rallying global equity markets, investors are evidently very optimistic about the US debt ceiling negotiations and not too worried about the slowdown in China. Yet, the same optimism is not evidenced in FX markets, with the dollar remaining on the front-foot. But is that about to change, will the US dollar forecast turn more bearish moving forward?

Rallying equities not enough for risk-sensitive FX pairs

This morning saw the German DAX index causally rally another 200 points to hit its highest level since January 2022. Elsewhere, the Nikkei has been on a tear, rising 17% from its March low to break the September 2021 peak. The day before, saw the Nasdaq 100 climb to its best level since last August, and index futures were pointing to another higher open on Wall Street today.

But unlike equities, the FX markets are not so cheerful. Admittedly, the JPY crosses have been on a tear along with the Japanese equity markets to suggest it is indeed “risk-on”. But if you look at the US dollar against other currencies, you will get a different picture – for it is also continuing to rise against the more risk-sensitive currencies like the AUD, GBP and EUR.

US data surprises to upside

In terms of economic data, we have just seen the release of jobless claims. Claims surprised on the upside las week but were expected to decline from 264K to 252K. However, if they came better at 242K, thus supporting the dollar further. What’s more, the May Philly Fed came in -10.4 versus -19.8 expected.

Later in the day we have existing home sales data, while Philip Jefferson, Michael Barre and Lorie Logan are among today’s Fed speakers.

China concerns holding back commodity currencies

Global demand concerns have dragged on sentiment towards commodity FX in recent weeks, following the release of a number of disappointing data pointers from China in April. Among other things, these include most recently retail sales and industrial production. We also saw a big drop in imports while house prices fell again, extending the decline to 11 consecutive months. China’s property sector is key for the economic growth outlook as it accounts for around 20% of the country’s GDP. As well as the AUD and NZD, we have also seen the yuan slump to lift the USD/CNH pair to levels not seen since November.

US dollar forecast: Will the greenback weaken again?

In the US, interest rates are already at a peak and inflation is on a downward trajectory. There is a possibly that the economy is going to weaken in the months ahead, allowing the Fed to pivot by as early as September.

In the short-term, the potential weakness for USD could arise from a potential rebound in foreign currencies, should improving risk appetite make its way into risk-sensitive currencies. President Joe Biden and House Speaker Kevin McCarthy’s rhetoric have narrowed, and both are optimistic about achieving a deal by Sunday.

Will major FX pairs rebound?

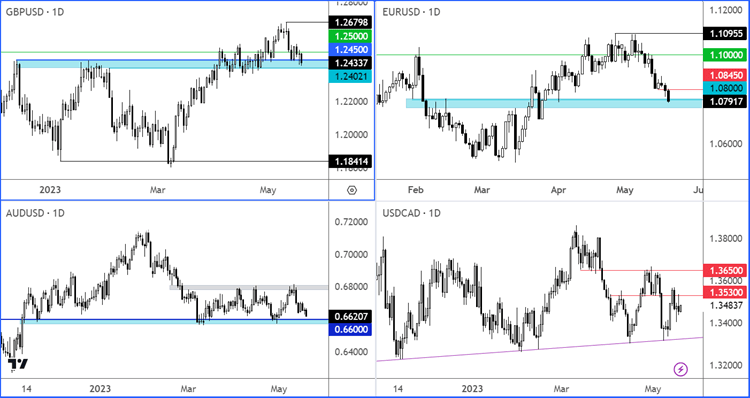

So, are we going to see the risk-on trade make its way into the FX markets today and see the likes of the EUR/USD, GBP/USD, AUD/USD and CAD/USD rebound?

Source: TradingView.com

Well, if you look at the GBP/USD and EUR/USD, they are both testing some interesting technical levels of around 1.24ish and 1.08ish, respectively. The AUD/USD remains in the lower half of its tight 200-pip range between 0.66 to 0.68. There’s a similar pattern on the NZD/USD pair. But the USD/CAD has started to trend a little lower, closing lower on Wednesday, potentially providing the first indication that the USD might be about to turn lower against other currencies, too.

But as traders, we must act on what’s in front of us and right now the dollar bears are not getting the signal they are looking for. Therefore, if you are looking for potential long setups on the majors, some confirmation must first be observed.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade