GBP/USD rises ahead of BoE rate decision

- BoE to hike rates by 25 bps

- Weigh up high inflation & banking stress

- GBP/USD trades above 1.23 at a 6-week high

GBP/USD has risen above 1.23 to a six-week high following the Federal Reserve’s dovish interest rate hike and as investors look ahead to the BoE rate hike.

The BoE is expected to hike rates by 25 basis points in a move that will mark the 11th straight rate hike and takes the interest rate to 4.25%.

The meeting comes as the bank weighs up a surprise increase in inflation to 10.4% YoY and the recent stresses in financial stability. The vote is expected to be split, with some policymakers expected to vote to keep rates on hold. However, while the BoE has other tools available to help with financial stability, as we saw post Autumn’s mini-Budget, the bank’s principal tool for fighting inflation is to hike rates.

The 25 basis point rate hike is 94% priced in by the market, which means that the upside following a hike could be limited. There is still a small possibility that the Bank of England will choose to keep interest rates on hold in order to assess the recent fallout in the banking sector and hike again in May. Such a decision could pull the pound sharply lower.

Forward guidance will also be closely watched, with the BoE expected to be nearing the end of its rate hiking cycle.

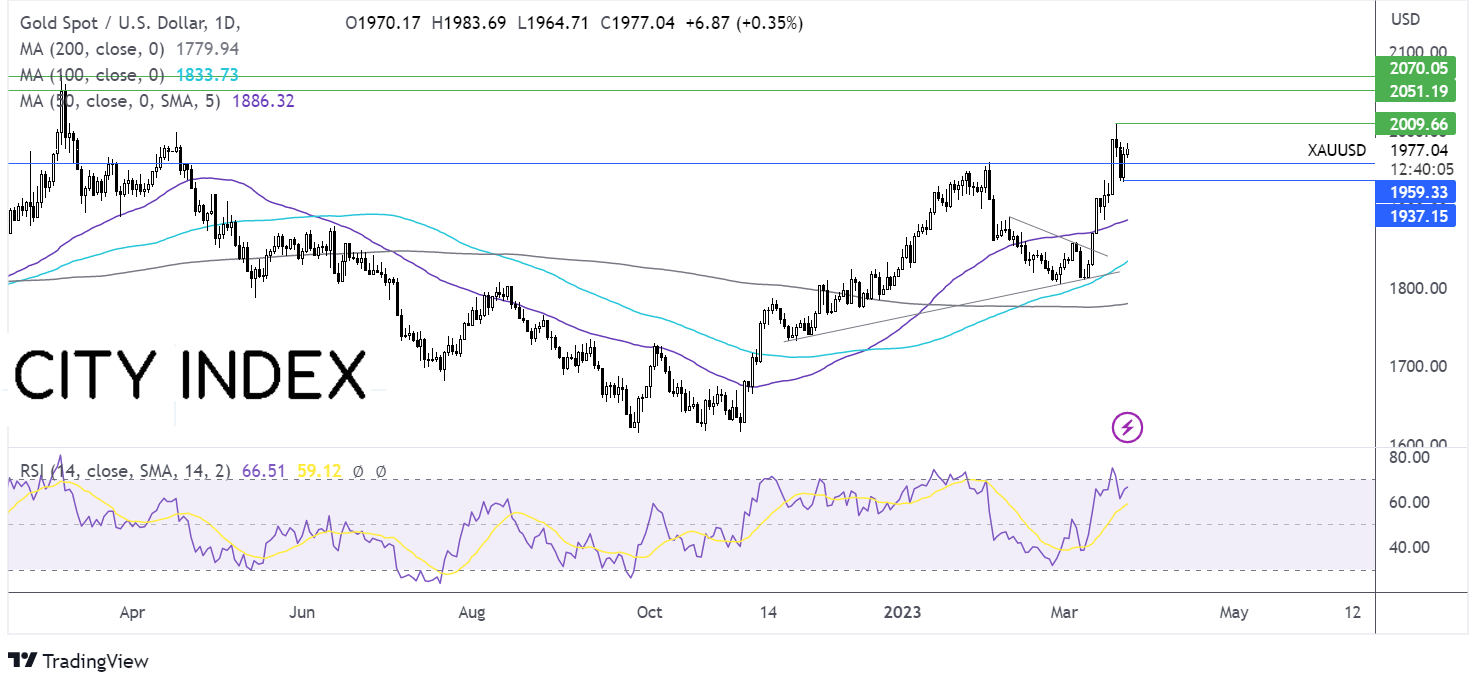

Where next for GBP/USD?

GBP/USD has rebounded from 1.18, the 2023 low, rising above the 200, 100 & 50 sma and above resistance at 1.2270, the February 14 high.

This, along with the bullish RSI, keeps buyers hopeful of further gains towards 1.2450, the 2023 high. A rise above here sees 1.2665, the May high comes into focus.

Immediate support can be seen at 1.2275, with a break below here exposing the 50 sma at 1.2150 and 1.2025 the March 15 low.

Gold rises post Fed and looks to jobless claims

- Fed hikes by 25 bps

- Near end of hiking cycle

- Gold looks towards resistance at $2000

Gold prices jumped 1.6% on Wednesday after the Fed hiked interest rates by 25 basis points as expected. While Fed Chair Powell pushed back on market expectations of a rate cut this year, the market focused on the more the Fed’s less hawkish adjustment to the statement: the removal “ongoing increases” from the statement, suggesting that the central bank is nearing the end of the hiking cycle.

The 2-year treasury yield and USD fell, boosting non-yielding, USD denominated gold. However it is worth keeping in mind that while the market is still pricing in a rate cut this year, the Fed isn’t so this does leave gold vulnerable to a re-pricing should the latter prove correct as the year progresses.

Today, in addition to the BoE and the SNP US jobless claims will be in focus. US jobless claims are expected to rise 197k from 192k the week before. Weaker than expected jobless claims could fuel the less hawkish Fed bets and boost Gold.

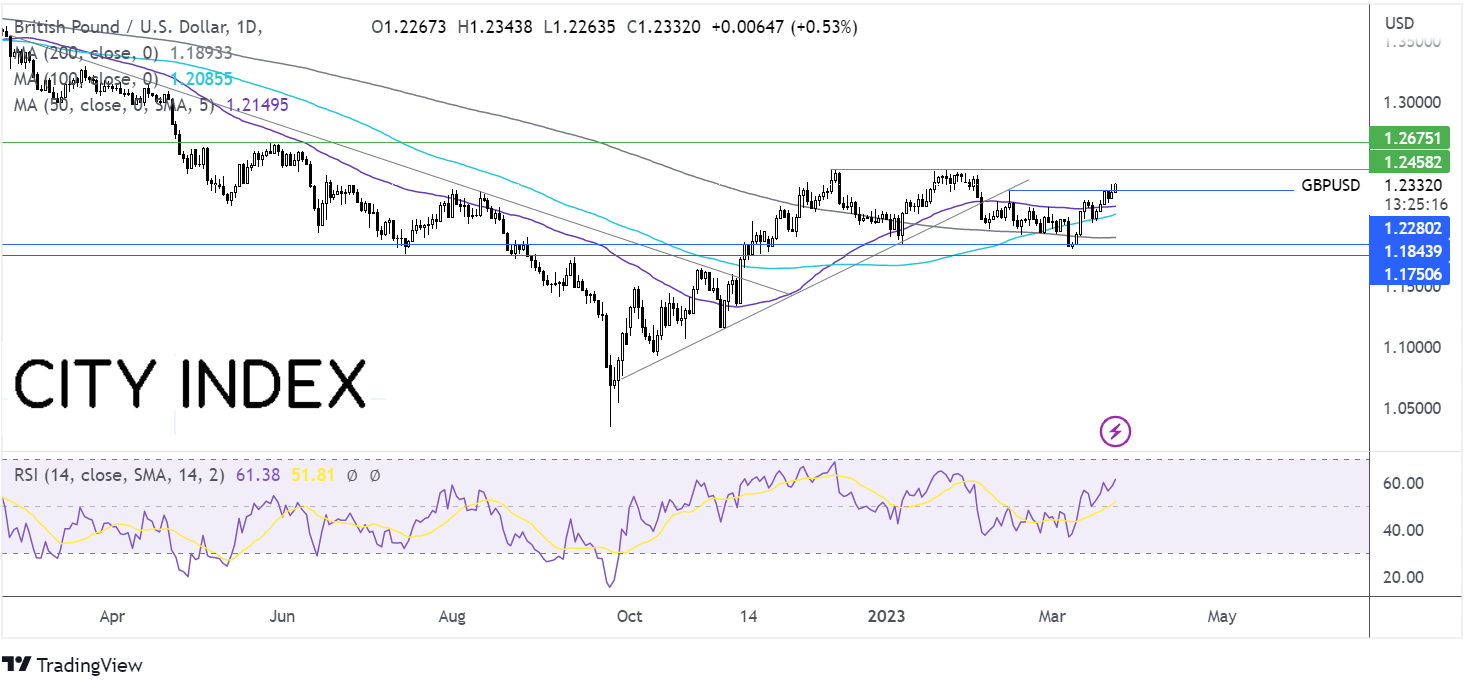

Where next for Gold?

The rise above resistance at 1960, plus the bullish RSI keeps buye5rs hopeful of further gains. Buyers need to break above resistance at 1998-2000 to open the door to 2009 the 2023 high. A rise above here creates a higher high.

On the flip side, sellers could be encouraged by the long upper wick on Monday's candle suggestiNg that there was little appetite at the higher price. A break below support at 1960 could open the door to 1934 the weekly low.