FTSE falls on banking rout fears & despite GDP beat

- FTSE drops after banking rout fears spread from US

- UK GDP +0.3% MoM

- FTSE fall aggressively through support

The FTSE, along with its European peers, is heading sharply lower, tracking steep losses on Wall Street in spite of stronger than expected UK GDP reading.

Losses track a 1.8% drop in the S&P where the S&P500 banking sector tumbled almost 6%, its worst performance in 2 years as shares of SVP financial tumbled 61%.

A share sale of$1.75 billion as the tech lender sparked fears of capitalization risk across the sector. Bellwethers Bank of America & Wells Fargo tumbled 6%.

Banking jitters are set to hit Europe on the open; the FTSE is underperforming its peers, given the heavy weighting of banks on the index.

Better than-expected UK economic growth in January is failing to boost mood. UK GDP in January rose 0.3% after contracting 0 .5% in December; this was ahead of the 0.1% forecast. The UK economy has proved to be more resilient, which gives the BoE more wiggle room for hiking rates.

The data will help ease recession fears. If the UK did enter a recession in Q1, which is still possible, it is likely to be milder than initially feared.

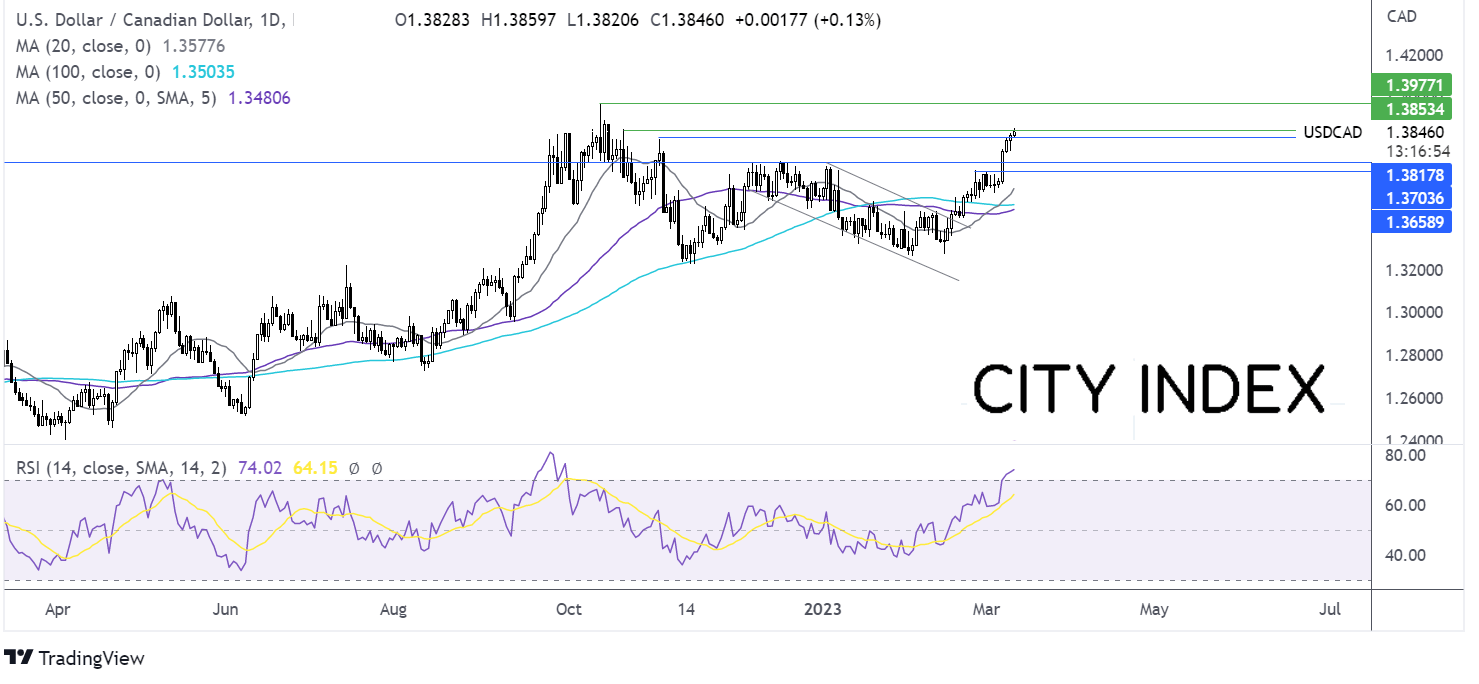

Where next for the FTSE?

The FTSE has fallen aggressively through support at 7860; the bearish engulfing candle, which combined with the RSI below 50 keeps sellers hopeful of further downside.

Sellers will be looking for a fall towards 7700, the late January low towards 7625 the November high.

Buyers will look for a rise above 7875 to regain control and extend gains towards 7970 the March high.

USD/CAD rises to 2023 high with jobs data in focus

- SD/CAD rises on central bank divergence

- US & CAD jobs data due

- USD/CAD in overbought territory

USD/CAD is rising for a fourth straight session climbing to a five-month high above 1.38, boosted by central bank diversion, safe haven flows, and falling oil prices ahead of key jobs data from both Canada and the US.

Oil is trending lower for a fourth straight day amid concerns that the slowing global economic growth will hurt fuel demand.

Meanwhile, central bank divergence has been in play across the week after the Bank of Canada paused its rate hike Federal Reserve chat time how that US interest rates would likely rise higher and for longer.

Attention now is turning to labour market data from Canada and the US. Canada’s job market needs to be strong in recent months. However, job creation is expected to slow to 10,000 in February, down from 150,000 in January. The unemployment rate is forecast to tick higher to 5.3%.

The main show in town will be the US non-farm payroll report, where investors will be watching closely to see whether January’s blowout was a one-off. Expectations are for 205,000 jobs to add it in February up to 517,000 were added in January. Unemployment rate to expected to remain at historically low levels of 3.4% while average earnings are forecast to tick higher to 4.7%, up from 4.4%.

A strong U.S. jobs will fuel bets that the Federal Reserve could raise interest rates by 50 basis points in the March meeting, boosting the USD.

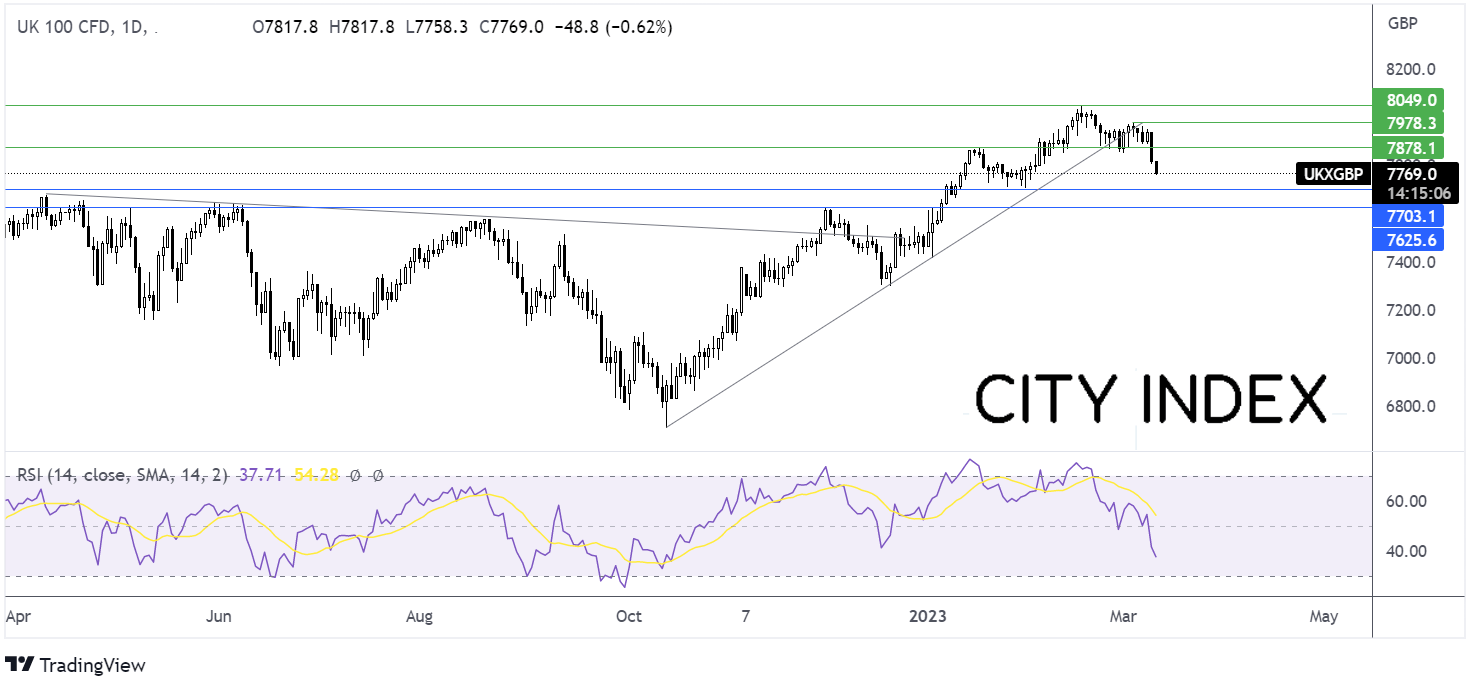

Where next for USD/CAD?

USD/CAD is extending gains towards 1.3850, a fresh 2023 high. The 20 sma is crossing above the 50 & 100 sma is a bullish sign. The RSI is in overbought territory, so buyers should be cautious.

A rise above 1.3855, the October 21 high, is needed to extend gains towards 1.3977, the October high, and on to the 1.40 psychological level.

Support can be seen at 1.3680, the November high, before 1.3620, the December high, and 1.3520, the February high.