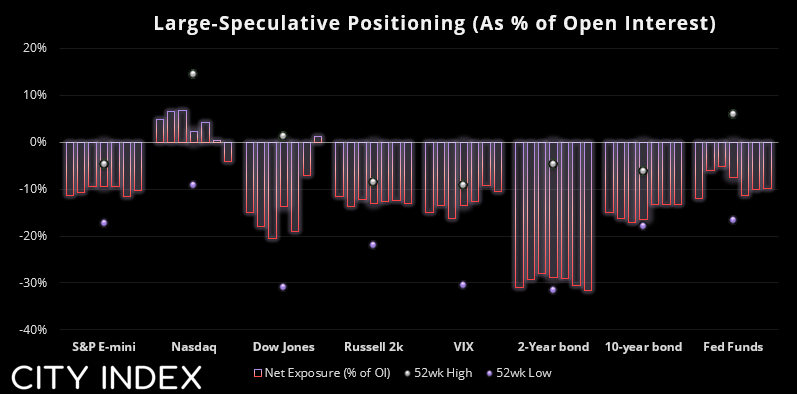

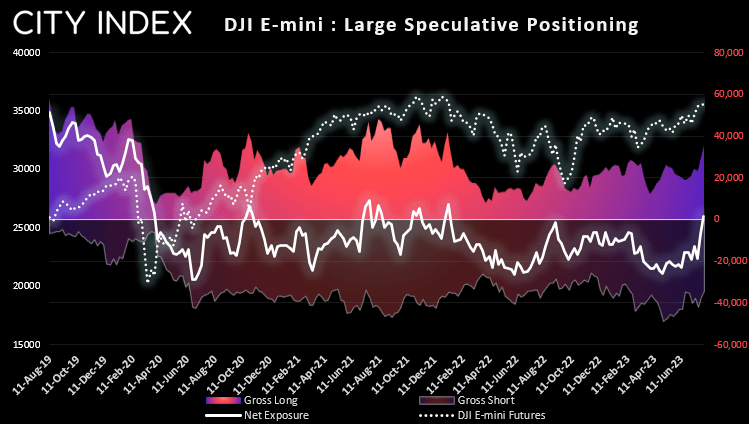

Large speculators flipped to net-short exposure to Nasdaq futures and net-long Dow Jones futures. Although if recent history is anything to go by, bullish exposure to the Dow Jones could be short given traders have struggled to remain net-long for more than a few weeks at a time since the Pandemic.

Traders reduced net-short exposure further to yen futures ahead of the BOJ meeting.

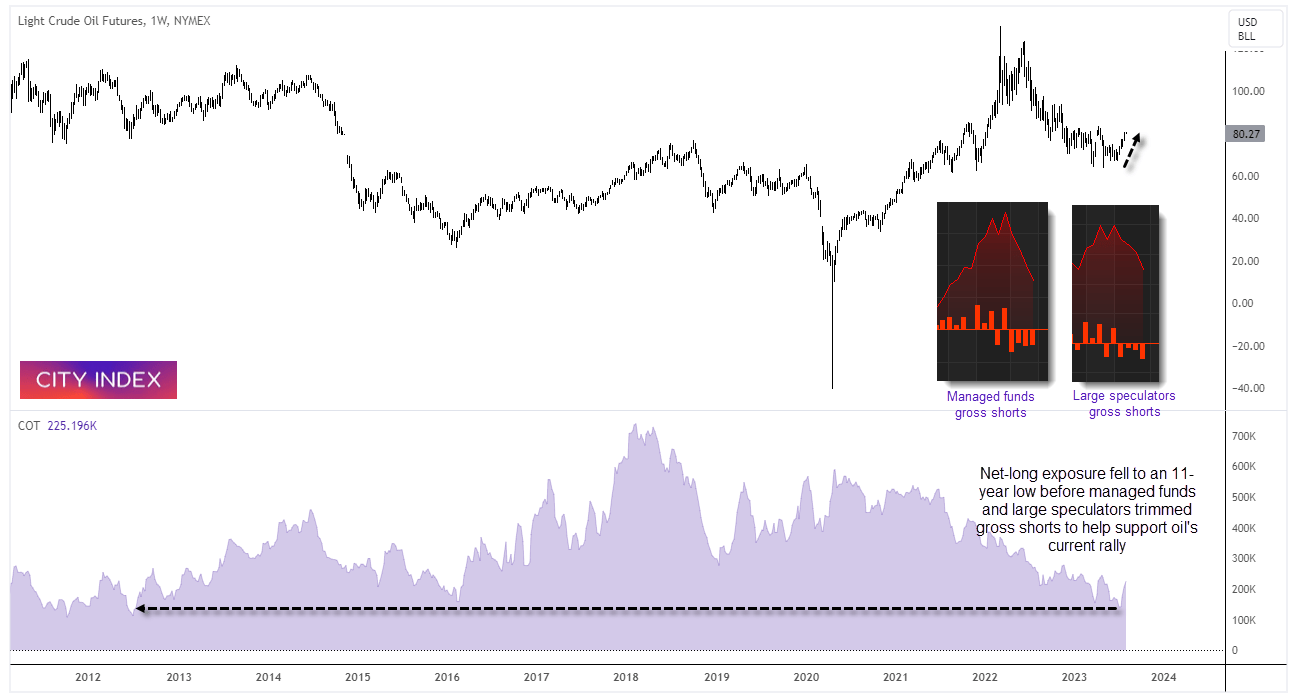

WTI has extended its rally as managed funds and large speculators reduced their short exposure for a fourth week and is currently on track for its best month in 18. Whilst this has pushed the 3-month percentile up to the top of its range, it may not necessarily mean an overbought level given net-long exposure fell to an 11-week low just five weeks ago.

There’s no loss of appetite for shorting the 2-year bond note, with traders hitting a fresh record high for net-short exposure. And that means it remains very much at a sentiment extreme and leaves the market vulnerable to a sharp reversal at some point. We just do not know when.

This content will only appear on City Index websites! Read our guide on how to interpret the weekly COT report

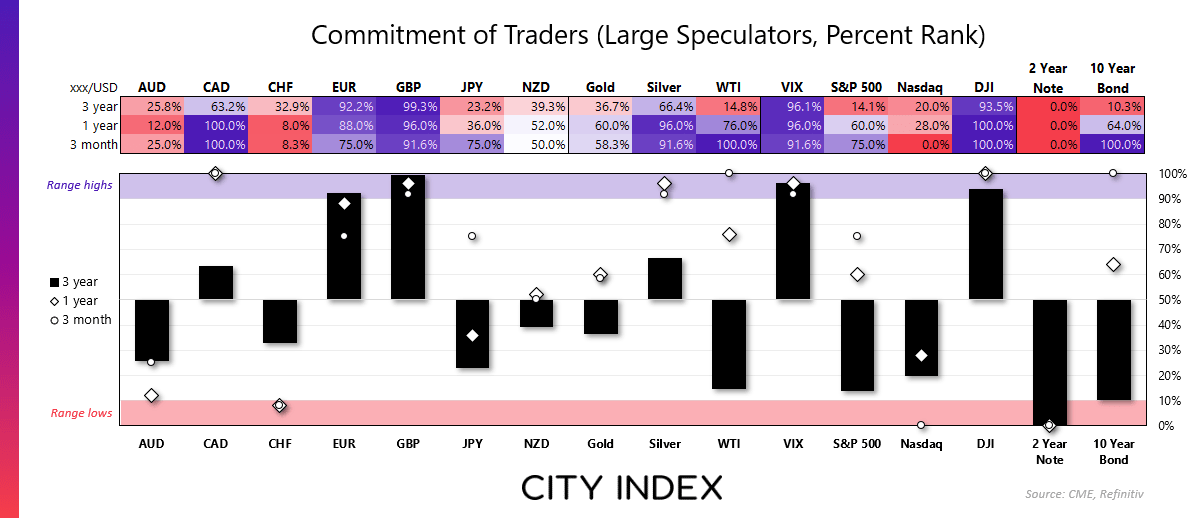

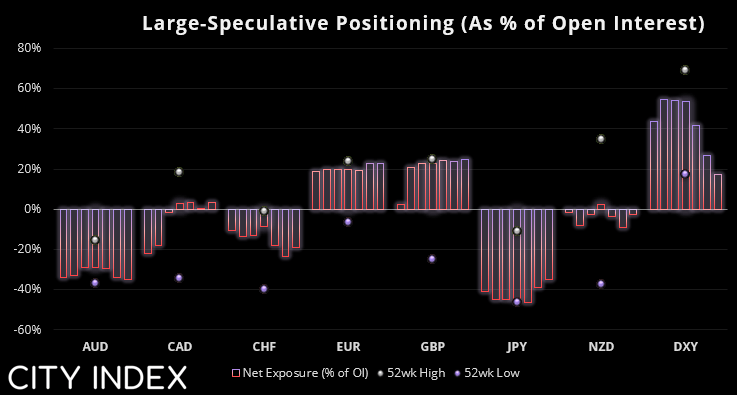

Commitment of traders (forex) – as of Tuesday 25th July 2023:

- Traders were net-short the US dollar against G10 currencies by US -$18.01 billion according to IMM

- Net-short exposure to JPY futures fell for a second week (gross shorts lower for a third week)

- Net-long exposure to US dollar index futures (DXY) fell to a 2-year low

- Large speculators were their most bullish on GBP/USD futures on nearly two years

- Net-short exposure to AUD futures rose to an 8-week high

- Traders were their most bullish on CAD futures in 45 weeks

Commitment of traders (indices, bonds) – Tuesday 25th July 2023:

- Large speculators flipped to net-short exposure to Nasdaq 100 futures and decreased gross-long exposure by -11.9%

- Traders flipped to net-long exposure to Dow Jones industrial (DJI) futures and increased gross-long exposure by 19.3%

- Net-short exposure to the 2-year note hits yet another high with gross-short exposure also at an all-time high

Dow Jones Industrial futures (DJ) - Commitment of traders (COT):

Traders flipped to net-long exposure to Dow Jones futures for the first time since January 2022. It rose for a third week and closed at a 17-month high and trades just -4% from its record high. However, it is worth noting that spells in net-long territory have been short lived since it flipped to net-short exposure in April 2020. There have been five time it has reverted to net-long exposure since April 2020, each time lasting a few weeks only. And as we’re approaching resistance around 36,00 and of course the record highs, it’s not yet apparent it may be ‘different this time around’. Because if we’re to look back over the past three years, current levels of net-long exposure could also be considered as overbought.

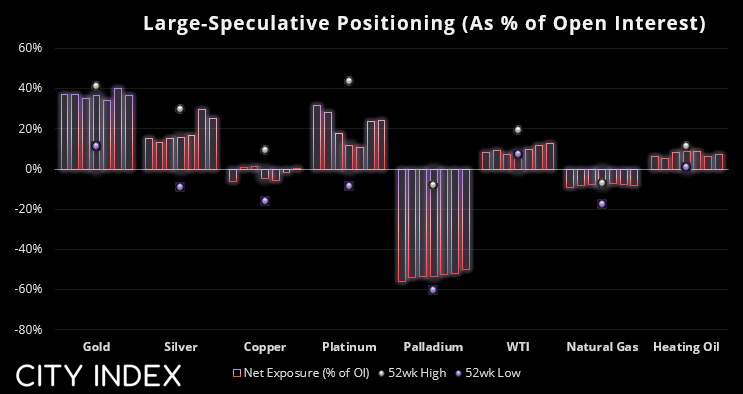

Commitment of traders (commodities) – Tuesday 25th July 2023:

- Managed funds and large speculators trimmed short exposure to WTI crude oil futures for a fourth week

- Net-long exposure to gold futures was trimmed at its fastest weekly pace in five months

- Short exposure to silver futures rose for a fourth week

- Net-short exposure to palladium futures reached another record high

WTI crude oil weekly chart:

We noted that WTI had likely hit a sentiment extreme five weeks ago, when net-long exposure had fallen to its lowest level in 11 years and that gross-short exposure was being trimmed. Since then we have seen managed funds and large speculators reduce their gross-short exposure over the past four weeks and managed funds increased gross-short exposure over the past three weeks.

Softer inflation figures and bets the Fed will not hike at their next meeting have helped support sentiment towards oil, as has news of more stimulus for China’s economy and that Saudi Arabi is to extends it oil production cut of 1 million barrels per day through to September.

This now has WTI crude oil on track for its best month in eighteen and now currently trades above $80.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade