When is the Spring Statement?

The Spring Statement is on Wednesday 23rd March at 12:30pm

Between a rock and a hard place

UK Chancellor Rishi Sunak will announce the Spring Statement just hours after the latest inflation data for the UK. UK CPI is expected to show that inflation sits at around 5.8% YoY in February, its highest level in 30 years, even before the Ukraine war sent energy prices surging. The BoE expects the cost of living to keep rising to around 8% by April and potentially continue growing to double digits by October.

As the cost-of-living surges, the historic squeeze on households puts Rishi Sunak in a tough spot. The Chancellor will need to decide to either ease the squeeze on households or press ahead with getting public finances back to normality after the COVID spending surge.

In addition to the latest ONS inflation and growth forecasts, Rishi Sunak is expected to outline how he intends to steer the UK through the headwinds of rising prices for food, materials, and energy. The OBR has forecast the government would borrow £183 billion, when it is on course to borrow £160 billion, thanks to more substantial tax receipts. This will give Rishi Sunak some headroom for spending, although October’s Budget is often used for big announcements.

Here are a few of the key areas to watch:

Fuel duty cut

Petrol prices have soared as oil prices jumped higher following the Russian invasion. The Chancellor hinted that he could cut fuel duty by 5p a liter to ease the pressure on household finances. This may not be sufficient to cause any real impact.

Another approach could be a windfall tax on oil and gas producing companies. If such a move was announced, expect to see the likes of BP and Shell share prices drop quickly.

National insurance rise

Many business leaders and politicians have urged Rishi Sunak to delay the planned increase in National Insurance payments. From April, employees and the self-employed are due to pay 1.25p more in the pound in a decision taken last autumn when the economic landscape was very different to now. Such a move could put more pressure on households and or firms already struggling to cope.

Defense spending

In addition, to help households, an increase in defense spending is likely to be announced in light of Russia’s invasion of Ukraine. Keeps an eye on defense stocks such as BAE systems which could benefit from such as move.

The Pound

As attention turns towards domestic events, sterling is rising against both the euro and the USD. Should the market feel that the Chancellor is taking measures to protect household income, to keep consumer spending supported, the pound could push higher. Any sense that Rishi is failing to protect households and or businesses, or worse anouncing measures which will make them struggle, hurting the economic outlook, this could send the pound lower.

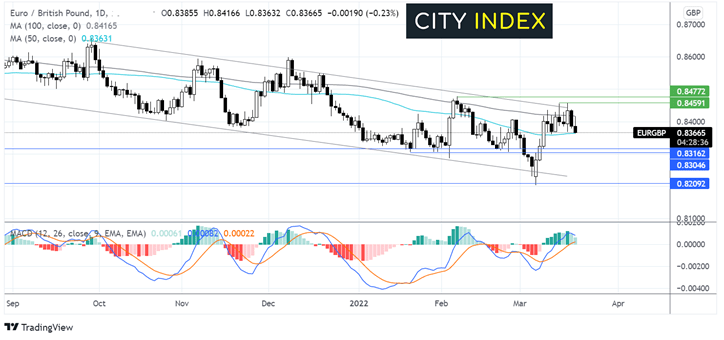

Where next for EURGBP?

EURGBP extended its rebound from 0.82 2022 low, running into resistance at 0.9450 last week, The pair has since eased lower and trades supported by the 50 sma at 0.8360 on the lower band and capped by the 100 sma at 0.8420 on the upper band.

The receding bearish bias on the MACD suggests that there could be more downside to come. Sellers will look for a move below 0.8360 to open the door to 0.8300/15 zone before looking towards 0.82.

Buyers will look for a move over 0.8420 to test 0.8450 for more upside towards 0.8480.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.