Earlier, Europe was sharply higher and that had lifted US futures. But since Wall Street opened for the final day of trading, it has been more of the same downward motion for stocks and indices. Tesla shares, for example, touched a fresh nine-month low after dropping 5% on the session. Some of the U.S. indices turned lower, with the small cap Russell leading the declines. At the time of writing, the S&P was barely holding in the positive. European indices were clinging on, but with the weekend approaching, investors were not too keen to hold their positions. Unless something changes dramatically, we may be headed for the 7th straight week of losses on Wall Street.

Why are stocks falling?

Stocks remain on a shaky footing. Investors’ list of worries grows ever larger. Inflation. Interest rate hikes. Low economic growth. Stagflation. Recession. Perhaps most importantly for stocks, the Fed is not there to provide cushion, like before. Consumer confidence is likely to drop further as incomes are squeezed. Those big falls in shares of retailers – Target and Walmart – and others such as Amazon and Apple we saw in mid-week certainly point towards this trend, as profit margins are squeezed at a time when consumers are likely to cut back on their spending. The outlook does not look great. Producers will be passing on raised input costs onto consumers, and this will ensure inflation is not going to be easing significantly any time soon, at a time when the economic outlook also appears grim. The Fed’s hands will be tied.

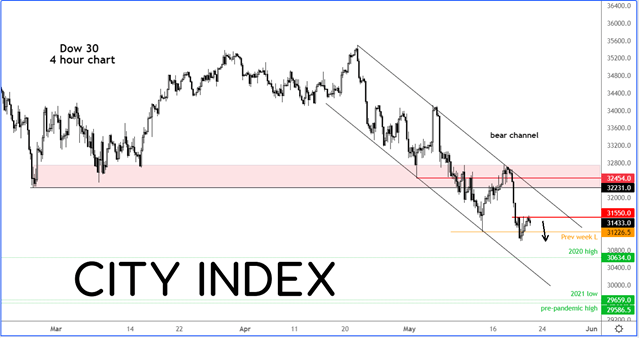

Dow Jones in bear channel

Source: StoneX and TradingView.com

Like the rest of the US indices, the Dow is making lower lows and lower highs and as such we continue to remain bearish on the markets. Though we will see oversold bounces here and there, the underlying trend is bearish and as such we expect resistance levels to hold and supports to break down until something changes fundamentally. From here, a revisit of last week’s low at 31226 seems highly likely. If we get there and there’s acceptance below it this time (unlike the day before), then we may even see a re-test of the 2020 high at 30634 at some point in the near future.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade