US futures

Dow futures -1.1% at 32930

S&P futures -1.3% at 4124

Nasdaq futures -1.6% at 12605

In Europe

FTSE +0.25% at 7618

Dax -1.1% at 14420

Euro Stoxx -1.2% at 3795

US futures are set for a negative start, parring some of last week’s impressive gains with the Fed’s tightening plans in focus and the prospect of higher inflation as the EU bans most Russian oil imports.

While stocks rallied last week as investors reined in expectations of a more aggressive Federal Reserve, that optimism has been dashed by Fed governor Christopher Waller who indicated that the US central bank would hike rates harder and sooner if that were needed to tame inflation. The mention of outsized hikes at every meeting until inflation subsides substantially has spooked the market.

With oil prices on the rise again after the EU bans 90% of Russian oil imports, the Fed may well need to act more aggressively to bring inflation down.

Looking ahead, US President Joe Biden is set to meet with Federal Reserve Chair Jerome Powell to discuss how to bring down inflation, which surged to a 40-year high in March. Although the President has said he will not interfere with Powell’s decisions

In corporate news:

AMC Entertainment rises 12.8% pre-market after the core theater business had a strong opening weekend from Top Gun Maverick.

Nio ADRs rise 5.3% pre-market after Morgan Stanley gave an upbeat outlook for the stock, saying that the EV maker is poised for a comeback as China eases COVID lockdown restrictions.

Zoom rises 1.6% after a broker upgrade.

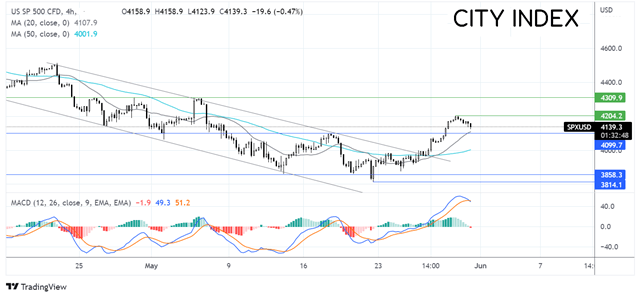

Where next for the S&P?

After rising from the 3810 May 20 low, the S&P500 has run into resistance at 4204 and reversed lower. The failure to recapture 4200, combined with the bearish crossover on the MACD, keeps sellers hopeful of further downside. Strong support can be seen at 4100, the 20 sma on the 4-hour chart, and the mid-May high. A break below here is needed in order to continue the bearish move and expose the 50 sma at 4000 round number. On the flip side, should the support hold, buyers could look for a move over 4200 to extend gains towards 4300 the May high.

FX markets – USD rises, EUR falls

USD is rising, tracking Treasury yields higher. Hawkish comments from Fed Governor Christopher Waller have helped to buoy the buck. Waller said that he expects outsized rate hikes over several meetings and would be in favour of hiking rates beyond neutral to rein in inflation.

GBP/USD is falling versus the strong USD, and as data flashes more warnings signals over the health of the UK economy. Credit card borrowing is at its highest level since 2005, which could reflect the worsening cost of living crisis hitting households.

EUR/USD is falling on the back of the recovery in the USD and amid the souring market mood. Hot inflation data has failed to help the common currency higher. Eurozone inflation rose to a record 8.1% YoY in May, up from 7.4% in April and well ahead of forecasts of 7.7%.

GBP/USD -0.54% at 1.2589

EUR/USD -0.7% at 1.07003

Oil rises on EU ban

Oil bulls are charging high for a sixth straight session and are set for a sixth consecutive month of gains, its longest run of gains in a decade.

The latest leg higher comes after EU leaders finally approved a ban on most Russian oil imports and as China re-opens.

Oil prices rose to a fresh two-month high after the latest round of sanctions from the EU included a 90% ban on Russian oil imports after modifying the deal to get Hungary onside. This deal is by no means a surprise to the market, and it is watered down from the original proposal. However, the impact is still likely to be significant, and that will keep oil prices elevated.

On the demand side of the equation, the outlook is improving as China relaxes lockdown restrictions after two months and as the US enters peak driving season.

WTI crude trades +0.86% at $117.50

Brent trades +0.67% at $119.03

Looking ahead

14:00 US house price index

15:00 US consumer confidence

How to trade with City Index

You can trade with City Index by following these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade