US futures

Dow futures 0.68% at 38845

S&P futures 1.34% at 5047

Nasdaq futures 1.96% at 17820

In Europe

FTSE 0.53% at 7685

Dax 1,57% at 17370

- Nvidia smashes forecasts and soars higher

- Jobless claims unexpectedly fall to 201k

- Oil falls after stockpiles rise

Nvidia boost sentiment, jobless claims are overshadowed

U.S. stocks are set to open at record highs after Nvidia’s blockbuster earnings, and the minutes of the January Federal Reserve meeting bring nothing new to the table. Meanwhile, equity bulls are shrugging off stronger-than-expected jobless claims.

Jobless claims expectedly fell to 201K after rising 212K in the previous week and defied expectations of a rise to 218K. The strength in the US labour market supported the Federal Reserve's view that it's too early to talk about rate cuts.

This view was transmitted in the FOMC January meeting minutes, which showed the Fed was in no rush to start loosening monetary policy.

US PMI data is due shortly and is expected to show that growth slowed modestly in both the services and manufacturing sectors.

Otherwise, attention is firmly on Nvidia, which has soared higher after blowout earnings.

Corporate news

Nvidia is set to open 13% higher after the AI chipmaker posted stronger-than-expected Q4 results. The chip maker posted revenue of $22.10 billion, a rise of 265% year on year, while net income surged 769% as it continues to see a boost from excitement over AI.

Nvidia is on course to add $250 billion to its market cap, which would make it the biggest ever single session increase in value for any stock. With profits growing even faster than the share price, there is still room for more upside.

Other chip making stocks such as Advanced Micro Devices and Super Micro Computer are rising, benefitting from Nvidia’s impressive outlook.

Rivian slumped 17% after the EV maker reported annual production guidance that fell short of Wall Street estimates and announced steep job cuts.

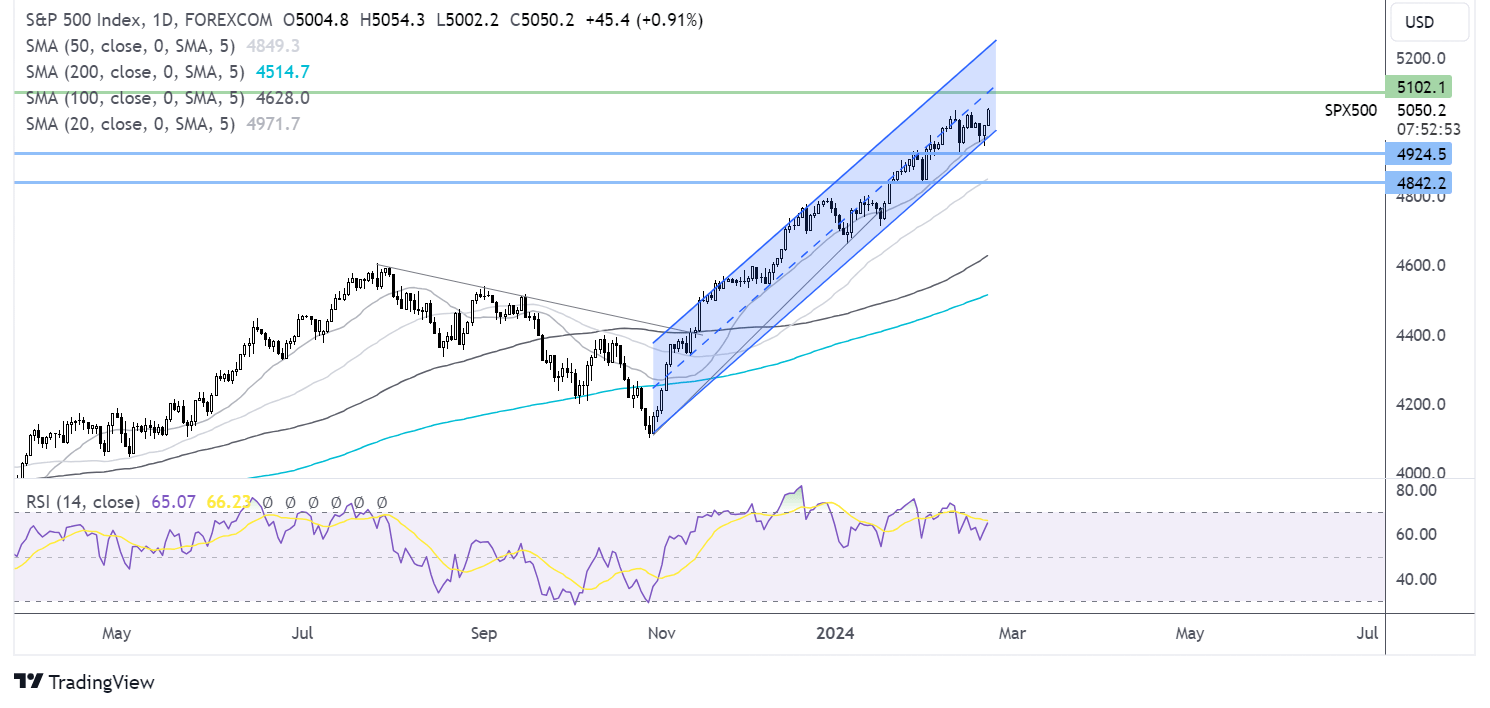

S&P500 forecast – technical analysis

The S&P has risen to a fresh all-time high. It trades within a rising channel, and the RSI supports further upside while it remains out of overbought territory. Buyers will look to push gains towards 5100 round number. Immediate support can be seen at 4950, yesterday’s low, ahead of 4840 the February low.

FX markets – USD is steady, GBP/USD rises

The USD has pared losses and is edging higher after the strong jobless claims data and despite the upbeat market mood that fuels safe haven outflows.

EUR/USD is rising as PMI data shows the economy is improving, and services inflation remains a hurdle for ECB rate cuts. The composite PMI rose to 48.9 in February, up from 47.9, with the service sector posting I returned to grace at 50.

GBP/USD is flat after stronger-than-expected PMI data, which suggests that the recession in the UK is already over. Composite PMI rose to 53.3, up from 52.9, boosted by a strong performance in the service sector, with activity at 54.3 in February.

Oil falls as stockpiles rise

Oil price prices are falling for a second straight day after US inventories rise and as investors mull over a weaker dollar and ongoing attacks on ships in Yemen.

According to the API, US crude stocks rose 7.17 million barrels in the week ending February 16th, and gasoline stockpiles also rose. Outages at large refineries have seen utilization rates at the lowest level in two years, lifting US crude inventories; however, plants are coming back online.

Stockpile data from the Energy Information Administration is due later today.

.