Ahead of the US jobs report, equity index futures look sluggish and ready to resume lower. Sentiment remains fragile following the big sell-off on Thursday, which more than wipe out the gains made day the before when the Fed Chair had dismissed talks of 75 basis point rate hikes. The main source of worry is high levels of inflation around the world, which is hurting consumer pockets. On top of this, a global wave of monetary-policy tightening, which includes quantitative tightening, means stock markets can no longer rely on this source of support that had propped up the markets all these years, especially in the aftermath of the first waves of Covid lockdowns back in early 2020. What’s more, the impact of Russia’s invasion of Ukraine continues to push up oil and gas prices, meaning inflation is unlikely to recede any time soon. Perhaps, China’s Covid lockdowns are going to help somewhat, but this is also growth-sapping. It is a lose-lose situation.

The mood in Europe is not great either, with concerns about a recession in Germany hurting the DAX. The German index was on course for the fifth straight week of losses, as my colleague Fiona noted earlier. Europe’s largest economy has been suffering badly from disrupted supply chains on the back of Russian-Ukraine conflict and lockdowns in China. Industrial production continued the trend of weaker macro data here, with a fall of almost 4% in March which was miles below expectations.

The market’s focus will be on the US jobs report, up next. Ahead of it, US bond markets are continuing to sell-off, causing the yield on the 10-year to remain above that 3% level. A big rise in wages data could lift this even further. If so, watch out for further weakness in stocks that pay low or no dividends and are still expensive.

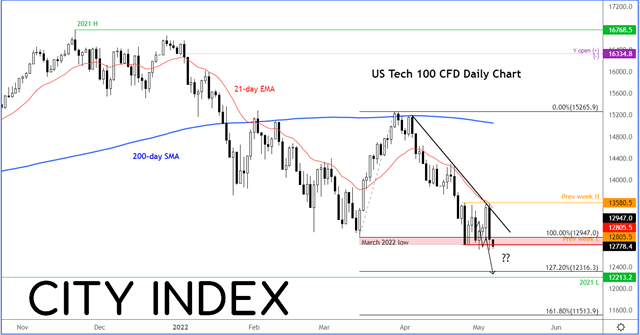

The Nasdaq which contains such stocks could be hit hard once again, as it limps near recent lows:

Source: StoneX and TradingView.com

The Nasdaq remains below the trend line, the 21-day exponential and 200-day simple moving averages. With all these various technical indicators pointing lower, including price action itself, I think a drop to the low of last year looks almost inevitable now. Worryingly for the bulls, there is no fundamental reason for it to then stop there. I therefore remain bearish until there is a confirmed bullish reversal observed on the charts.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade