- Nasdaq 100 analysis: What’s driving the market right now?

- PPI mixed, eases inflation concerns somewhat

- JPMorgan, Wells Fargo and Citigroup to start bank earnings Friday

Video: Nasdaq 100 analysis plus insights on other indices and FX majors

Today’s mixed PPI report barely caused any further volatility for the markets. If anything, the major US indices were trading a bit higher on the day at the time of writing, all bar the Dow. The latter was testing its mid-February lows. The day before, in response to a hotter CPI report, sentiment had turned rather bearish across the board. Investors have been forced to adjust their Fed rate-cut expectations sharply. They are now anticipating just two trims instead of three and starting in September rather than June or even July. The probability of a cut in June has fallen to below one in five, while the odds of a July 25bps cut is now less than a coin-flip at 47% -- a stark contrast to a couple of weeks ago when a cut in June was almost a foregone conclusion.

Concerns over rising inflation and bond yields have dented the appetite for risk somewhat and this has been evidenced by the major US indices struggling to show the form they had enjoyed for much of the past 2 quarters, when almost every day was a record-setting day. Now, we are seeing more two-way price action, and in the case of the Dow it has been more selling than buying pressure.

Nasdaq 100 analysis: What’s driving the market right now?

The focus will now start to shift to the upcoming earnings season, which begins on Friday April 12th, with reports from JPMorgan, Wells Fargo and Citigroup among others to come. Investors expect solid earnings, for otherwise the markets wouldn’t be at these elevated levels. It looks like the economy is holding its own better than expected, and with consumer demand high, S&P 500 companies are looking at another boost in profits for the second quarter running. But expectations are high, and the bar may have been set too high for some.

Meanwhile, Middle East tensions affecting crude oil prices, is an additional factor fanning inflation concerns. That being said, crude prices eased back down somewhat today, albeit only modestly. These renewed uncertainties have tempered earlier optimism about interest rate cuts, with inflationary pressures and resilient economic data presenting challenges for bullish investors they had not expected.

Nasdaq 100 analysis: Technical levels and factors to watch

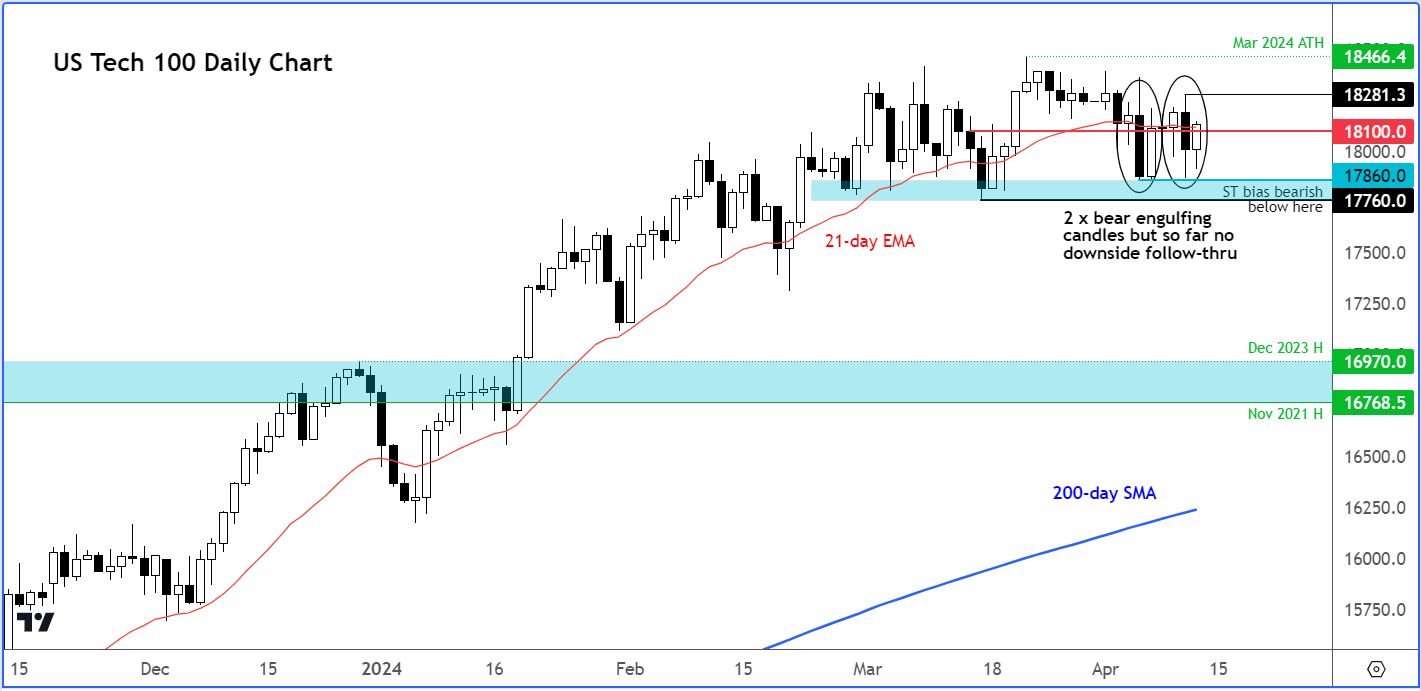

Source: TradingVIew.com

Still, despite the above macro concerns, we haven’t seen any signs of a panic yet, which shows the level of bearish conviction (very low). This is also highlighted by the fact that despite the formation of two bearish engulfing candles on the chart of the Nasdaq Index, we haven’t seen any downside follow-thru yet.

Key support continues to hold around the upper end of the 17760-17860 range (highlighted in blue on the chart). A break below this range is needed to shift the balance back in the bears’ favour.

Short-term resistance comes in around 18100, this being a pivotal short-term level.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade