Japanese Yen Takeaways

- The Japanese yen continues to weaken amidst quiet trade to start the week – all eyes remain on potential intervention from Japanese authorities if it weakens further.

- USD/JPY is consolidating just below its 2023 high near 146.60.

- EUR/JPY and GBP/JPY pulled back last week, but remain in bullish medium-term structures.

Japanese Yen Fundamental Analysis

It’s been a quiet day in the forex market with the UK out on summer bank holiday, and with little on the economic calendar during the US session, we could see that quiet trade extend from here.

Taking a step back, USD/JPY remains one of the more interesting currency pairs at the moment. After rallying 200 pips in the last 48 hours of last week, the pair is once again probing its highest levels of the year. We’re already above the area where the BOJ intervened to try to strengthen the yen last year, though its worth noting that other crosses like EUR/JPY and GBP/JPY are trading notably lower than last week’s highs (see below for more).

As it stands, the weakness in the yen remains a dominant theme, and with broader equal- and trade-weighted indices of the currency’s value off their lows, yen bears may have an opportunity to extend that well-established trend further this week.

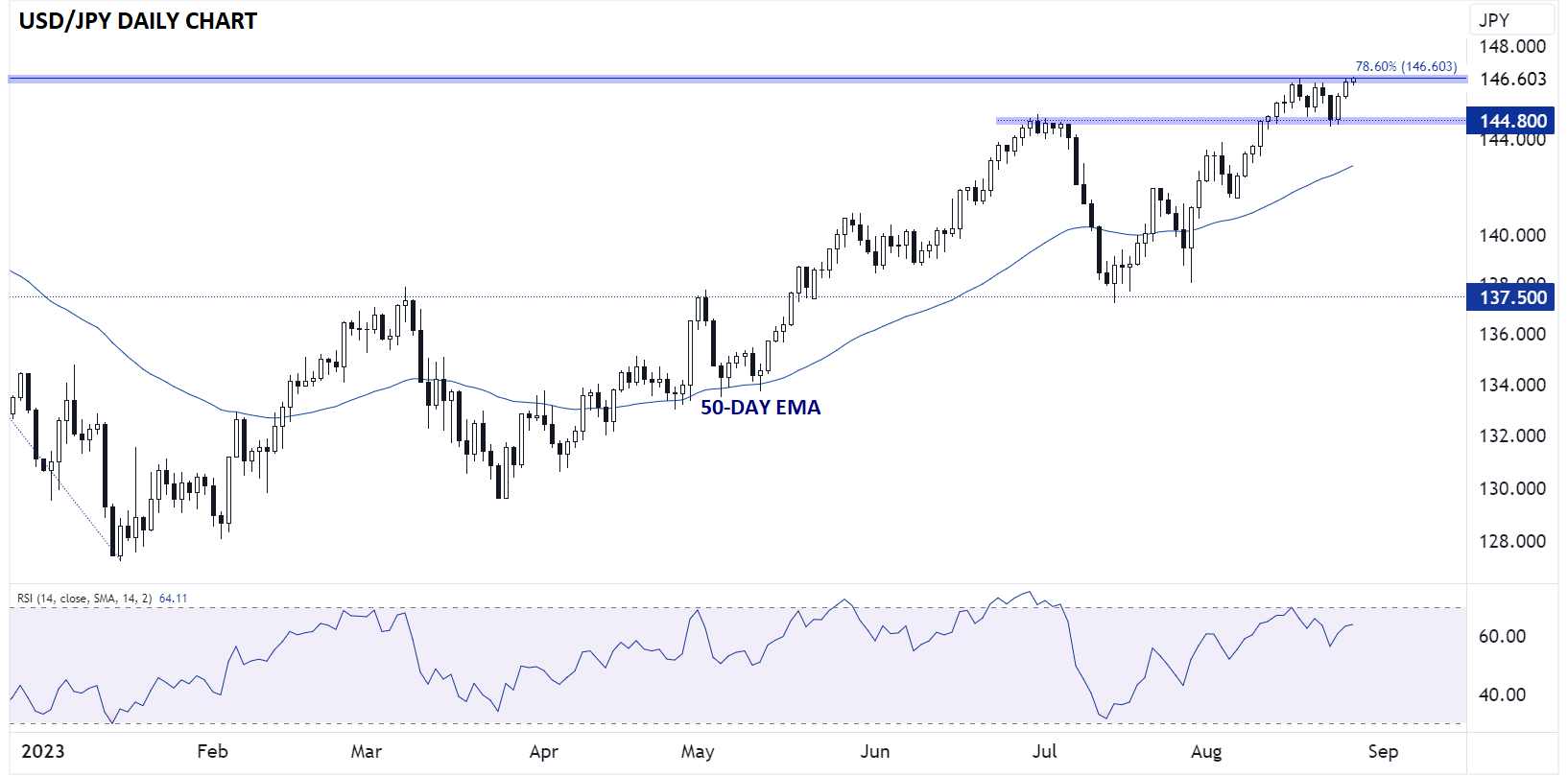

Japanese Yen Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

As noted above, USD/JPY is probing its 2023 high above 146.60, a level that also marks the 78.6% Fibonacci retracement of the Q4 2022 drop. Bulls remain hesitant to push the pair above this key barrier given the lack of clear fundamental catalysts and risk of intervention, but if we do see a clean breakout this week, the pair could quickly test 148.00 before

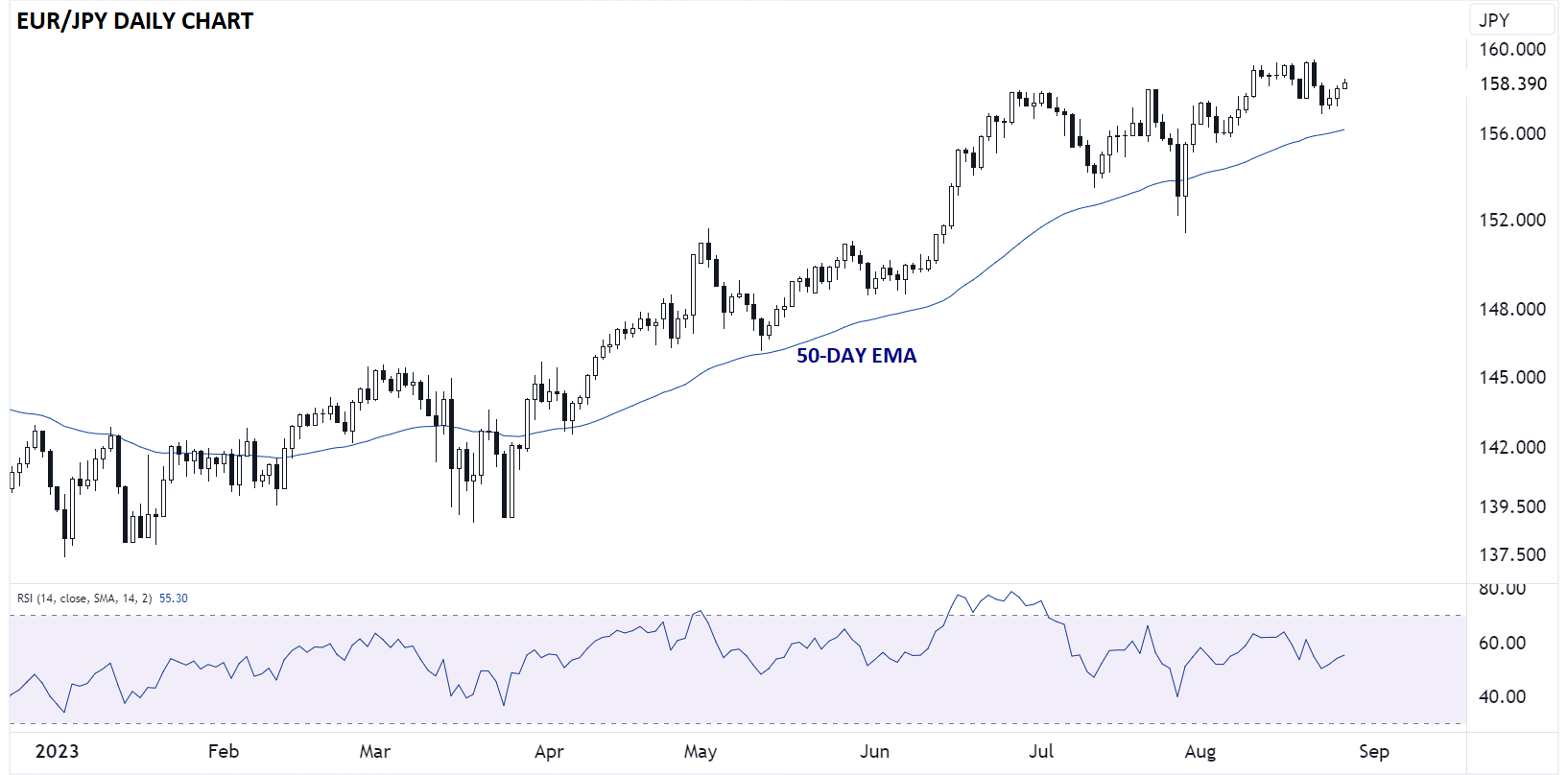

Japanese Yen Technical Analysis – EUR/JPY Daily Chart

Source: TradingView, StoneX

Turning our attention to EUR/JPY, the technical picture is more muddled. The cross pulled back sharply from year-to-date highs near 160.00 through the middle of last week, and even after a late-week bounce, the pair remains more than 100 pips below last week’s high. Rates haven’t been higher in more than a decade, so if we do see a clean breakout, the a move up to the psychologically-significant 160 level could be next. Meanwhile, bulls may look to buy the pair on dips into the mid-150s, where the rising 50-day EMA has consistently provided support since the start of April.

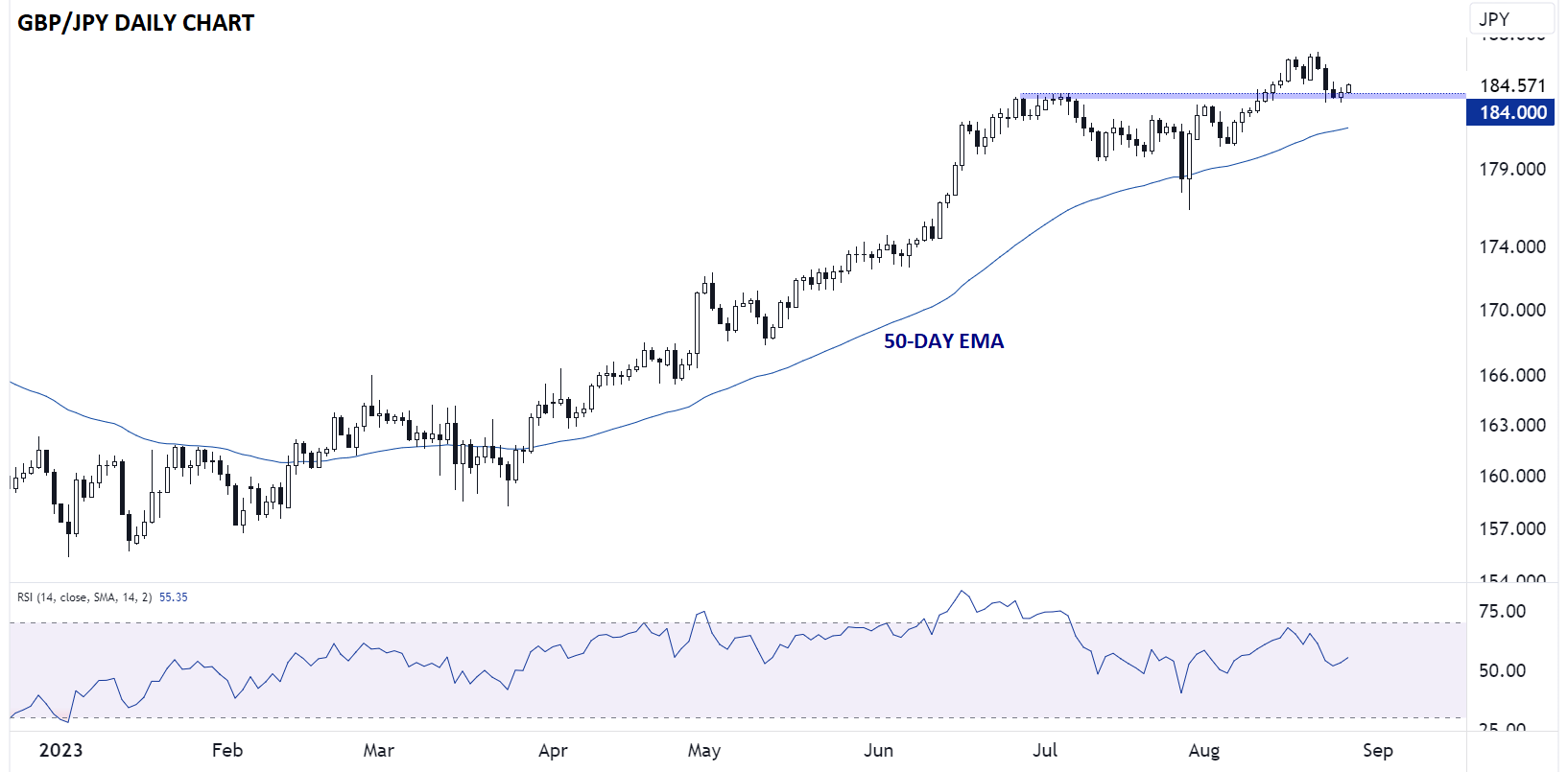

Japanese Yen Technical Analysis – GBP/JPY Daily Chart

Source: TradingView, StoneX

Jumping across the English Channel, GBP/JPY’s chart looks like a mix of USD/JPY and EUR/JPY. The pair has pulled back from decade+ highs over the last week, but rates appear to be turning higher off previous-resistance-turned-support near 184.00, a clear bullish sign. As long as the pair remains above last week’s low, the path of least resistance remains to the topside for a potential retest of the 2023 high in the mid-186s or higher if this week’s key US data comes in stronger-than-expected.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX