French Presidential elections

The first round of the French Presidential elections will be held on Sunday 11th April. A candidate needs to win 50% of the votes in order to win straight out. This has never happened, and this year is unlikely to be the first. The second round is held on the 24th of April.

Heading into the election, President Macron is the favourite to win. However, the market has woken up to the prospect of a political shock and a win by far-right candidate Marine Le Pen. Macron faced Le Pen back in the 2017 election, where he won a landslide victory.

In 2017 Macron won by 66% to 34%. Today that difference is much tighter with one poll even pointing to a Le Pen win, but most are looking at 53%, 47%.

While back in 2017, Le Pen was focused on exiting the euro, this time around, she has rebranded herself to focus on economic problems. With consumer prices surging ever higher, there are certainly plenty of economic issues to be focusing on.

Le Pens’ policies are a big concern for the market with expectations for large-scale public borrowing, contravening the Eurozone’s budget rules and challenging the German-led consensus of fiscal stability.

Reflected in the market

Nerves in the market have started to show up this week. Firstly, the spread between the French and the German 10-year bonds, considered a proxy for political risk, has widened.

The French stocks market has also underperformed, losing over 2% across the week, while the FTSE has risen 0.5%, and the EUR/USD has traded lower for seven straight days. A close first round between Macron and Le Pen could see EUR/USD sink to fresh 2022 lows. Meanwhile a Le Pen win could see EUR/USD sink significantly lower. Currently the odds of a Le Pin sit at around 20%.

The market has started to sweat as Le Pen has closed the gap in the polls. The risks are being priced in, but a Macron victory is still the most likely outcome for now.

Where next for EUR/USD?

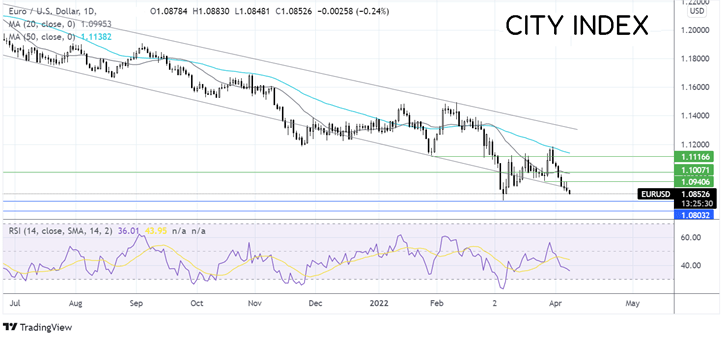

EUR/USD rebounded lower from the 50 sma, breaking below 1.10 the key psychological level and the lower band of the multi-month falling channel.

The RSI points to further losses whilst it remains out of the oversold territory. Support can be seen at 1.08 the 2022 low ahead of 1.0730 the April 2021 low.

Any recovery would need to rise above 1.0940 the March 28 low, ahead of 1.10.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.