Asian Indices:

- Australia's ASX 200 index rose by 62 points (0.89%) and currently trades at 7,024.00

- Japan's Nikkei 225 index has fallen by -23.41 points (-0.09%) and currently trades at 27,454.31

- Hong Kong's Hang Seng index has risen by 139.76 points (0.71%) and currently trades at 19,707.45

- China's A50 Index has fallen by -7.88 points (-0.06%) and currently trades at 13,033.58

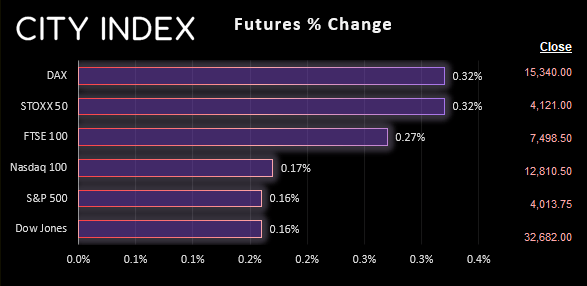

UK and Europe:

- UK's FTSE 100 futures are currently up 20 points (0.27%), the cash market is currently estimated to open at 7,491.77

- Euro STOXX 50 futures are currently up 13 points (0.32%), the cash market is currently estimated to open at 4,177.62

- Germany's DAX futures are currently up 49 points (0.32%), the cash market is currently estimated to open at 15,176.68

US Futures:

- DJI futures are currently up 51 points (0.16%)

- S&P 500 futures are currently up 6.5 points (0.16%)

- Nasdaq 100 futures are currently up 22 points (0.17%)

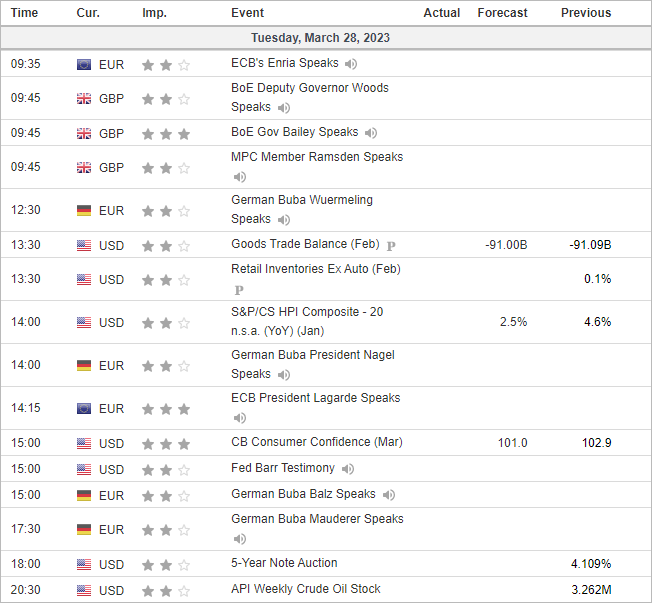

- The Fed’s Jefferson warned that they’re keeping an eye on the “potential distributional aspects” of deposits moving cash from smaller to larger banks, as it “could have a disproportionate impact on small businesses”.

- The yen was the strongest major overnight, which we suspect could be to do with the repatriation trade for Japanese firms leading into the end of the fiscal year, and announcement of ¥22 trillion fiscal stimulus program from Japan’s Finance Minister

- The US dollar was the weakest major as it lost some of its safe-haven appeal thanks to yesterday’s risk-on session

- Australian retail sales grew just 0.2% in February, further backing the odds that the RBA will pause their tightening cycle in April

- BOE members including Andrew Bailey, Sam Woods and David Ramsden are speaking at the Treasury Select Committee hearing on Silicon Valley Bank, although this is more likely to be a formality now that SVB are to be purchased by Citizen, thanks to US authorities expanding a lending facility to boost balance sheets for regional banks

- Whilst ECB members Enira and Lagarde also speak, they do not appear to be monetary policy related looking at their speech titles

- Fed member Barr is to testify to congress on the failure of Silicon Valley Bank, although his pre-prepared remarks say it failed due to mismanagement, they were too late to address their issues and that US banks remain sound

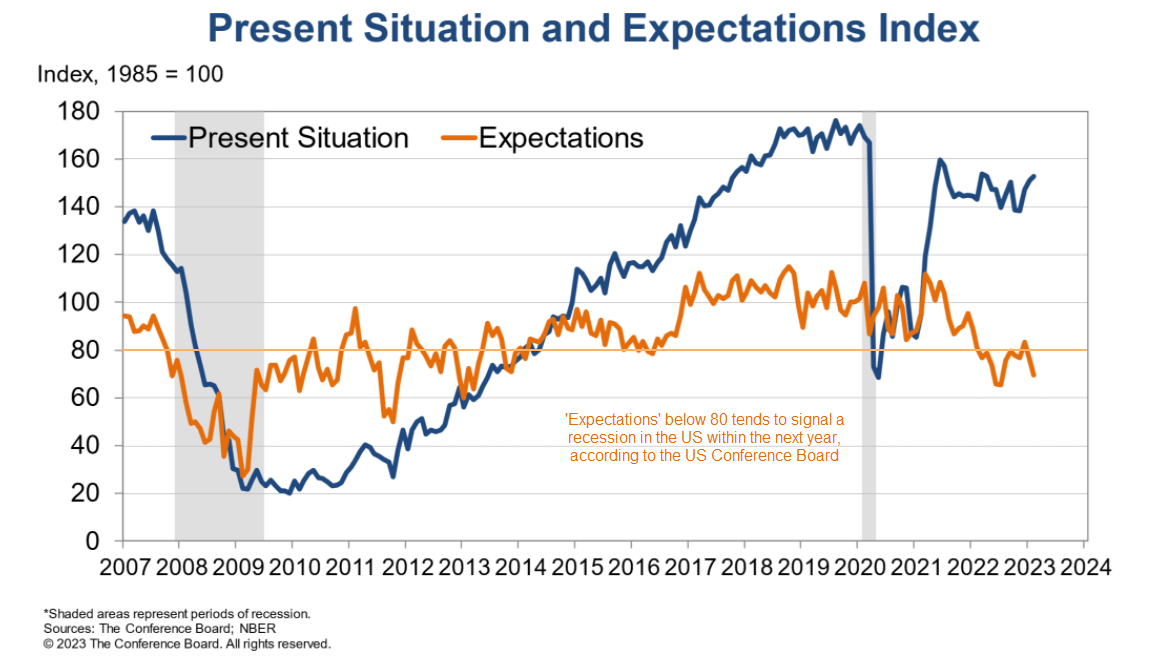

Will it be another grim consumer sentiment survey from the US Conference Board?

The Conference Board measure of consumer confidence is released at 15:00, which tends to be the more optimistic when compared with the University of Michigan read. Whilst Feb’s survey indicated a higher ‘present situation’ read, the ‘expectations index’ fell to 69.7 – which is quite far below the 80 threshold which tends to signal recessions. That said, it has remained below the recessionary threshold for 11 of the past 12 months, so is this the exception?

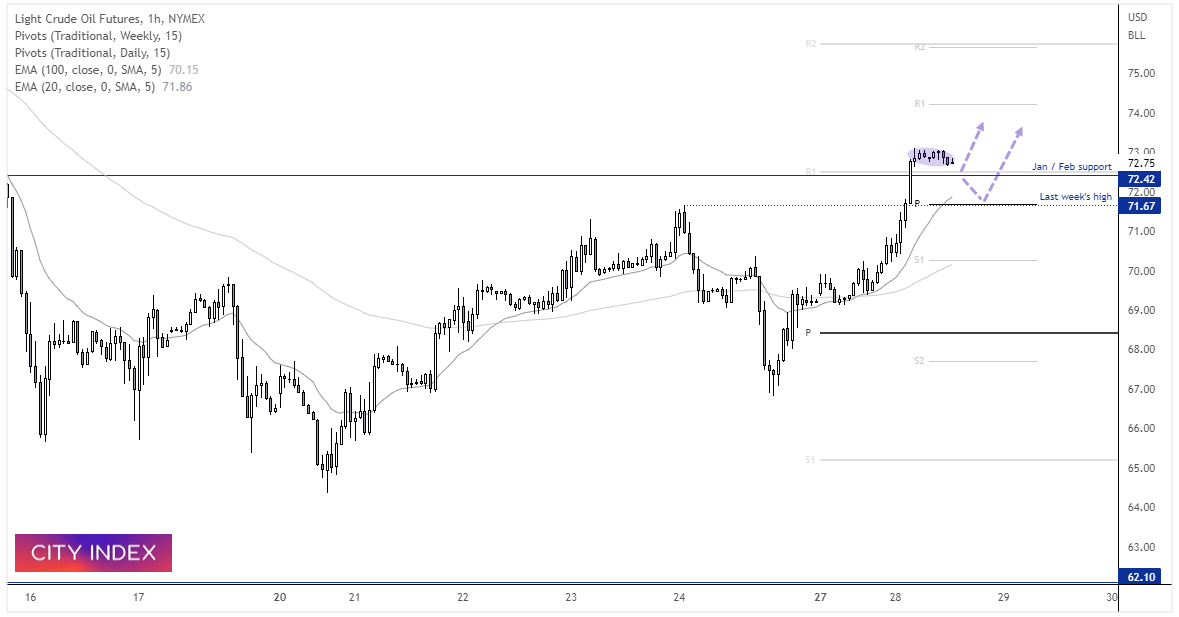

WTI crude 1-hour chart:

Oil prices have clearly benefitted from the improved sentiment, with WTI now back above $70 as if noting happened. It also broke above the 74.40 area which provided support in January and February, and prices are trading within a very tight consolidation around yesterday’s high.

Whilst this leaves the potential for a bullish breakout, such small consolidations are prone to spikes before the momentum move really takes off. So we are equally open to the potential for a pullback as we are continued gains (although probably leaning closer to a pullback).

The weekly R1 pivot sits around the Jan / Feb low, and is the first line of defence for bulls to defend, a break of which brings last week’s high and the daily pivot into focus around 71.67.

Economic events up next (Times in GMT+1)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade