Asian Indices:

- Australia's ASX 200 index rose by 21.6 points (0.3%) and currently trades at 7,307.00

- Japan's Nikkei 225 index has risen by 305.08 points (1.12%) and currently trades at 27,409.40

- Hong Kong's Hang Seng index has fallen by -304.09 points (-1.49%) and currently trades at 20,047.26

- China's A50 Index has fallen by -192.15 points (-1.42%) and currently trades at 13,356.52

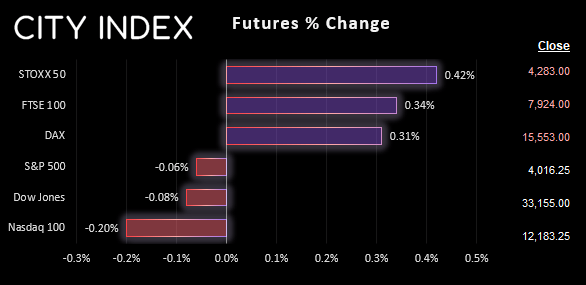

UK and Europe:

- UK's FTSE 100 futures are currently up 27 points (0.34%), the cash market is currently estimated to open at 7,934.72

- Euro STOXX 50 futures are currently up 18 points (0.42%), the cash market is currently estimated to open at 4,276.16

- Germany's DAX futures are currently up 47 points (0.3%), the cash market is currently estimated to open at 15,522.69

US Futures:

- DJI futures are currently down -27 points (-0.08%)

- S&P 500 futures are currently down -23.25 points (-0.19%)

- Nasdaq 100 futures are currently down -2.25 points (-0.06%)

- Incoming BOJ governor Kazuo Ueda disappointed anyone who was hoping for a hawkish twist at his confirmation hearing, instead opting to tow the party line and back the current ultra-easy policy

- And this is despite Japan’s inflation hitting a 41-year high ahead of the hearing

- The easy BOJ stance helped Japan’s equity markets lead the way higher overnight,

- WTI rose for a second day as the potential cut in Russian oil production could partially offset higher inventories in the US

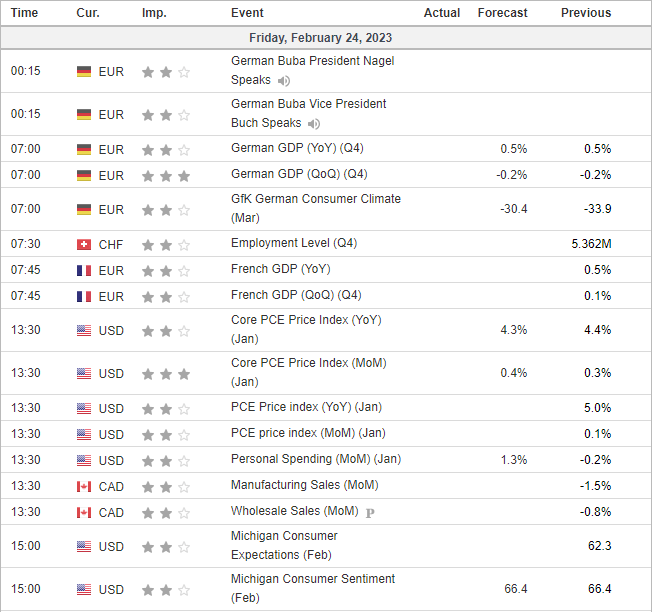

- German GDP and consumer sentiment kicks of data in today’s euro session at 07:00 GMT, with Spanish producer prices at 08:00

- But the main event is clearly the US PCE data set at 13:30 and has the potential to drive sentiment for all four corners of the global market; bonds, equities, commodities and currencies

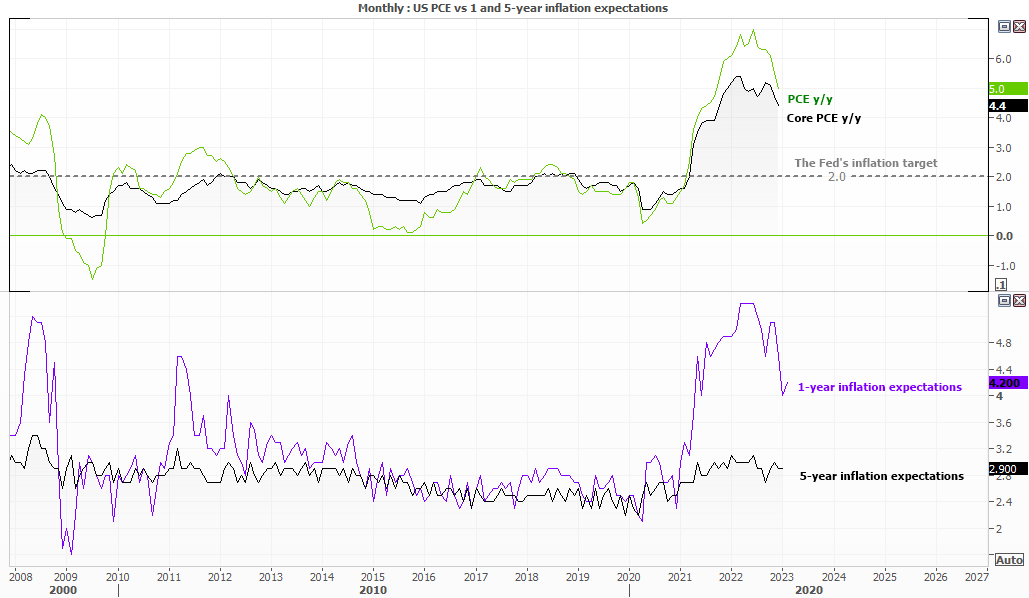

Markets cannot get enough of US inflation data at present and what it means for the Fed. And that means today’s PCE figures are now likely the more important, given the upwardly revised inflation figures in the final Q4 GDP report. A hot PCE print today will simply exacerbates those fears of an aggressive Fed and likely increases bets of a 50bp Fed hike in March.

The final Michigan consumer sentiment survey also warrants a look, for the inflation expectation components if nothing else. We’d all like to see 1 and 5-year expectations soften, although recent headlines of hot inflation may not help. But the ideal scenario is a combination of soft PCE data alongside lower inflation expectations, and that would likely weigh on the dollar as Fed fund futures lower their implied probability of a 50bp hike in March. But whatever happens, the dollar is very much in focus today - it’s likely to remain bid should PCE and inflation expectations move higher.

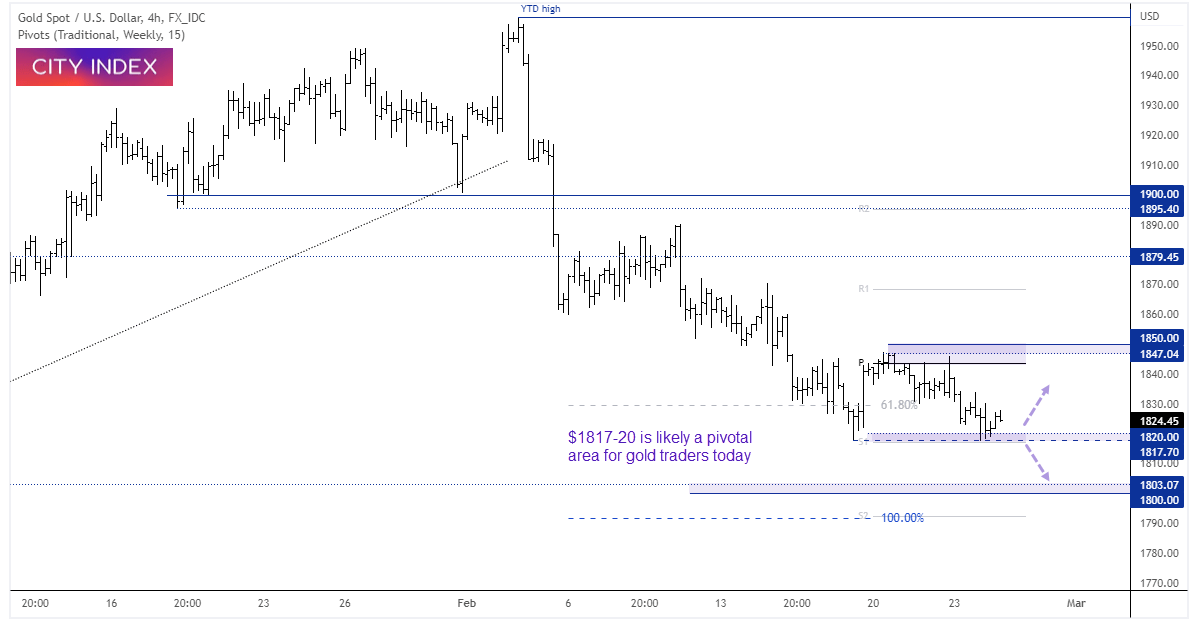

XAU/USD 4-hour chart:

Gold is on track for its fourth consecutive bearish week, and at current levels has erased all of January’s gains. Our downside target at $1800 remains in play – which a hot inflation print would help with, although $1820 is currently providing support and could act as a springboard should inflation come in soft. Either way, $1820 is the pivotal level to watch for a likely binary outcome from today’s PCE data.

Economic events up next (Times in GMT)