Asian Indices:

- Australia's ASX 200 index rose by 67.7 points (0.93%) and currently trades at 7,376.40

- Japan's Nikkei 225 index has fallen by -180.31 points (-0.65%) and currently trades at 27,472.43

- Hong Kong's Hang Seng index has risen by 487 points (1.79%) and currently trades at 27,711.58

UK and Europe:

- UK's FTSE 100 futures are currently up 14 points (0.2%), the cash market is currently estimated to open at 7,012.28

- Euro STOXX 50 futures are currently up 16 points (0.4%), the cash market is currently estimated to open at 4,042.68

- Germany's DAX futures are currently up 38 points (0.25%), the cash market is currently estimated to open at 15,460.50

US Futures:

- DJI futures are currently up 286.01 points (0.83%)

- S&P 500 futures are currently up 14.5 points (0.1%)

- Nasdaq 100 futures are currently up 2.75 points (0.06%)

Learn how to trade indices

Indices:

Asian share markets were higher overnight, with the MSCI APAC (ex-Japan) index rising around 1%. The Hang Seng was the strongest performer, rising 1.75% with the KOSPI 200 rising 1.3% and STI up 1.2%. The ASX 200 rallied for a second day and closed in on its record highs after successfully holding above trend support and rising to the top of its range.

US futures have opened a touch higher, FTSE futures are currently up 14 points (0.2%) and the DAX is up 38 points (0.25%).

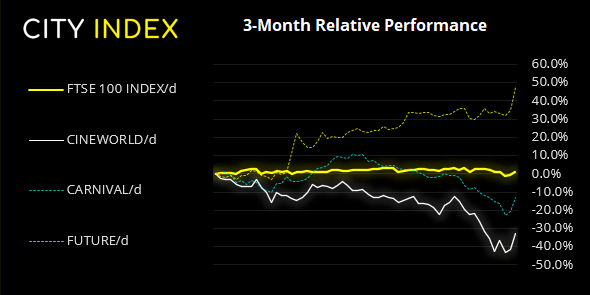

It was the FTSE’s most bullish session in five months yesterday, which closed just beneath 7,000 and at a two-day high. It also closed with a three-bar bullish reversal (Morning Star) pattern to suggest a swing low is in place. Whilst key resistance is clearly at 7,000, take note of the 50 and 20-day eMA’s around 7040 which may also act as resistance, whilst a break above these levels clears the way for a run towards the July highs.

Earnings: Unilever PLC (UVLE) and Pearson Plc (PSON) are set to release earnings ahead of the open.

FTSE 350: Market Internals

FTSE 350: 4016.86 (1.70%) 21 July 2021

- 313 (89.17%) stocks advanced and 28 (7.98%) declined

- 14 stocks rose to a new 52-week high, 5 fell to new lows

- 76.64% of stocks closed above their 200-day average

- 44.16% of stocks closed above their 50-day average

- 9.97% of stocks closed above their 20-day average

Outperformers:

- + 14.8% - Cineworld Group PLC (CINE.L)

- + 9.36% - Carnival PLC (CCL.L)

- + 9.16% - Future PLC (FUTR.L)

Underperformers:

- -4.10% - Network International Holdings PLC (NETW.L)

- -2.71% - Royal Mail PLC (RMG.L)

- -2.35% - Hilton Food Group PLC (HFG.L)

Forex: ECB up next

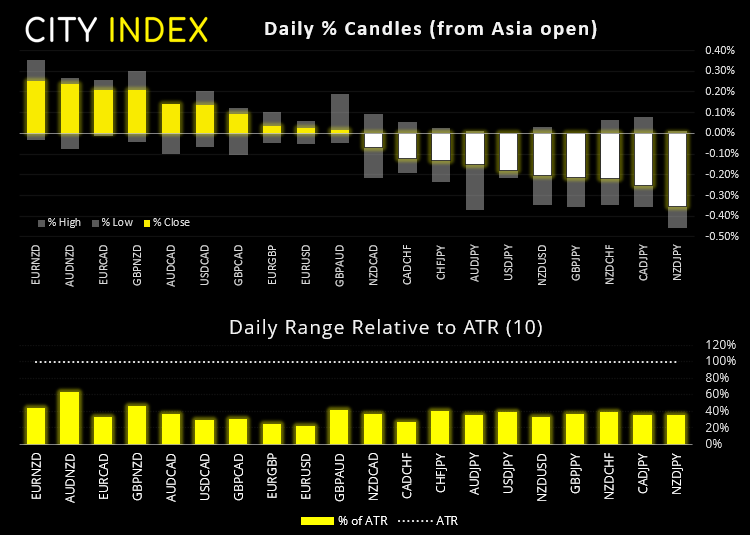

The Japanese yen is currently the strongest currency whilst NZD and CAD are the weakest. As this is a minor reversal from yesterday’s play then it looks like a combination of profit taking and repositioning.

The US dollar index is trading near yesterday’s bearish engulfing / outside day low. The dollar is slightly higher against emerging markets, flat against AUD and -0.2% against the yen.

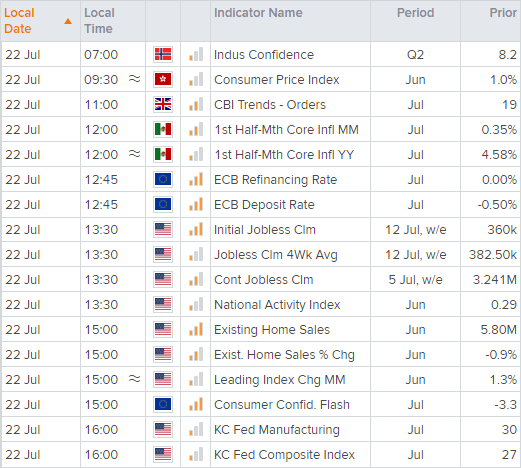

Aside from today’s ECB meeting the calendar is quiet. And it’s not completely certain that the ECB meeting (or press conference 45 minutes later) will turn into a volatile event, yet that does not mean it should not be on trader’s radars. Hopefully, ECB members will come to an agreement on how to manage their forward guidance under their new ‘symmetric 2%’ inflation target framework. Whilst they unanimously agreed upon the change taking place, it has been reported that they were unable to agree on how it should be implemented. So hopefully they will (for once) be in agreement today and allow Lagarde to clarify such details in the press conference. We can only hope.

Learn how to trade forex

Commodities: Oil tracks risk appetite

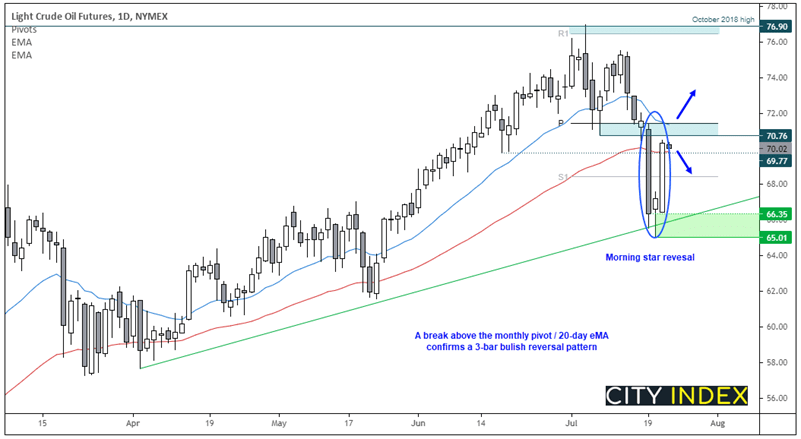

Oil has looked past its bearish fundamentals (OPEC+ increasing supply and higher inventories) these past two days, in favour rising risk appetite. Should that continue, then WTI could also break higher.

WTI futures formed a small bullish hammer on Tuesday so show bears were losing control, before yesterday’s trade recouped almost all of Monday’s losses and closed just above the 50day eMA. A 3-bar bullish reversal pattern has now formed (Morning Star Reversal) to suggest a corrective low is in place, and a break above the monthly pivot point / 20-day eMA confirms the reversal and assumes trend continuation. Should prices initially retrace lower within yesterday’s range, we’d consider bullish setup around the monthly S1.

Silver is trading just below yesterday’s bullish engulfing candle. Whilst it shows the potential to rise towards the 25.53 – 25.76 resistance zone over the near-term we would still seek evidence of a swing high forming around such an area.

Copper is testing trend resistance from the May high. Despite showing the potential to fall further on Monday, risk sentiment is not currently supportive of that presently, so there is a risk coper could break trend resistance if equities and yields continue to rally. Otherwise, a break beneath Monday’s low assumes bearish continuation.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.