Asian Indices:

- Australia's ASX 200 index fell by -36.3 points (-0.52%) and currently trades at 7,008.60

- Japan's Nikkei 225 index has fallen by -549.83 points (-1.92%) and currently trades at 28,058.77

- Hong Kong's Hang Seng index has fallen by -260.26 points (-0.92%) and currently trades at 27,970.78

UK and Europe:

- UK's FTSE 100 futures are currently down -28 points (-0.4%), the cash market is currently estimated to open at 6,976.63

- Euro STOXX 50 futures are currently down -22 points (-0.56%), the cash market is currently estimated to open at 3,925.43

- Germany's DAX futures are currently down -51 points (-0.34%), the cash market is currently estimated to open at 15,099.22

Wednesday US Close:

- DJI futures are currently up 104 points (0.31%), the cash market is currently estimated to open at 33,691.66

- S&P 500 futures are currently up 55 points (0.42%), the cash market is currently estimated to open at 4,118.04

- Nasdaq 100 futures are currently up 13.25 points (0.33%), the cash market is currently estimated to open at 13,014.88

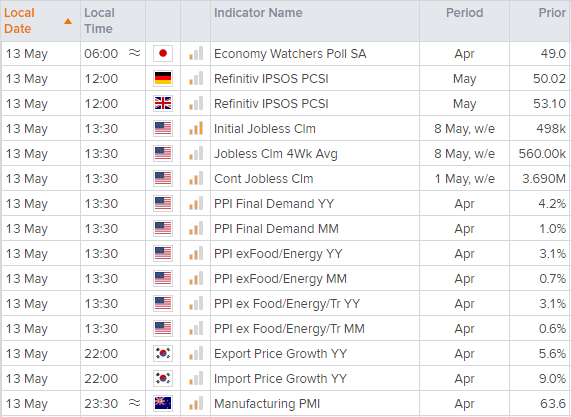

And by an extension of yesterday’s moves we mean a stronger US dollar and yields, alongside weaker equities. Moreover, a stronger than expected jobless claims could exacerbate the excitement, given the Fed also need to see employment gravitate towards maximum potential before they publicly admit they have spoken above tapering or even hiking.

Asian equities tracked Wall Street lower, with the Hang Seng Enterprise Index (HSCE) and CSI300 falling -0.95% and 0.8% respectively, and the ASX 200 down -0.4% (but holding just above yesterday’s low around 7,000).

Still, US futures have opened higher with Nasdaq E-minis adding 54.5 points (0.43%, the S&P 500 E-minis are up 14.5 points (0.36% and the Dow E-minis are up 115 point (0.34%).

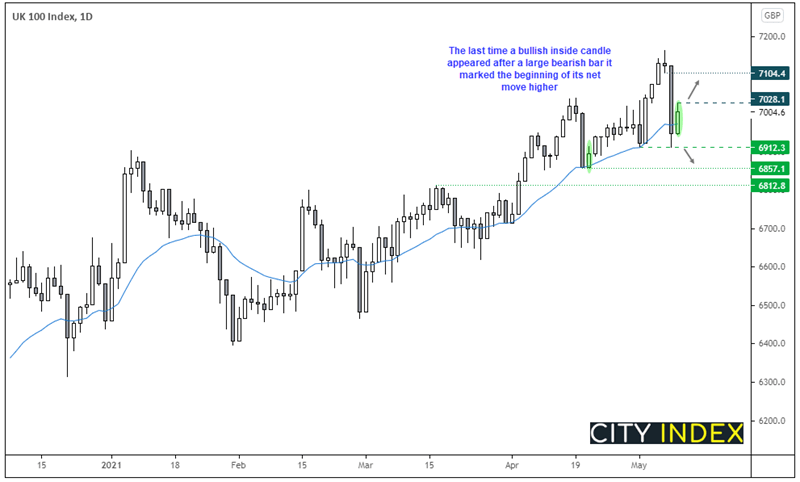

FTS100 clambers back above 7000 (just)

The FTSE 100 closed back above 7000 yesterday after suffering its worst single day loss in 10-weeks on Tuesday. But the jury is out as to whether global equity sentiment (and therefore the FTSE 100) will continue to slide today. However, yesterday’s small bullish inside candle provides hopes for bulls, as a similar pattern emerged on the 1st of April after shedding over 2% the prior session. So, if history is to repeat on this occasion, a break of yesterday’s high looks appealing to bulls. However, if prices break beneath 6900 is also clears two swing lows and could signal the FTSE’s next move lower. But, before that can happen, bears should take note of the potential bearish wedge forming on the four-hour chart.

FTSE 350: Market Internals

FTSE 350: 7004.63 (0.82%) 12 May 2021

- 146 (41.60%) stocks advanced and 193 (54.99%) declined

- 7 stocks rose to a new 52-week high, 10 fell to new lows

- 80.06% of stocks closed above their 200-day average

- 17.66% of stocks closed above their 20-day average

Outperformers:

- + 20.7% - UDG Healthcare plc (UDG.L)

- + 6.85% - Redde Northgate PLC (REDD.L)

- + 5.18% - Chemring Group PLC (CHG.L)

Underperformers:

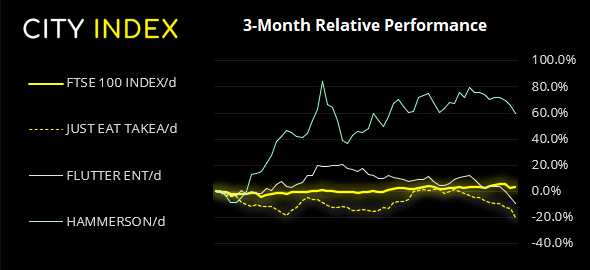

- -8.32% - Just Eat Takeaway.com NV (TKWY.AS)

- -4.46% - Flutter Entertainment PLC (FLTRF.I)

- -3.60% - Hammerson PLC (HMSO.L)

Learn how to trade indices

Forex: Dollar holds onto ‘inflationary’ gains

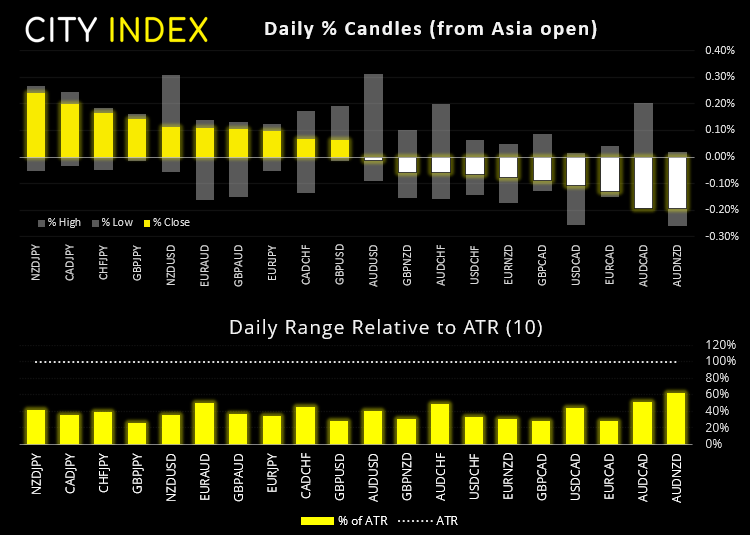

It was quiet ranges overnight, although NZD and CAD are currently the strongest majors and JPY is the weakest.

- EUR/GBP produced a bullish pinbar yesterday and closed on the 0.8580 support level, warning of the potential for a minor bounce today. Regardless, the bias remains bearish beneath the 0.8620/30 resistance zone (but is equally useful as a near-term bullish target, if prices break above yesterday’s high).

- GBP/JPY didn’t rip higher yesterday as hoped, but it is holding above 153.88 support and momentum has turned higher overnight.

- GBP/USD fell to a two-day low yesterday and prices are coiling up on the four-hour chart. A break beneath yesterday’s low brings the 1.4000/17 support zone into focus for bears, at which point we’d see if a support level could build and reconsider potential bullish setups.

- The US dollar index (DXY) is holding steady around 90.74 just off yesterday’s high, and the overnight low found support at the March 3rd low.

- Conversely, the stronger dollar yesterday saw EUR/USD make light work of crashing through 1.2100, and our bias remains bearish beneath that key level today, with its next support level sitting at 1.2035/42.

Learn how to trade forex

Commodities: Colonial Pipeline turn on the taps

News that Colonial’s pipeline is slowly beginning to revert back to normal operation weighed on energy prices overnight. WTI crude futures were down -0.8% with the front month trading at 65.56, whilst brent futures fell -0.75% and now trade at 0.76%. Gasoline futures were also off by -0.9%.

Gold and silver look set to extend their retracements after a momentum shift at recent highs. Gold trades around 1817 but anchored to yesterday’s lows, a break of which brings 1800 into focus over the near-term.

Silver is also in a corrective phase yet within a bullish channel, therefore a break beneath 26.95 brings 26.63 support into focus, or the lower trendline of its bullish channel.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.