Asian Indices:

- Australia's ASX 200 index fell by -37.4 points (-0.5%) and currently trades at 7,494.50

- Japan's Nikkei 225 index has risen by -11.51 points (0.04%) and currently trades at 27,713.29

- Hong Kong's Hang Seng index has fallen by -384.85 points (-1.5%) and currently trades at 25,309.10

UK and Europe:

- UK's FTSE 100 futures are currently down -19 points (-0.27%), the cash market is currently estimated to open at 7,131.12

- Euro STOXX 50 futures are currently down -11 points (-0.26%), the cash market is currently estimated to open at 4,170.12

- Germany's DAX futures are currently down -54 points (-0.34%), the cash market is currently estimated to open at 15,806.66

US Futures:

- DJI futures are currently up 39.24 points (0.11%)

- S&P 500 futures are currently down -38.5 points (-0.25%)

- Nasdaq 100 futures are currently down -7.5 points (-0.17%)

Indices

Japan’s equity markets were up slightly at the start of the session with transport stocks leading the way. Yet the choppy session saw gains turn to minor losses along with the broader Asian share market. There doesn’t appear to be a particular driver, and presumably traders are likely squaring up positions ahead of Jackson Hole. Shares in South Korea were lower after their central bank raised interest rates for the first time in nearly three years. The KOSPI is currently down -0.3% for the day. Although it is the CSI300 and Hang Seng which were the worst performers overnight, falling -1.8% and -1.3% respectively.

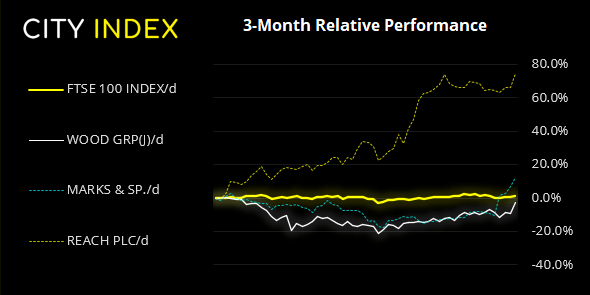

FTSE 350: Market Internals

FTSE 350: 4134.18 (0.34%) 25 August 2021

- 206 (58.69%) stocks advanced and 131 (37.32%) declined

- 33 stocks rose to a new 52-week high, 1 fell to new lows

- 76.07% of stocks closed above their 200-day average

- 83.19% of stocks closed above their 50-day average

- 23.93% of stocks closed above their 20-day average

Outperformers:

- + 7.25% - John Wood Group PLC (WG.L)

- + 5.13% - Marks and Spencer Group PLC (MKS.L)

- + 4.84% - Reach PLC (RCH.L)

Underperformers:

- -5.02% - Capita PLC (CPI.L)

- -2.46% - Tyman PLC (TYMN.L)

- -2.37% - PureTech Health PLC (PRTC.L)

Forex: Employment claims in focus

Australia’s capital expenditure (Capex) for Q2 beat expectations, rising to 4.4% versus 2.5% expected. This means that next week’s GDP may not come in as weak as expected, and spending remained relatively robust considering lockdowns were already underway when companies were surveyed in July. This also suggests businesses are expecting lockdowns to end sooner than later, which could negatively impact Q3 spending if lockdowns continue to be extended.

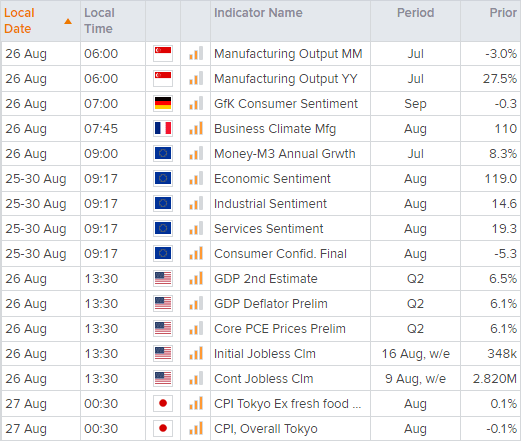

Markets may find themselves in a holding pattern up until Jerome Powell’s speech tomorrow night, although US employment claims is worth a look as it may provide preliminary moves for the dollar (and related markets) if we ger a surprise number. Should it fall much more than expected, bulls will likely be more confident of a hawkish speech tomorrow (dollar bullish) yet if it misses to the downside it plays into Powell’s ‘transitory inflation’ view and could see the dollar move lower.

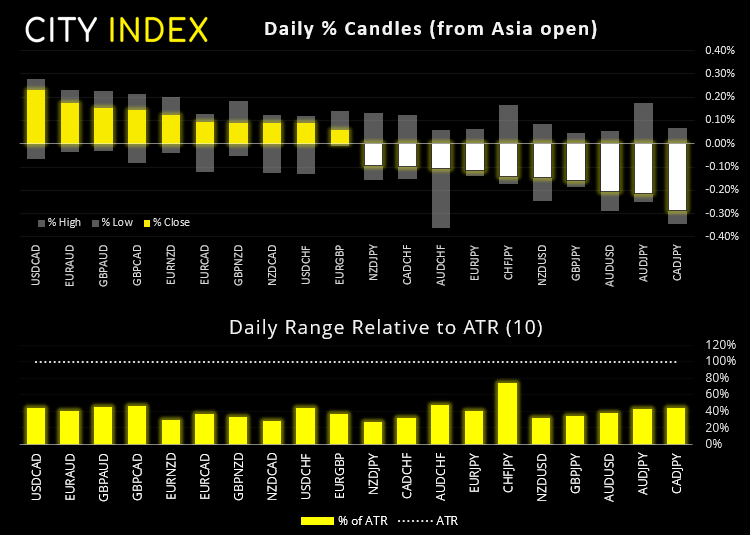

As for overnight moves, currency markets corrected slightly against yesterday’s moves, which saw JPY and USD as the strongest majors with CAD, AUD and NZD as the weakest.

AUD/USD and AUD/JPY has found resistance at its 20day eMA and weekly R1 pivot. GBP/JPY reached out 151.40 target yesterday but, like AUD/JPY has also stalled at its weekly R1 and 20-day eMA. We suspect the odds favour a gentle retracement for all pairs from current levels, given the magnitude of the moves seen over the past 3-sessions. GBP/USD have some wriggle room for further upside over the near-term. It has a bullish structure on the four-hour chart and the next resistance cluster is around 1.3800.

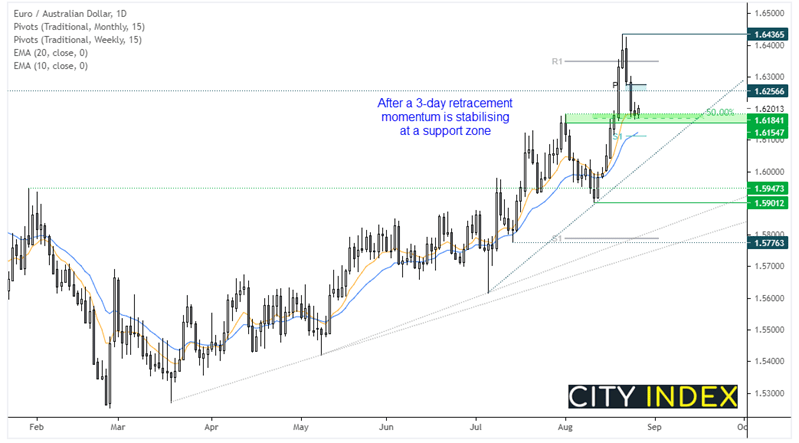

It’s been four days since EUR/AUD accelerated its way above 1.6400 and to its highest level this year. Yet it failed to close above that round number on the day, then embarked upon a three-day correction. Whilst the retracement was quite deep relative to its time, is also needs to be taken in context of the strong prior move (which was borderline parabolic). Besides, price action is showing signs of stability at a support cluster between 1.6154/84 which comprises of swing highs, a 50% retracement level and 10-day eMA.

Learn how to trade forex

Commodities:

Commodity prices remain in the hands of the dollar, although the CRB commodity basket has managed to rally for three days thanks to hopes the Delta virus may be contained. A strong employment report could further bolster commodity prices and send the CRB back above 218 and head for its 221.50 high.

Copper futures rose to a 6-day high yesterday yet, like WTI, its small Doji warns of a loss in momentum and potential near-term top. Today’s support levels include 4.224 and 4.20, resistance is 4.30 and 4.735.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.