- Euro to US dollar analysis: With both the Fed and ECB to make interest rate decisions in the next 24 hour, expect the EUR/USD to experience heightened volatility

- FOMC set to hikes rates by 25 basis points, but will this be the last one?

- ECB has toned down its hawkish rhetoric, but it is far too early to relax in inflation fight

Will this be the Fed’s last rate hike?

First up, the Fed will take centre stage later today, when it will most likely – almost certainly – deliver what everyone expects, a 25-basis point rate hike. The dollar’s reaction will depend entirely on the FOMC’s hints about the next meeting in September. According to the CME FedWatch tool, the Fed is given a 20% chance by rates traders of another hike in that meeting. This means that in the short-term, there’s bigger room to the upside for the dollar in the event the Fed strikes a very hawkish tone, than it is to the downside in the event the central is more dovish than expected. But we agree with the consensus view that this meeting could mark the end of the Fed’s tightening cycle, for inflation has been falling consistently and more so than expected in recent months. Still, Jerome Powell will be hedging his bet and will likely leave the door open for further rate increases. That’s not to say the market will believe him. So, unless Powell is uber hawkish, any short-term strength the dollar may find in the immediate reaction, may fade quickly.

ECB set to deliver another 25bps hike

Once the Fed is out of the way, the focus will shift to the ECB meeting on Thursday, insofar as the EUR/USD is concerned. The ECB could revert back to data-dependency, something which the markets have been pricing in with the EUR/USD falling noticeably in recent days. If ECB President Christine Lagarde refuses to provide a strong hawkish signal for September, then this would be deemed a slightly dovish outlook, potentially keeping the euro under pressure and stock markets underpinned. But there’s the potential for the EUR/USD to rally anyway, should the Fed deliver a dovish surprise on Wednesday first.

My base case scenario is that that the ECB will strike a balance in its policy decision on Thursday, one that would potentially keep the EUR/USD outlook mildly positive. Lagarde may hone in on the "higher for longer" narrative in order to counter speculation that the ECB will start cutting interest rates next year, when 75 basis points of cuts are priced in. But “higher for longer” may just mean a longer pause than further hikes. But it would probably keep the door wide open for a potential hike in September, rather than pre-committing to it in light of renewed weakness in Eurozone economy – especially in the manufacturing sector. In this scenario, I don’t think the EUR/USD will fall materially in terms of initial reaction and will likely remain above the 1.10 handle once the dust settles, before potentially resuming higher.

Euro to US dollar analysis: EUR/USD Technical Analysis

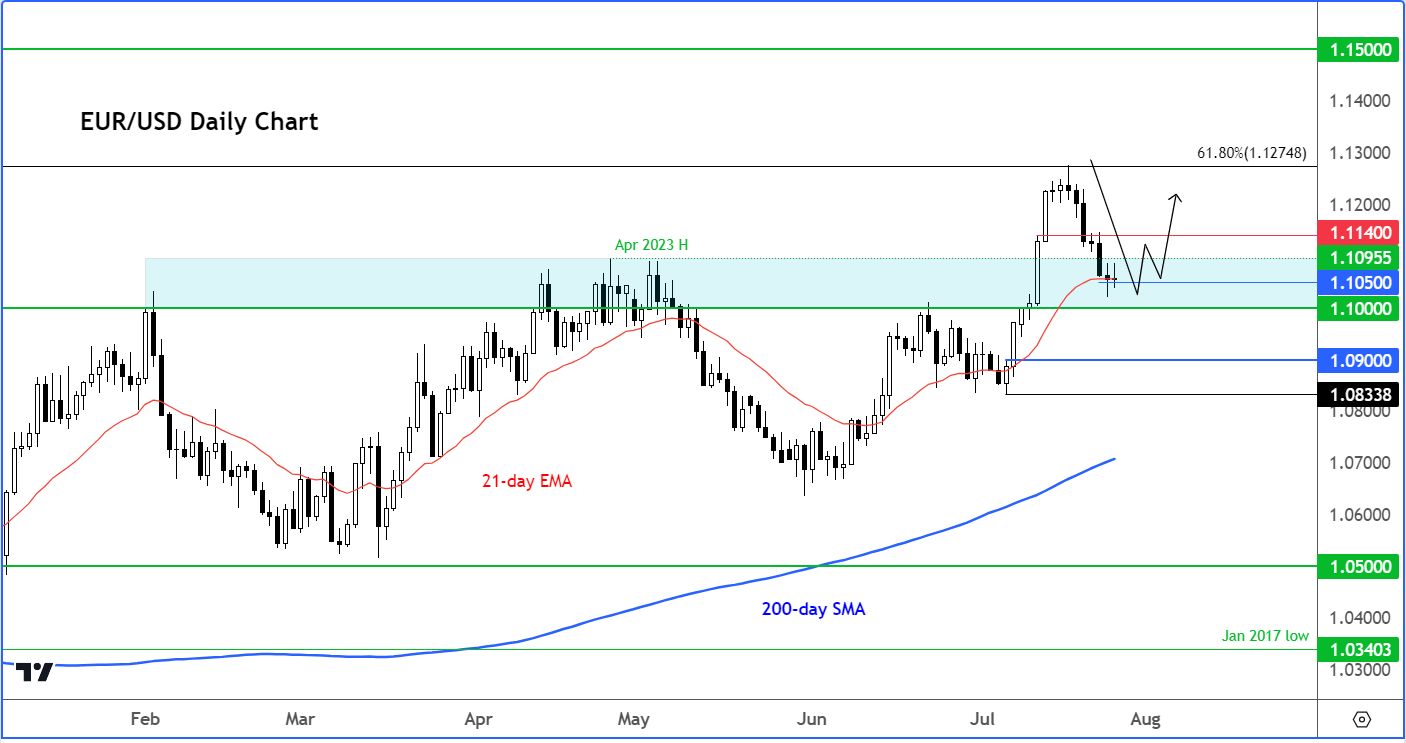

With these key risk events ahead of us, any form of technical analysis should be taken with a pinch of salt. That being said, there is no denying in that the underlying trend in the EUR/USD is still bullish, with price consistently making higher highs and higher lows. Until this structure changes, I will maintain a bullish view on this par.

Source: TradingView.com

As it happens, the market has perfectly timed the latest dip into a key support area with these central bank meetings. The area between 1.100 to 1.1095 was previously a ceiling on several occasions this year. So, we could see the EUR/USD rebound and push higher again from this area.

In the event of a hawkish surprise by the Fed and/or dovish surprise by the ECB, the next key level to watch below the abovementioned area is around 1.0900 – this being the base of the prior rally.

The line in the sand is at 1.0833 for me. This being the last low hit in early July, prior to the latest rally to a new 2023 high earlier last week. If we break below this level, then we will have created out first lower low. At that point, should we get there, I would therefore drop my bullish view on EUR/USD.

Incidentally, last week’s high came right in around the 61.8% Fibonacci retracement level (1.1275) of the big downswing that started in January 2021. This level is now the key target for the bulls to claim. If they do so successfully, then there’s not many further resistances until 1.1500. But 1.1140 is a more immediate focus area for the bulls.

So, there you have it: My euro to US dollar analysis is still the same (bullish) until the charts tell us otherwise.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade