The breakdown of EUR/USD does not bode well for investor risk appetite moving forward, pointing to the growing risk of higher volatility and weaker asset prices moving forward.

An environment of US dollar strength and rising US bond yields never typically goes down well with investors, sucking capital like a sponge back to the United States. The longer it persists, the greater the risk of volatility, often culminating with something “breaking”. Think emerging markets, lower-rated sovereign and corporate bonds, currencies whose central banks are powerless to repel potential attacks. It’s been shown time and again that when the US dollar and yields rise in tandem, trouble follows.

EUR breakdown backed by fundamentals

Right now, US yields are threatening to break to fresh multi-decade highs while the US dollar has risen to levels not seen in months. The momentum is moving in the same direction, raising questions as to what will stop it?

The Fed could turn neutral or even dovish towards the inflation outlook, but that seems unlikely unless US economic data starts to roll over noticeably. Another is for activity to strengthen in other parts of the world, especially in China and the Eurozone. But that looks remote near-term, including in Europe where expectations for further ECB rate hikes are rapidly diminishing, contributing to the EUR/USD breaking down on the charts. You only need to look at the relative levels of recent PMIs to see why the EUR is flailing while USD is sailing.

Representing such a large proportion of the US dollar index (DXY) – nearly 60% -- a continuation of EUR weakness will really get the US dollar wrecking ball going, especially when the Japanese yen is also under significant selling pressure. Given the momentum, fundamentals and potential for renewed turbulence in markets, the risk-reward for EUR/USD looks skewed to the downside.

Risk-reward for EUR/USD looks skewed to the downside

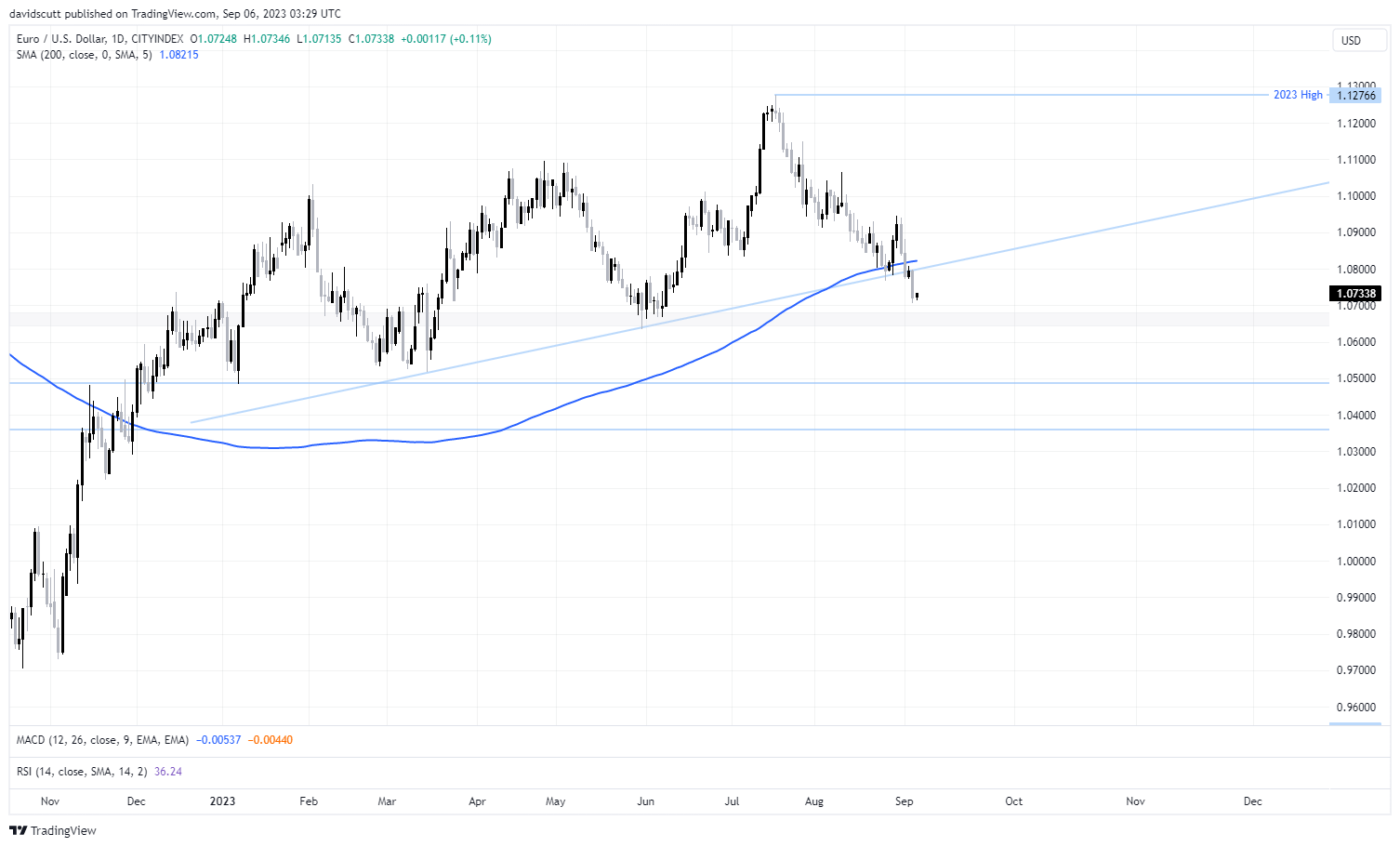

Having broken the 200-day SMA and uptrend that began in March, it’s hard to get excited about the prospects for renewed upside. Those with high conviction for an extended selloff may be willing to enter shorts here, although pushes back towards 1.0800 may offer more attractive levels for those with a shorter trade timeframe. A stop above 1.0800 will help to limit losses should the pair unexpectedly reverse. On the downside, a support zone from 1.0680 established in June is the first port of call. Should that go, a flush down to 1.0500, or even 1.0360 may be on the cards.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade