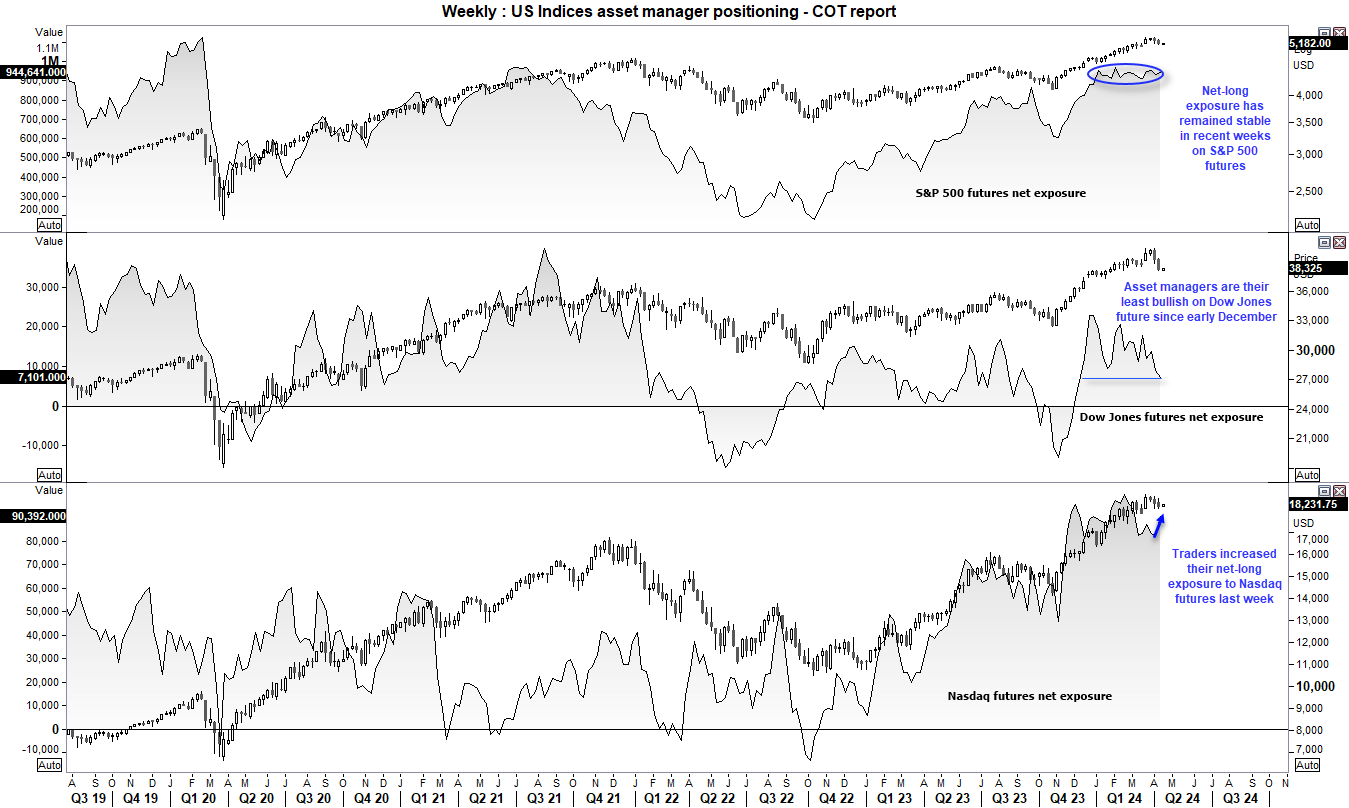

Over the past couple of months I have pointed out that there was a divergence between net-long exposure of asset managers and rising US indices. Yet what became more apparent recently was that the Dow Jones was the least popular of the three, as net-long exposure has since fallen to its least bullish level since early December. And traders could actually flip to net-short exposure against the Dow Jones in a few weeks of bears continue to close longs and initiate fresh shorts at a similar pace to the last few weeks.

This alone suggests that bears may want to limit their short positions for the Dow Jones. Also note that net-long exposure to S&P 500 futures has remained stable around its cycle highs in recent weeks, and bullish exposure actually increased to Nasdaq 100 futures last week. And that suggests bulls may have better luck with longs on the Nasdaq 100 or S& 500, given their ability to hold above support levels despite the recent bout of risk off.

Ultimately, until we see a material pickup of shorts bets against the Nasdaq 100 or S&P 500, any pullback for these indices could be limited compared to the Dow. But that is not to say they cannot fall further from here.

The combination of tensions from the Middle East alongside the growing realisation that the Fed not have to hike at all this year could take their toll on sentiment. And whilst nobody want to consider this right now, what if the Fed actually do have to hike rates again? I suspect we’d see some serious repricing, and not in the favour of risk assets such as US indices.

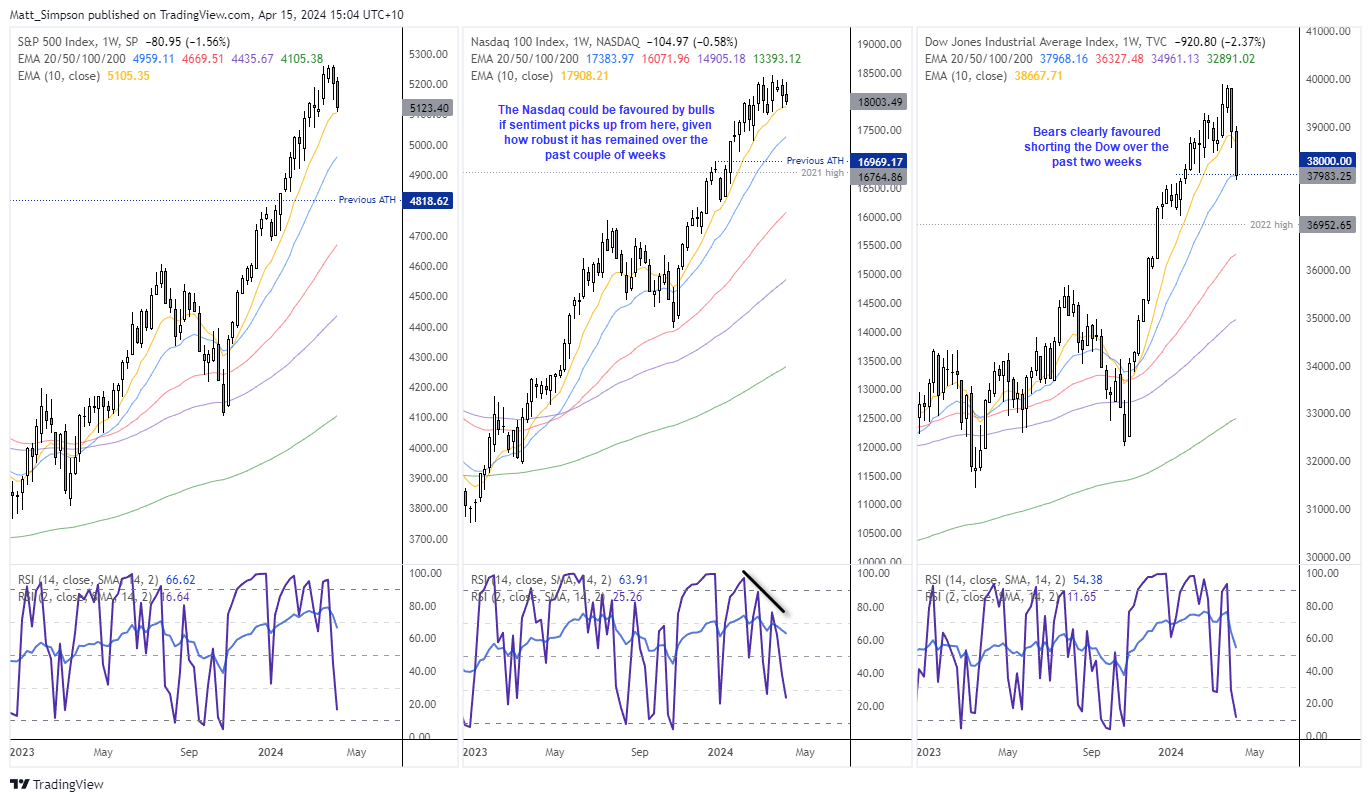

S&P 500, Nasdaq, Dow Jones weekly chart:

We know that US indices tend to track each other very closely the majority of the time, but a quick look at the weekly charts shows how they can also differ. Overall, bearish setups are preferred on the Dow Jones and bullish ones on the Nasdaq.

- The S&P 500 fell close to 3% over the past two weeks yet remains above its 10-week EMA

- The Nasdaq formed a small inside week and also remains above its 10-week EMA

- The Dow Jones broke beneath its 10-week EMA last week, closed on its 20-day EMA and had the weakest rally above its old prior high

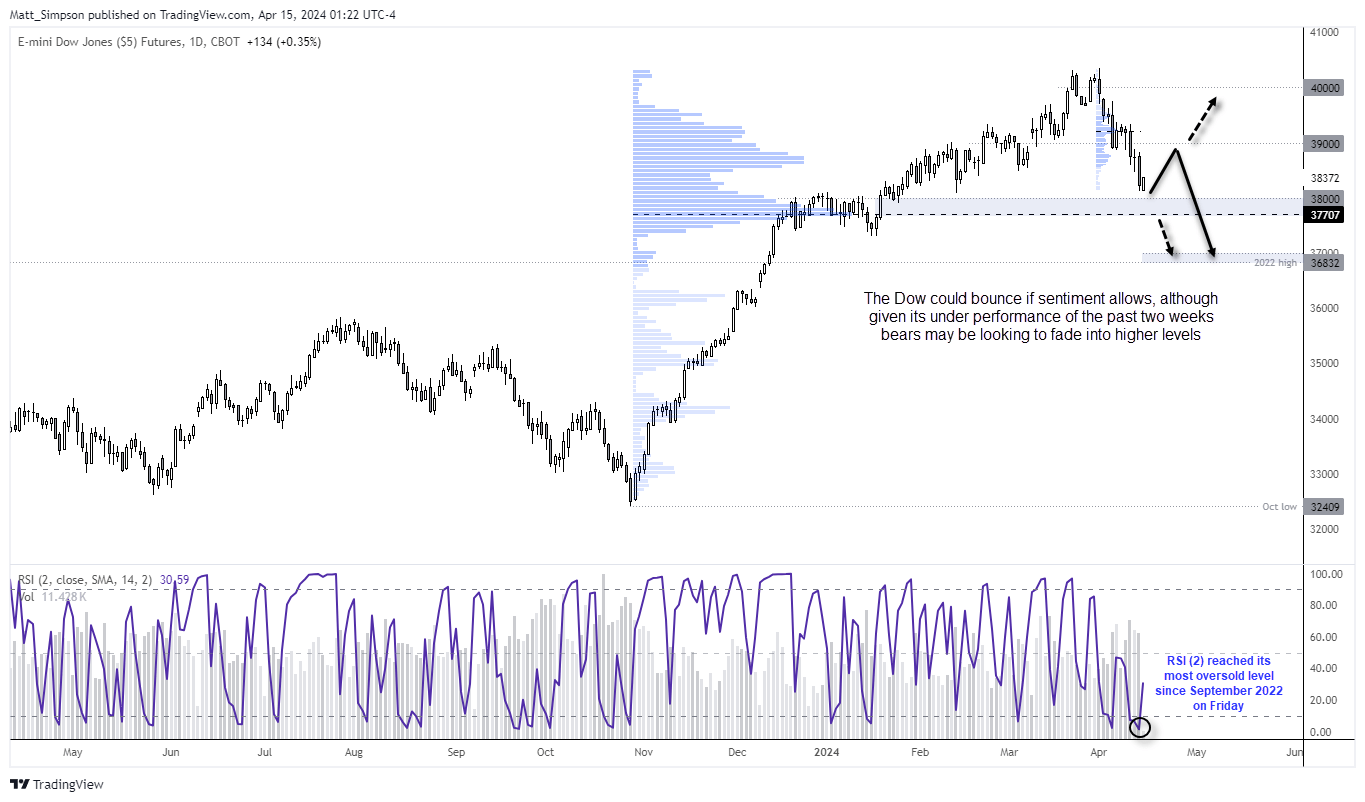

Dow Jones futures technical analysis (daily chart):

The Dow Jones failed to hold above the 40k level on two occasions, leaving a double top just above that key milestone level. The index has fallen in a relatively straight line, and the market is holding above 38k for now. RSI (2) reached its most oversold level this year on Friday, and with headlines that Israel is not looking to retaliate against Iran, then perhaps there is an opportunity for a bounce from current levels.

However, given the depth of the decline from the highs against the Nasdaq and S&P 500, I suspect any upside bounce could underperform. Therefore, bears may want to monitor any such bounce for evidence of a swing high in anticipation of an eventual break beneath 38k.

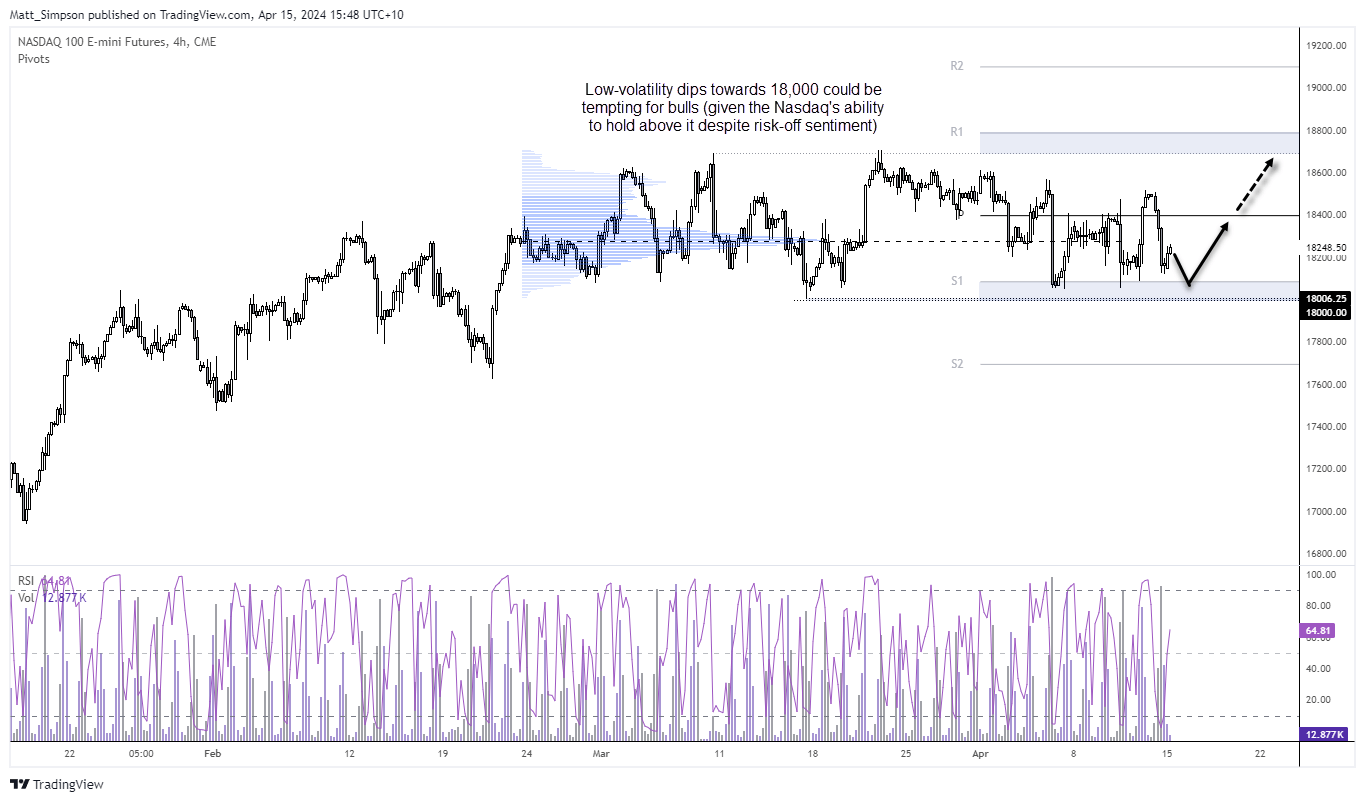

Nasdaq 100 futures technical analysis (4-hour chart):

Despite all that has been thrown at it, the Nasdaq remains defiant and not too far below its record highs. We’ve seen a slight rebound in Monday’s Asian trade, and prices seem a little hesitant to break above the 18,250 – 18,300 level, near the most traded price by volume during its sideways consolidation.

As sentiment is a little fragile, I would prefer to see prices pull back towards last weeks lows before seeking longs. There is clearly support above 18,000, so any low-volatility towards it could be tempting for bulls to seek a bounce towards 18,250 – 18,300. And should US data remain firm and geopolitical tensions recede, perhaps it can break above 18,400. But should war in the Middle East escalate, a break beneath 18,000 seems likely (but for that, I’d prefer to see bearish setups on the Dow Jones).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade