- Crude has consolidated on its bullish break to start the new trading week

- Gold looks heavy after surging to record highs

- A key event for commodity markets this week is how many rate cuts with the Federal Reserve signal this year

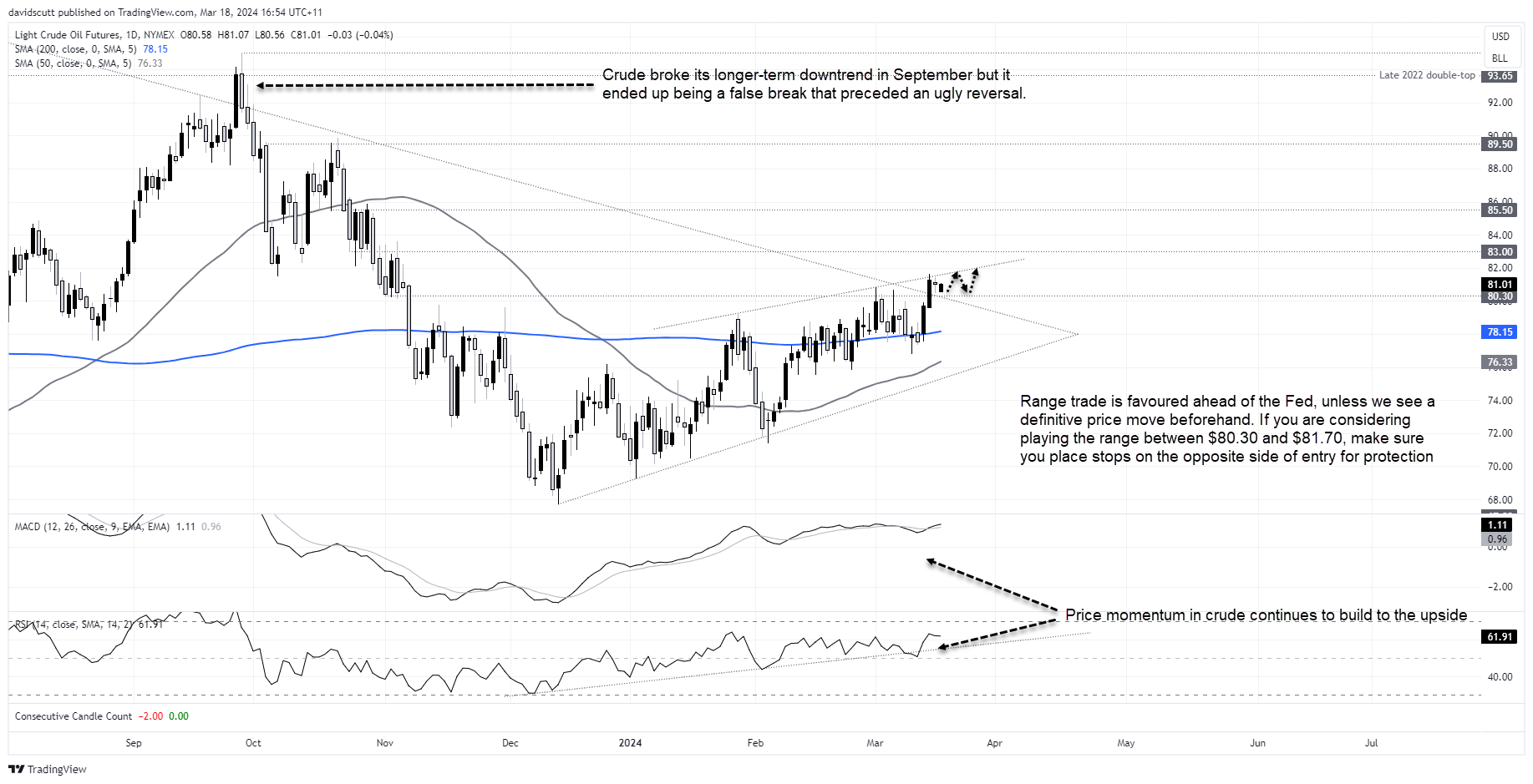

US crude oil futures have broken the downtrend running from early 2022, doing away with resistance located around $80.30 along the way. They now sit at fresh hitting 2024 highs. However, a similar break of the downtrend fizzled last September, resulting in what was an ugly reversal at the time. As such, you can understand why there may be caution to go on with the move near-term, especially with so many major risk events this week.

Latest break not just reflecting supply risks

Despite the lack of follow through buying, the bias for crude appears higher, underpinned by evidence of strengthening demand and disruptions in Russia and the Middle East, two factors that contributed to the International Energy Agency (IEA) now expecting a modest market deficit this year should OPEC+ continue restrict supply.

You can see the topside break in WTI crude oil futures last week, with the IEA report combining with attacks on Russian refining capacity to push the price to highs not seen since early November. Unlike the false break of the longer-term trendline in September that was driven by the Israeli-Hamas conflict, the latest break appears to be far more reflective of both the supply and demand outlook.

Crude range trade favoured ahead of the Fed

I’d be inclined to buy dips towards $80.30 and sell rallies towards uptrend resistance around $81.70 ahead of the Fed, the key event this week that could move crude given the implications for US economic activity and US dollar strength. Tight stops on the opposite side of entry would be recommended given the number of macro events on the calendar, lending itself to choppy conditions. Traders may want to wait for the Fed decision to see whether the break of the longer-term downtrend sticks.

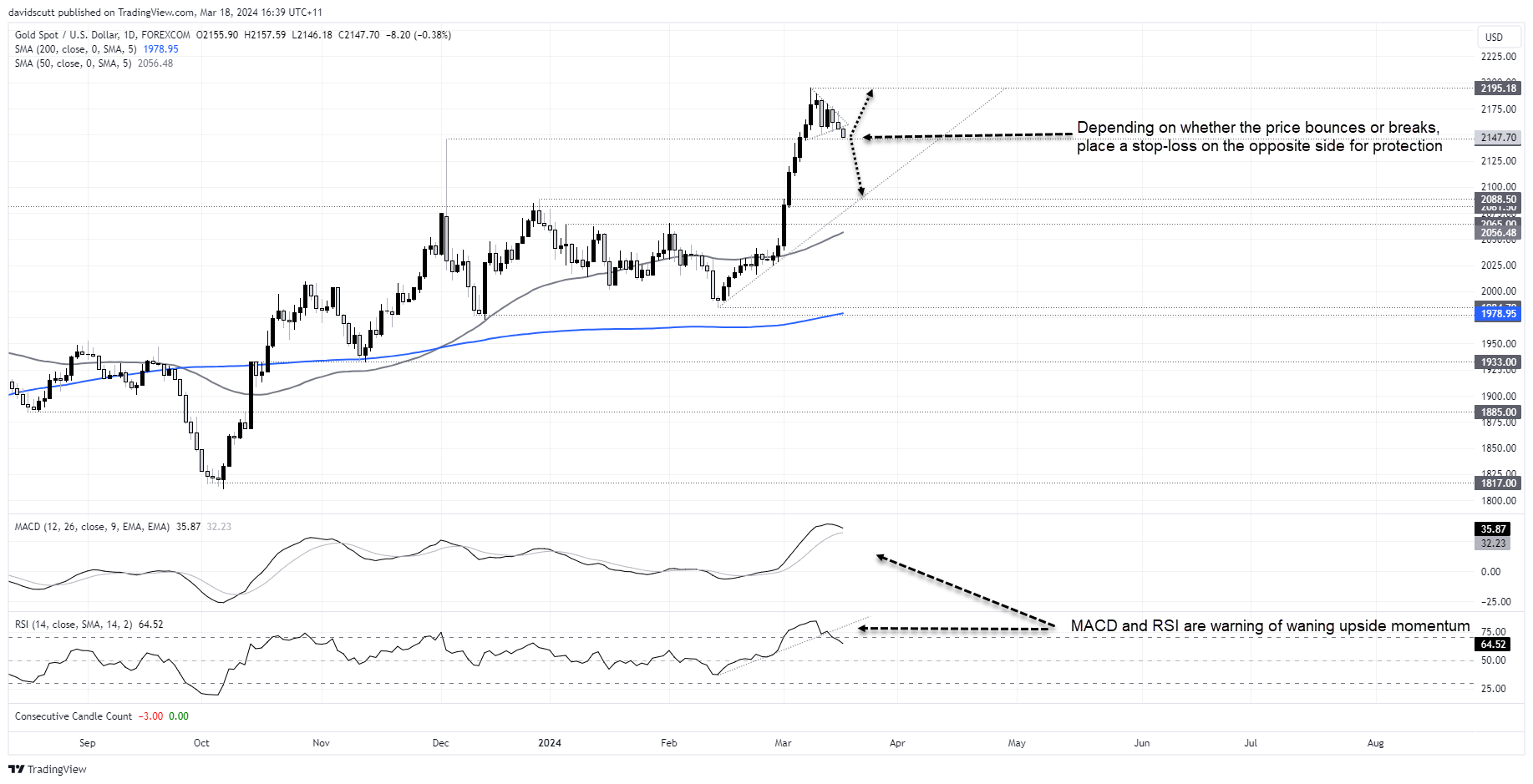

Gold looks tired and heavy

Gold is another market that may provide opportunities to trade either a range or range break ahead of the Fed, with the price currently sitting on the previous record high set in December having broken out of a symmetrical triangle pattern today.

Should the price be unable to push below current levels, traders could buy with a stop below $2145 targeting a push back towards the record highs. Conversely, should the price break $2145, it will allow for shorts to be established with a stop above looking for a retracement towards $2100.

With MACD looking like it will soon crossover from above with the RSI uptrend already broken, the price action looks heavy, suggesting the latter trade may be higher probability.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade