GBP/USD Key Points

- UK traders are out on a bank holiday as GBP/USD traders look ahead to the Bank of England’s “Super Thursday” festivities

- With traders still pricing in a chance of a June rate cut from the BOE, a data-dependent message may be seen as hawkish relative to expectations.

- The risks for GBP/USD are tilted toward a topside breakout and continuation toward 1.2700 if this week’s data plays along.

Markets are off to a slowish start to the new week with both Japanese and UK traders out of the office on bank holidays today. With traders bereft of new economic data, they’ve been mostly digesting last week’s dovish FOMC meeting and softer-than-expected NFP report, leading to another (small) round of weakness in the US dollar relative to most of her major rivals.

Looking ahead, the Bank of England’s “Super Thursday” festivities are a standout event risk on the calendar, even if BOE Governor Bailey and Company aren’t expected to make any changes to monetary policy. Overall, the UK economy is growing at a modest rate, with Q1 GDP expected to show 0.3% growth q/q on Friday, and that should lead to a dovish bent amongst BOE policymakers.

As it stands, traders are pricing in about 50bps of interest rate cuts across the year, with the first reduction expected in either August or September, with an outside chance of a cut at the BOE’s next meeting in June. If we’re to see an interest rate cut this summer, Governor Bailey and Company will be looking to set the groundwork as soon as this month’s meeting. Accordingly, a steady-as-she-goes, data-dependent message may be seen as hawkish relative to expectations, potentially setting the stage for another leg higher in the pound sterling against the greenback.

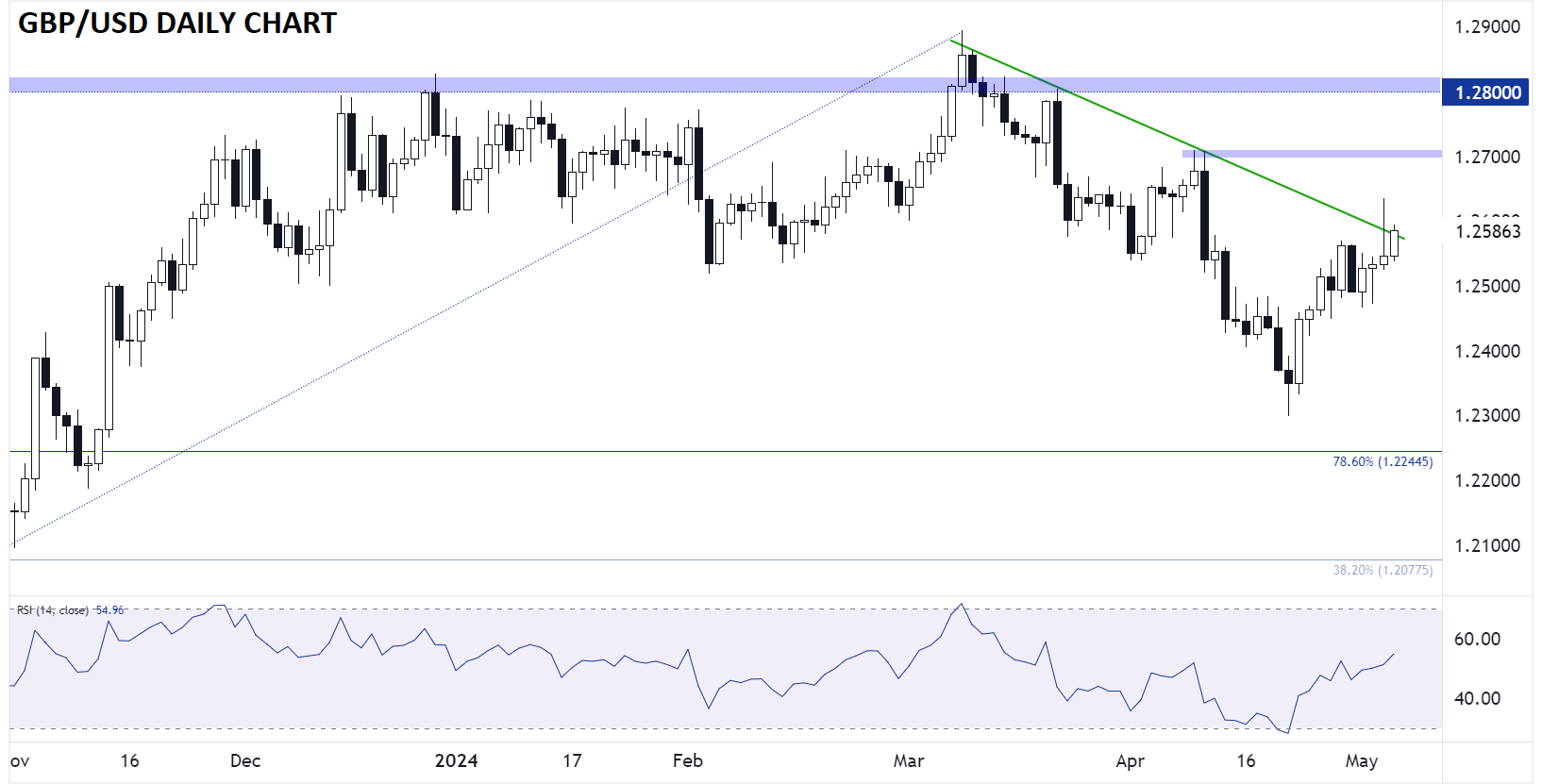

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

Speaking of GBP/USD, the cross is testing a key technical level as we go to press. Cable is pressing the top of its 2-month bearish trend line just below the 1.2600 level, as traders continue show a short-term preference for the UK currency. With a few days yet until this week’s key UK data (BOE on Thursday and GDP on Friday), GBP/USD traders will be watching to see if the pair breaks out above 1.26 or reverses off the current level by midweek.

If the data confirms the initial move, it would set the stage for a continuation as we head into next week and beyond. Given the broad bearish reversal in the US dollar last week, the risks are tilted toward a topside breakout and continuation toward 1.2700 if this week’s data plays along.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX