- AUD/USD outlook: US dollar largely unaffected by jobs data as focus turns to CPI

- AUD outlook likely to be impacted by Aussie and Chinese inflation data

- AUD/USD technical analysis shows Aussie’s uptrend still remains intact

Welcome to another edition of the Currency Pair of the Week.

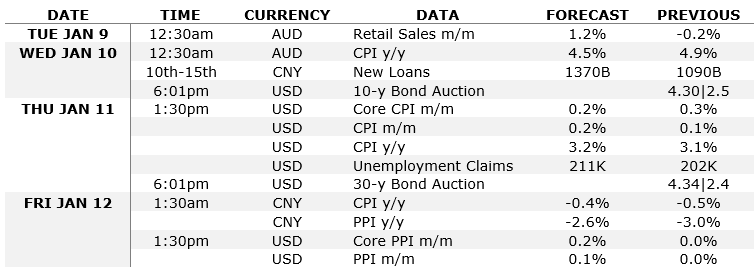

The AUD/USD is our featured currency pair this week, as we have important inflation data from the US, Australia and the latter’s largest trading partner, China. The economic calendar is otherwise quieter as we start the first full trading week of the year.

AUD/USD outlook: US dollar largely unaffected by jobs data as focus turns to CPI

The AUD/USD outlook will be largely determined by the direction of the US dollar this week, rather than domestic factors. The greenback ended the first week of the year higher, as investors reduced bets of a March rate cut by the Federal Reserve. The dollar was somewhat firmer against the majority of G10 currencies on Monday morning, although not by much. Bond yields pushed a little higher but remained within Friday’s range.

Investors were still trying to make sense of Friday’s conflicting data from the world’s largest economy, which created a bit of uncertainty in the markets.

On Friday afternoon, the dollar was already weakening post NFP as investors realised the headline beat was not as strong as it looked given those downward revisions to the previous months' data. Then the ISM survey came out much weaker and this accelerated the dollar selling. The employment component of the ISM services PMI showed a big drop into contraction from 50.7 to 43.3. However, by the close of play, the dollar had bounced off its lows again, leaving it little-changed on the session.

All told, while the US labour market is certainly cooling, the slowdown is not rapid enough to prompt rate cuts in the first quarter. This is especially true considering that wage growth remains resilient and the unemployment rate low. Given that the employment picture is not very clear, the dollar should remain very sensitive to incoming data, with the focus turning to the December CPI and PPI reports, scheduled for release on the last two days of the week.

Video: Dollar's reaction post NFP

In this video, I have discussed the dollar in greater detail, with a focus on the EUR/USD, gold and silver.

AUD outlook likely to be impacted by Aussie and Chinese inflation data

Ahead of the US inflation data at the end of the week, we will have CPI data from Australia on Wednesday, while China’s inflation figures will come out on Friday. Aussie retail sales are due for release on Tuesday. All these macro releases should have an impact on the AUD/USD outlook.

Here are this week’s key data highlights relevant to the AUD/USD pair:

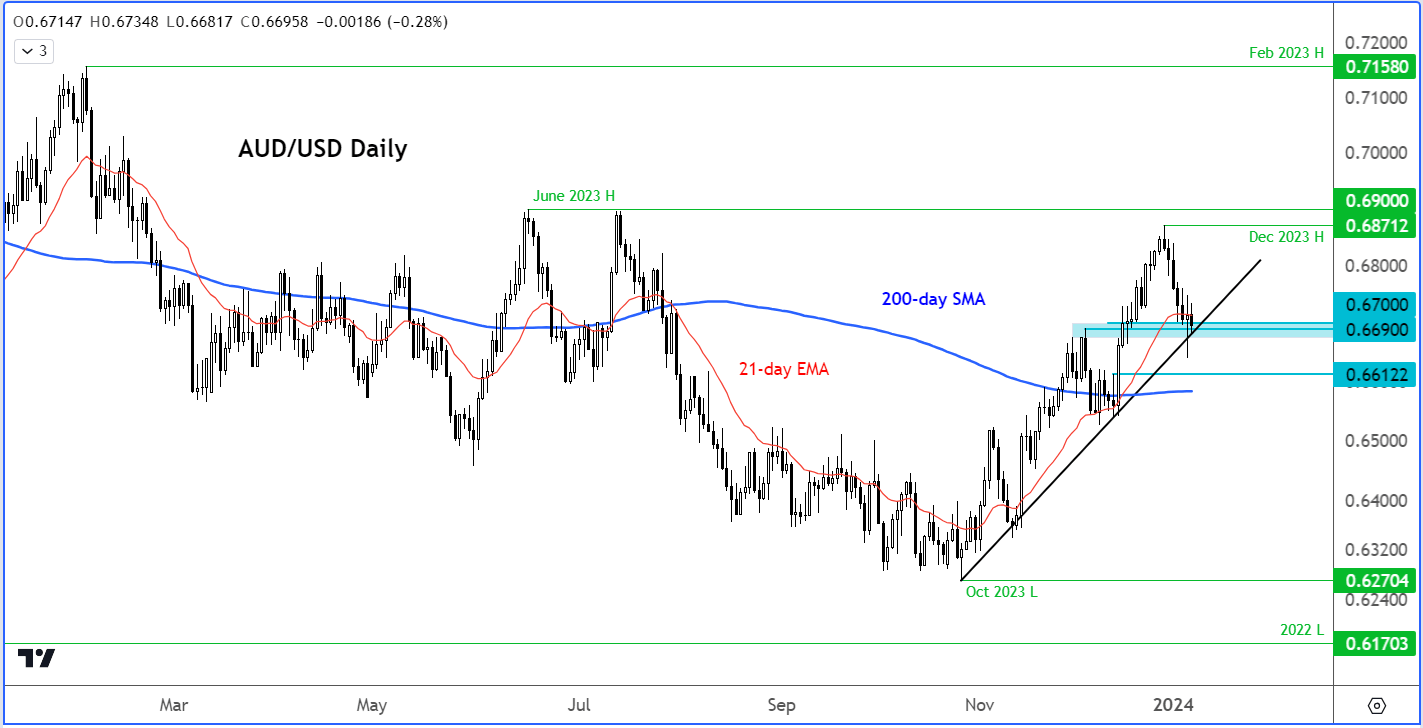

AUD/USD outlook: technical levels to watch

Source: TradingView.com

The AUD/USD has started the month of January lower after finishing each of the previous two months in the positive territory. The loss of bullish short-term bullish momentum is hardly surprising given how extreme investors had priced in the Fed’s rate cuts. Anyway, the bullish trend is still intact given that price has not broken any major lows yet.

In fact, the AUD/USD was testing key support just below the 0.6700 area at the time of writing. Here, prior resistance met with the bullish trend line going back to October. On Friday, the AUD/USD posted its first positive close in 6 sessions. But it has started Monday in the negative, again to the frustration of the bulls. But should it be able to recover later on in the day, and turn positive, then this could be a sign that it has hit a bottom and the bullish trend is about to resume. In this potential event, the bulls will aim for the December high at 0.6871 or the June peak at 0.6900 as their next upside objective.

Bullish traders must await such a bullish reversal signal given the recent bearish price action. In the event of a bullish no-show, then there is a risk the Aussie may dip to test the next support at 0.6610ish or even the 200-day average at 0.6585ish, before potentially reversing.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade