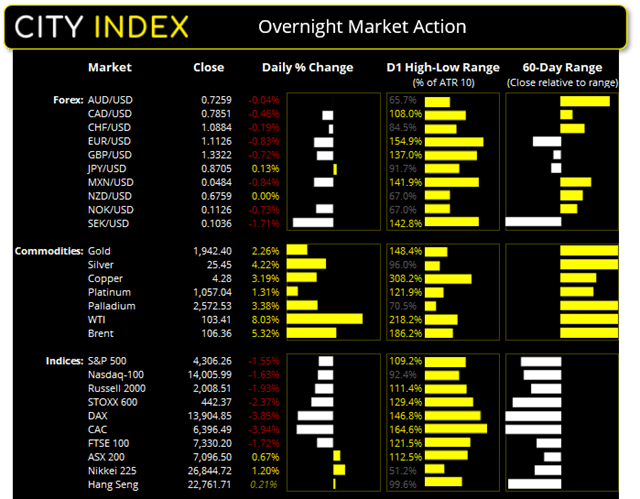

Tuesday US cash market close:

- The Dow Jones Industrial fell -597.65 points (-1.76%) to close at 33,294.95

- The S&P 500 index rose -67.68 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -231.823 points (-1.63%) to close at 14,005.99

Asian futures:

- Australia's ASX 200 futures are down -49 points (-0.7%), the cash market is currently estimated to open at 7,047.50

- Japan's Nikkei 225 futures are down -460 points (-1.71%), the cash market is currently estimated to open at 26,384.72

- Hong Kong's Hang Seng futures are down -161 points (-0.71%), the cash market is currently estimated to open at 22,600.71

- China's A50 Index futures are down -52 points (-0.35%), the cash market is currently estimated to open at 14,876.45

Russia has stepped up its attack on Ukraine after a convoy of Russian military vehicles over 40 km long reached Kyiv. Although simultaneous attacks are continuing across multiple cities throughout Ukraine.

- Russia has hit a TV tower which aims to ‘break the resistance of the people’ according to their defence minister, prompting Ukraine to make furtherer claims that Russia is targeting its civilians.

- Russian state news claims a second round of peace talks have been scheduled for Wednesday according to Russia, although Ukraine are “yet to confirm”.

- Meanwhile the Ukraine urged for the bombings to stop before peace talks can resume.

- An article of Russia’s invasion on Ukraine has prompted Russia to threaten blocking Russian access to Wikipedia

- Nord Stream have filed for bankruptcy and served termination notices to (all 106) employees

- The UK government “its first tranche” of sanctions Belarusian individuals for aiding Russia’s invasion of Ukraine

Volatility was higher for multiple asset classes overnight as risk-off trade resumed. Wall Street was broadly lower with Nasdaq banking stocks falling over -5% and the Nasdaq down -1.6%. The S&P 500 is back below yesterday’s open as choppy trading persists. The VIX closed to a 13-month high just below 35, gold rose to 1944 and oil hit fresh highs.

Crude oil rallied over 12%

Oil is on fire, both literally and metaphorically. Russia has ratcheted up its attack on Ukraine and has bombed fuel facilities, whilst the IEA agreed to release 60 mln barrels of oil in a move to cool rising prices. It hasn’t worked. Crude oil rallied over 12% during its highest level in 7.5 years before pulling back to 104. ASX energy stocks were already the best performers year-to-date by yesterday’s close, and we see little reason for them to be knocked from their perch today irrespective of that happens at the OPEC meeting. The main question for traders is whether OPEC will stick to the agreed 400-bpd increase or raise output at a faster rate to take the heat out of oil’s Ukraine-crisis-fuelled rally.

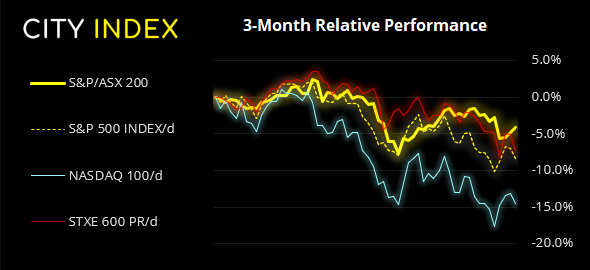

ASX 200:

The ASX 200 settled for an ok finish after an excellent start yesterday, as it handed back around half of its strong rally before closing back below 7100. And looking at the state of Wall Street overnight then we expect further selling pressure today. But the reality is that prices remain within Thursday’s volatile, war-triggered range – which means we’ll likely need a catalyst of some magnitude before we expect prices to break below 6959 or above 7208. Until which, choppy trading conditions can be expected and traders would be wise not to marry their positions.

Technology stocks posted another strong day of 5.7%, its second-best day since August. In fact, it has risen 13.6% since Friday’s low during its best 3-day return since March 2021. But we wish it luck keeping onto all of those gains today with the Nasdaq down another -1.5%.

ASX 200: 7096.5 (0.67%), 01 March 2022

- Information Technology (5.66%) was the strongest sector and Utilities (-2.15%) was the weakest

- 7 out of the 11 sectors closed higher

- 4 out of the 11 sectors closed lower

- 7 out of the 11 sectors outperformed the index

- 141 (70.50%) stocks advanced, 50 (25.00%) stocks declined

Outperformers:

- +14.94% - Yancoal Australia Ltd (YAL.AX)

- +12.99% - Paladin Energy Ltd (PDN.AX)

- +12.77% - Imugene Ltd (IMU.AX)

Underperformers:

- -11.64% - Sandfire Resources Ltd (SFR.AX)

- -6.33% - Zip Co Ltd (Z1P.AX)

- -4.22% - Evolution Mining Ltd (EVN.AX)

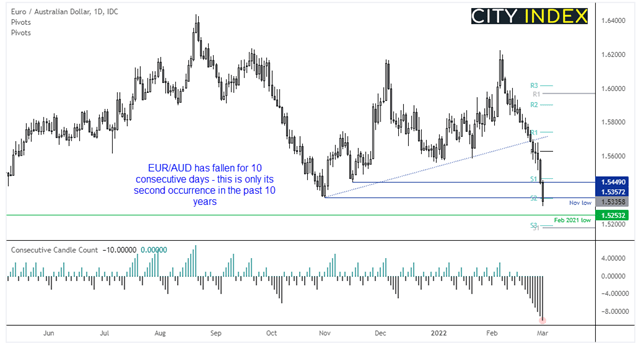

JPY and USD were the strongest major currencies

With European NATO allies potentially on the brink of sharing a closer border with Russia, the euro was the hardest hit major currency overnight. EUR/CAD probed the January low and EUR/CHF sank to its lowest level since the infamous January 2015 (when SNB removed the Swiss franc peg to the euro).

EUR/AUD has now fallen over -5% from this month’s high and has traded lower for 10 consecutive days. This is only its second 10-day bearish streak in 10 years. At some point mean reversion will kick in but only when sentiment allows it to. From here, the February 2021 is less than a day’s ATR away although something to look out for is whether prices can now remain below the November 2021 low. As a break back above it could be an early indication that mean reversion is finally underway. Although that likely requires a positive headline or two from the Ukraine crisis to appear, before we can expect a sustained countertrend rally.

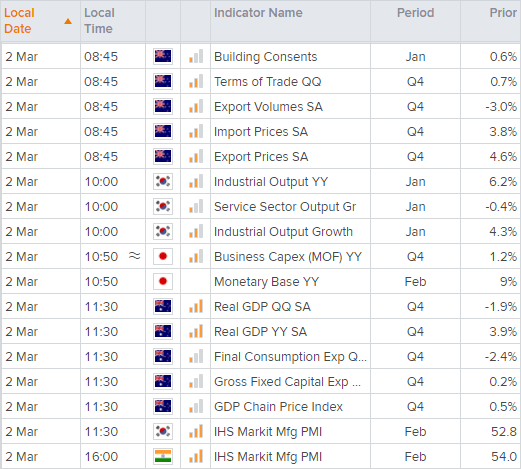

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade