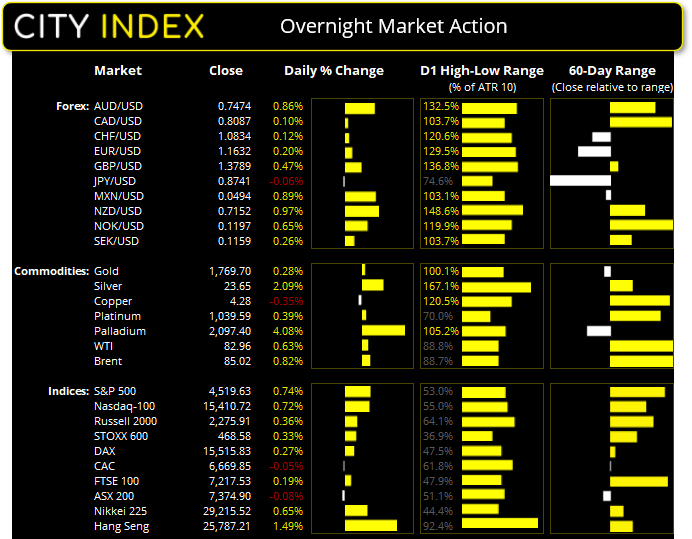

Asian Futures:

- Australia's ASX 200 futures are up 41 points (0.56%), the cash market is currently estimated to open at 7,415.90

- Japan's Nikkei 225 futures are up 90 points (0.31%), the cash market is currently estimated to open at 29,305.52

- Hong Kong's Hang Seng futures are up 224 points (0.87%), the cash market is currently estimated to open at 26,011.21

UK and Europe:

- UK's FTSE 100 index rose 13.7 points (0.19%) to close at 7,217.53

- Europe's Euro STOXX 50 index rose 15.43 points (0.37%) to close at 4,166.83

- Germany's DAX index rose 41.36 points (0.27%) to close at 15,515.83

- France's CAC 40 index fell -3.25 points (-0.05%) to close at 6,669.85

Tuesday US Close:

- The Dow Jones Industrial rose 198.7 points (0.56%) to close at 35,457.31

- The S&P 500 index rose 33.17 points (0.74%) to close at 4,519.63

- The Nasdaq 100 index rose 109.83 points (0.72%) to close at 15,410.72

Indices:

FOMC voting-member Christopher Waller made some of his more hawkish comments of late saying that the Fed’s biggest risk is if inflation doesn’t come down. If it remains above 5% in 2022 (which is not impossible) then the Fed would pull their rate expectations earlier – and everything hinges on inflation expectations. Ultimately, “we are ready to stop high inflation if we have to”.

The US 10-year yields 1.64% (a 4-week high) and is considering a break of its 200-week eMA as traders priced in a more hawkish Fed. According the Federal Funds futures, traders are now pricing in a 45.1% chance of a hike in July 2022, up from 42.5 the prior day.

Earning optimism lifted Wall Street for a fifth straight day. The S&P 500 was the leader of the pack, rising 0.74% and closed above 4500 for the first day in over a month. Healthcare and utilities sectors were the strongest sectors of the 10 that posted gains, only consumer discretionary closed slightly lower.

The ASX 200 is expected to open higher today, around the September 27trh high. This is a key level for it to break but we are mindful of yesterday’s bearish hammer on the daily chart and the fact that its rally from the 7256 low is losing steam.

The Hang Seng index closed firmly above its 50-day eMA for the first time since late June. Its daily trend structure remains bullish above 24,827, but hopefully bulls can maintain prices above the 25,437 breakout level.

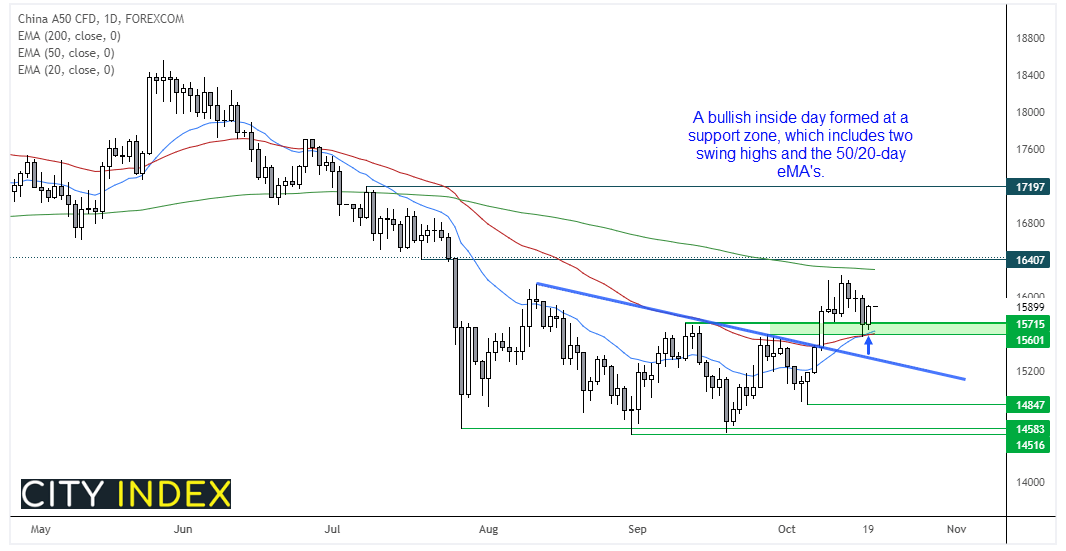

The China A50 appears to have respected the 15,600 – 15,715 support zone outlined on Monday. The zone comprises of September 10th and 28th highs and the 50 and 20-day eMA. Furthermore the 20-day has since crossed above the 50-day to show an increase in near-term bullish momentum. Yesterday’s bullish inside day appears promising so we are hopeful that its retracement from last week’s high is complete, and a break above 16,000 assumes bullish continuation towards 16,400 resistance.

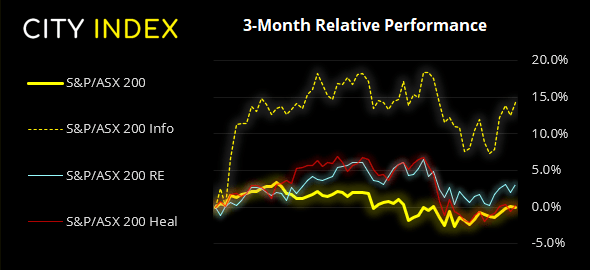

ASX 200 Market Internals:

ASX 200: 7374.9 (-0.08%), 19 October 2021

- Information Technology (1.59%) was the strongest sector and Materials (-1.39%) was the weakest

- 4 out of the 11 sectors closed higher

- 5 out of the 11 sectors outperformed the index

- 95 (47.74%) stocks advanced, 93 (46.73%) stocks declined

- 63.32% of stocks closed above their 200-day average

- 50.25% of stocks closed above their 50-day average

- 59.8% of stocks closed above their 20-day average

Outperformers:

- + 5.29%-A2 Milk Company Ltd(A2M.AX)

- + 5.19%-Zip Co Ltd(Z1P.AX)

- + 4.59%-Appen Ltd(APX.AX)

Underperformers:

- -5.72%-Unibail-Rodamco-Westfield SE(URW.AX)

- -4.47%-Codan Ltd(CDA.AX)

- -3.67%-Chalice Mining Ltd(CHN.AX)

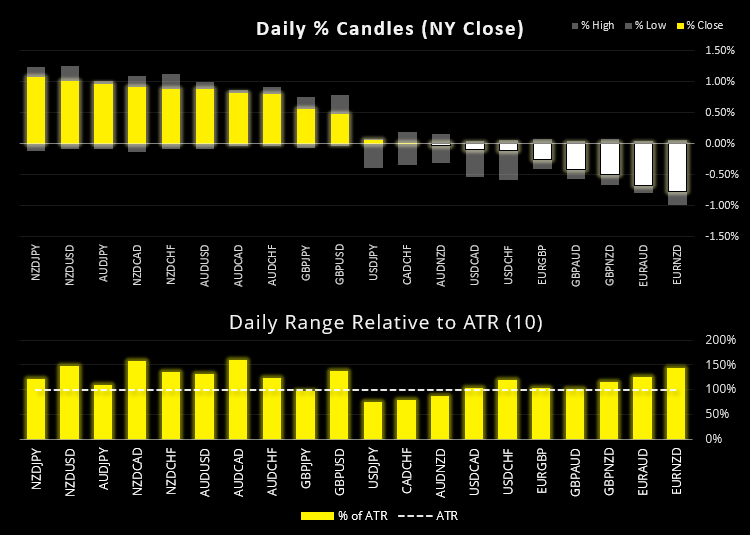

Forex:

The dollar selloff that began in Asia persisted throughout the European and US sessions to see the greenback as the weakest currency of the day. Risk assets were in favour for currency traders too, with AUD, NZD and GBP taking the lead and breaking to new cycle highs.

The US dollar index (DXY) fell to a 3-week low before finding support at the March high and recovering slightly to the August high. This allowed GBP/USD to trade beyond our initial target of 1.3810 and, with prices now retracing, seeking for support to build around 1.3770. USD/CAD tapped our 1.2300 target but has now pulled right back into the 50-hour eMA, yet remains in an established bearish channel. EUR/USD rally met resistance at the August know. AUD/USD traded above its 200-day eMA, beyond its head and shoulders target and now sits at the September high and at the upper trendline of its channel, so perhaps we’ll see some choppy price action around these levels throughout Asia.

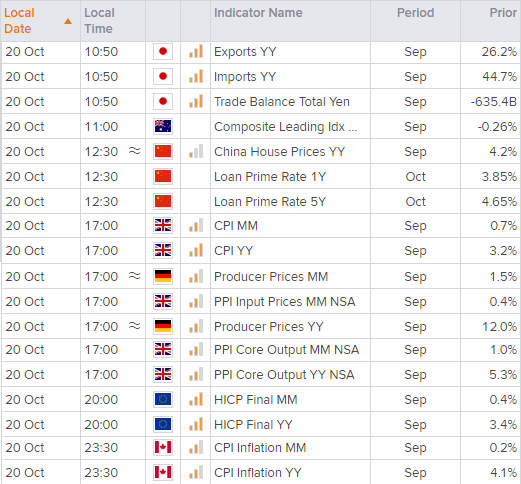

Japan’s trade data is released at 10:50 AEDT, followed by China’s 1 and 5-year loan rate at 12:30. Later we have inflation data for the UK at 17:00, Eurozone CPI at 20:00 and Canadian data at 23:30.

Commodities:

WTI is still trying to break above 83, although printed a marginally lower high compared to the prior day’s bearish hammer. Volume was also above average so it appears fresh buyers are stepping in. but our outlook remains the same – choppy trade could be expected to happen around current levels.

Silver rose over 4% by its highs of the day to keep the inverted head and shoulders pattern alive and well (and not a moment too soon). It tested $24 for the first time in 7-week and the target remains around 24.40, so now seeking higher lows to form along the way.

Up Next (Times in AEDT)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade