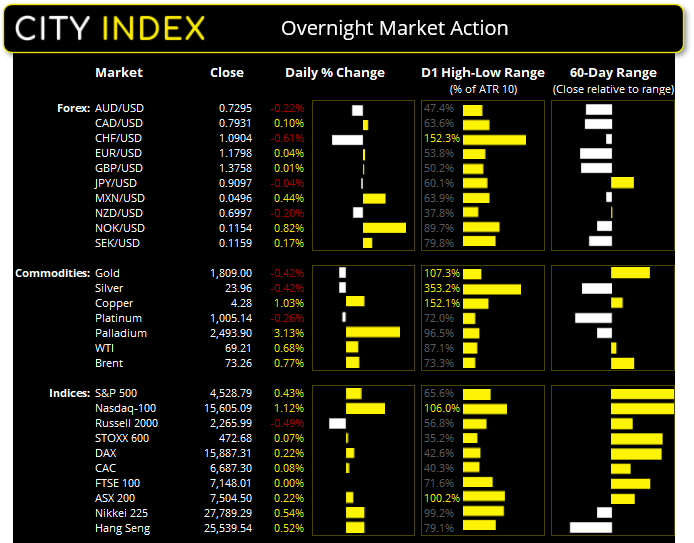

Asian Futures:

- Australia's ASX 200 futures are up 17 points (0.23%), the cash market is currently estimated to open at 7,521.50

- Japan's Nikkei 225 futures are down -50 points (-0.18%), the cash market is currently estimated to open at 27,739.29

- Hong Kong's Hang Seng futures are up 42 points (0.17%), the cash market is currently estimated to open at 25,581.54

UK and Europe:

- UK's FTSE 100 index rose 23.03 points (0.32%) to close at 7,148.01

- Europe's Euro STOXX 50 index rose 7.82 points (0.19%) to close at 4,198.80

- Germany's DAX index rose 35.56 points (0.22%) to close at 15,887.31

- France's CAC 40 index rose 5.38 points (0.08%) to close at 6,687.30

Friday US Close:

- The Dow Jones Industrial fell -55.96 points (-0.16%) to close at 35,399.84

- The S&P 500 index rose 19.42 points (0.44%) to close at 4,528.79

- The Nasdaq 100 index rose 172.136 points (1.12%) to close at 15,605.09

Learn how to trade indices

Indices:

The S&P 500 and Nasdaq 100 extended their record highs as sentiment for equity traders remained buoyant after the dovish Fed at Jackson Hole. Tech stocks outperformed, with Apple (AAPL) hitting a new high and the NYFANG+ index rising to just -0.79% beneath its all-time high set in July. Small caps didn’t fare so well, with the Russell 2000 falling -0.5% and the S&P 600 SC index down -1%.

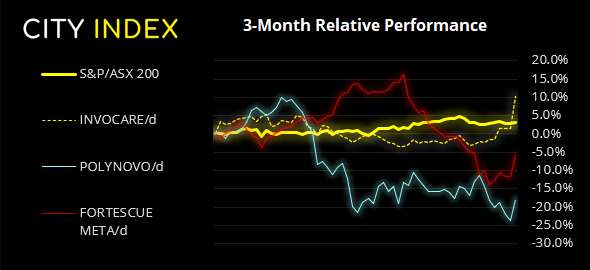

The ASX 200 appears hesitant to commit to a directional move ahead of tomorrow’s GDP report for Q2. Key support remains in place at the 7429.20 low and bullish trendline from the November low, with resistance sitting at 7542.4. Yet daily ranges continue to overlap and we suspect today may provide a similar scenario unless we see a fresh catalyst.

ASX 200 Market Internals:

ASX 200: 7504.5 (0.22%), 30 August 2021

- Materials (2.75%) was the strongest sector and Consumer Discretionary (-1.01%) was the weakest

- 5 out of the 11 sectors closed higher

- 7 out of the 11 sectors closed lower

- 4 out of the 11 sectors outperformed the index

- 69.5% of stocks closed above their 200-day average

- 61.5% of stocks closed above their 50-day average

- 58% of stocks closed above their 20-day average

Outperformers:

- + 8.68% - InvoCare Ltd (IVC.AX)

- + 7.5% - Polynovo Ltd (PNV.AX)

- + 6.6% - Fortescue Metals Group Ltd (FMG.AX)

Underperformers:

- -14.3% - Altium Ltd (ALU.AX)

- -10.8% - Nuix Ltd (NXL.AX)

- -7.34% - Healius Ltd (HLS.AX)

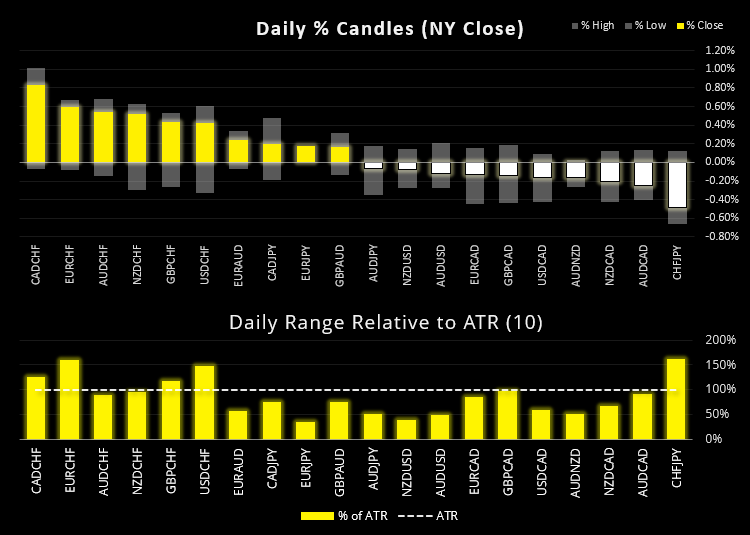

Forex: China manufacturing PMI in focus at 11:00 AEST

The baulk of forex volatility was seen across Swiss franc pairs as money flowed out of the safe-haven currency. Bullish engulfing candles formed on GBP/CHF and CAD/CHF and USD/CHF recouped most of Friday’s losses. NZD/CHF rose to a 2-week high and close above the 200-day eMA, as its countertrend rally within its bearish channel continued to play out.

The US dollar index (DXY) touched a -week low yet volatility was capped. USD/NOK fell -0.5% to a 2-month low and closed beneath its 200-day eMA for the first time since early July. USD/ZAR hit a 3-week low and traded beneath its 200-day eMA for a second session, although support was found above its monthly pivot point at 14.57. AUD/USD remained above its broken trendline and meanders around 0.73c ahead of tomorrow’s GDP report. NZD/USD remained just below Friday’s high but is struggling to hold above its 200-day eMA.

China’s NBS manufacturing PMI data is the main calendar event in today’s Asian session. According to a Reuters poll, factory output is expected to soften slightly to 50.2 from 50.4, which would be its fifth consecutive decline in growth and barely within expansionary territory (expansion is above 60, contraction is below). Should it dip below 50 then we’d expect risk assets such as equity markets and AUD to take a hit.

UK traders returned to their desks after a 3-day weekend so volumes will likely be replenished.

Learn how to trade forex

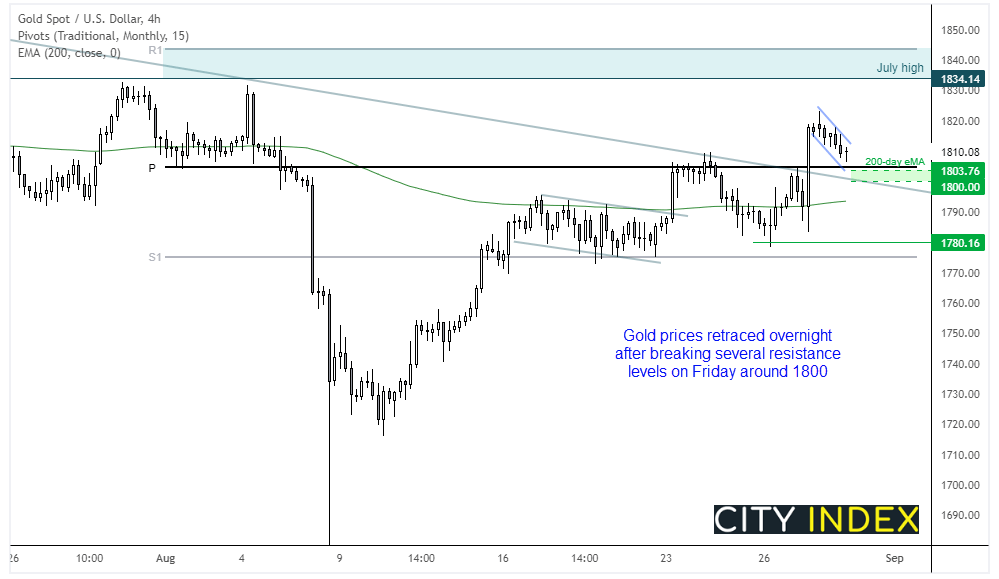

Commodities:

Commodities were broadly higher with the CRB commodity basket rising to a 1-month high (just below its 4-year high).

We’re keeping a close eye on gold to see if it can build a new level of support above or around 1800. It was down around -0.3% overnight as it retraced about a third of Friday’s bullish breakout, which saw it close above the 200-day eMA, monthly pivot point and trend resistance. We can see on the four-hour chart that it is trying to form a small bullish hammer (although the candle is yet to close) so prices are trying to stabilise. If prices can form a higher low then the next target for bulls is around 1830 – 1834.

Copper prices rose 1.4% and reached our 4.435 target. Whilst prices hold above Friday’s bullish engulfing low (4.21) then the bias remains for an eventual break above resistance towards the July high.

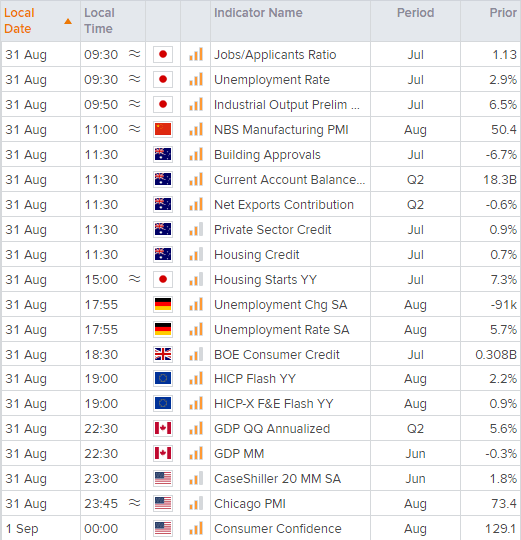

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.