Asian Futures:

- Australia's ASX 200 futures are up 33 points (0.46%), the cash market is currently estimated to open at 7,239.50

- Japan's Nikkei 225 futures are up 260 points (0.95%), the cash market is currently estimated to open at 27,788.87

- Hong Kong's Hang Seng futures are up 140 points (0.58%), the cash market is currently estimated to open at 24,106.49

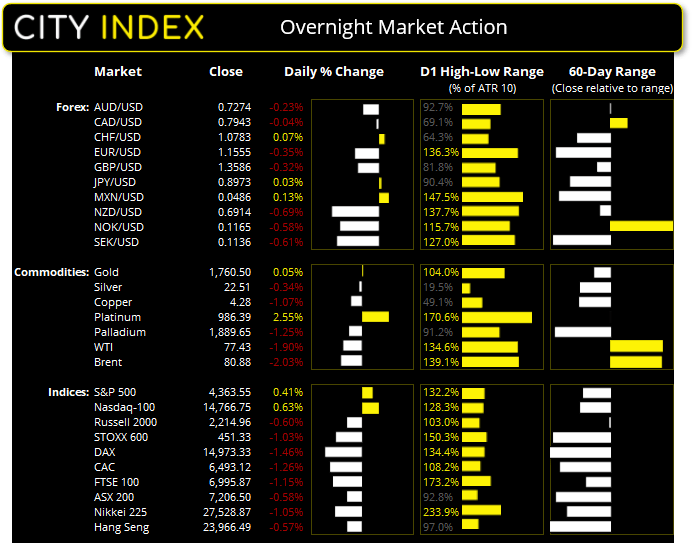

UK and Europe:

- UK's FTSE 100 index fell -81.23 points (-1.15%) to close at 6,995.87

- Europe'sEuro STOXX 50 index fell -52.78 points (-1.3%) to close at 4,012.65

- Germany's DAX index fell -221.16 points (-1.46%) to close at 14,973.33

- France's CAC 40 index fell -83.16 points (-1.27%) to close at 6,493.12

Wednesday US Close:

- The Dow Jones Industrial rose 90.49 points (0.26%) to close at 34,416.99

- The S&P 500 index rose 17.83 points (0.42%) to close at 4,363.55

- The Nasdaq 100 index rose 92.609 points (0.63%) to close at 14,766.75

US indices recover into the close on debt ceiling hopes

The vote to increase the US debt ceiling was postponed after Democrats were reported to be mulling over an offer from McConnell that could potentially remove roadblocks to make it happen. Currently the race is on to find a solution before the government misses its debt obligations on 18th October, an event Treasury Secretary Janet Yellen fears could trigger a recession. After a weak start, US indices went on to close higher led by the Nasdaq 100 which rose 0.63%, the S&P 500 was up 0.4% and the Dow 0.3%.

Those pining for a firmer Nonfarm payrolls report on Friday were given a glimmer of hope with ADP NFP employment change rising to 568k. Adding +228k to last month’s 340k print, it exceeded the 425k forecast and seemingly brings the Fed a step closer to get on with the tapering.

The ASX 200 may not have had lift-off just yet but, as long as prices remain above last week’s lows, the bias remains for an eventual break higher. And futures markets are pointing towards a firmer open.

Today is the last days of “National Day” celebrations in China, so Asian trading volumes will be replenished tomorrow.

ASX 200 Market Internals:

ASX 200: 7206.5 (-0.58%), 06 October 2021

- Energy (0.58%) was the strongest sector and Consumer Discretionary (-1.28%) was the weakest

- 9 out of the 11 sectors closed lower

- 6 out of the 11 sectors outperformed the index

- 56 (28.00%) stocks advanced, 134 (67.00%) stocks declined

- 58.5% of stocks closed above their 200-day average

- 35% of stocks closed above their 50-day average

- 32.5% of stocks closed above their 20-day average

Outperformers:

- + 4.06%-Whitehaven Coal Ltd(WHC.AX)

- + 3.86%-Virgin Money UK PLC(VUK.AX)

- + 3.18%-Janus Henderson Group PLC(JHG.AX)

Underperformers:

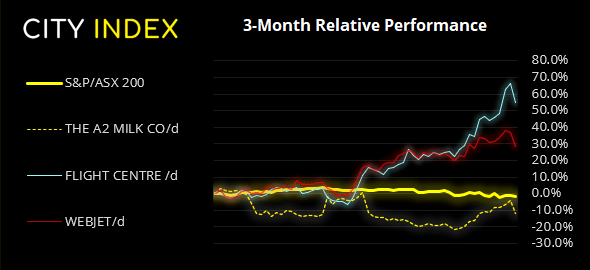

- ·-7.67%-A2 Milk Company Ltd(A2M.AX)

- ·-6.63%-Flight Centre Travel Group Ltd(FLT.AX)

- ·-6.19%-Webjet Ltd(WEB.AX)

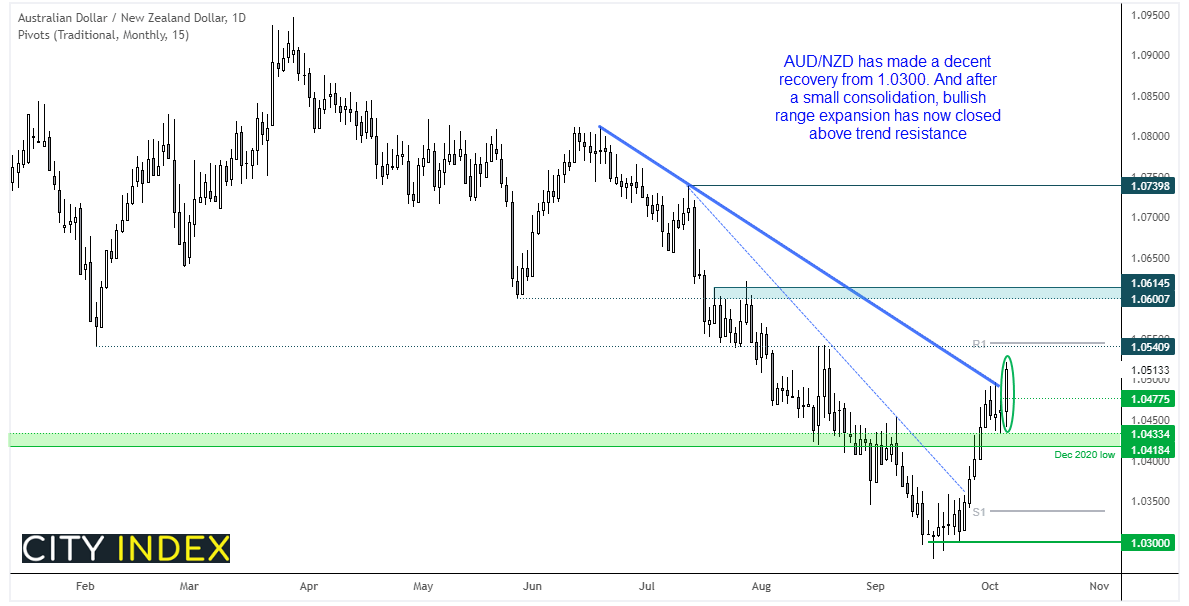

Forex: AUD/NZD continues to make headway

NZD dollar was the weakest currency as it continued to weaken after RBNZ’s ‘historic’ 25 bps interest rate hike.

EUR/USD fell to its lowest level since July 2020 thanks to weaker than expected industrial orders. Falling -7.7% in August (down from 3.4% in July) on dwindling demand after two unexpectedly strong months of growth. Falling around -0.63% by its low, EUR/USD now trades around 1.1573. EUR/CAD extended the prior days breakout to hit its lowest level since February 2020. We’re also keeping an eye on EUR/AUD as it approaches trend support and the monthly S1 pivot to see how momentum reacts around them.

AUD/NZD closed above trend resistance to suggest a higher low has been confirmed at 1.0433. Its move since the 1.0300 low over the past 14 days is around double the range of the 14 days leading down to 1.0300, which points towards a significant low. After consolidating for a few days beneath trend resistance, yesterday’s range expansion candle has closed firmly above it. The next resistance level for bulls to conquer is 1.054, near the monthly R1 pivot, where a break above it opens up a run for the highs around 1.0600 – 1.0615.

Commodities: Russia sends energy prices tumbling

Rising crude inventories weighed on oil prices, which saw them make one last push higher before rolling over. But Russia also stepped in to help soothe the energy crisis, which saw natural gas prices which tumble 10% yesterday, adding further pressure to the oil market. WTI had to correct at some stage after such an extended move, although we had thought that it may have made it to $80 first. Its initial breakout from its hourly bull flag reached 79.78 before rolling over and forming a bearish engulfing candle on the daily chart and finding support at the October high of 76.90 – making its today’s pivotal level for bulls and bears.

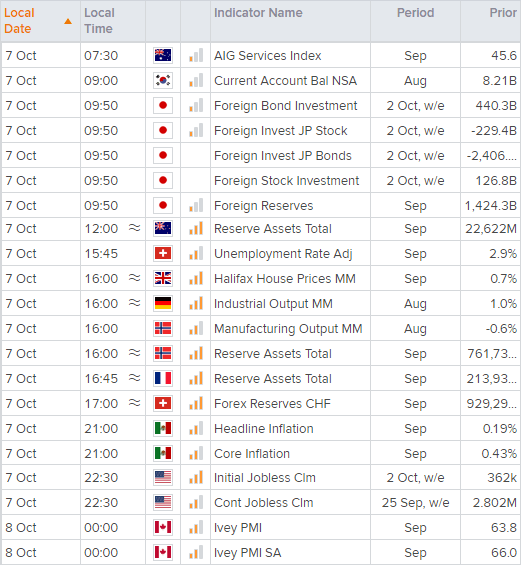

Up Next (Times in AEDT)