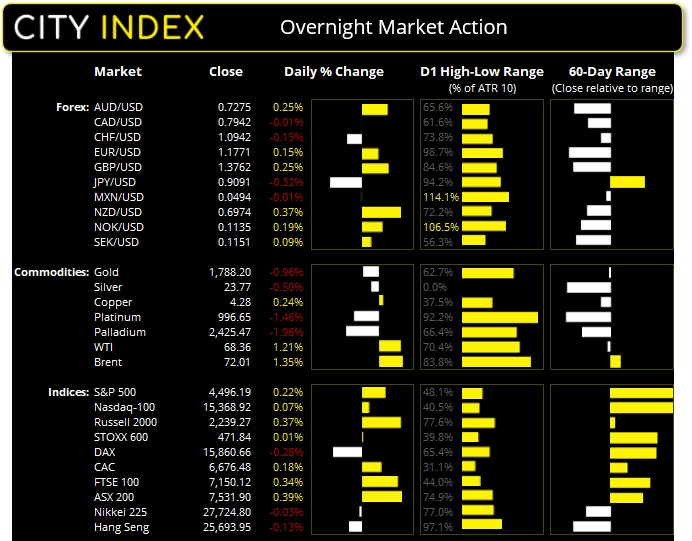

Asian Futures:

- Australia's ASX 200 futures are down -11 points (-0.15%), the cash market is currently estimated to open at 7,520.90

- Japan's Nikkei 225 futures are up 50 points (0.18%), the cash market is currently estimated to open at 27,774.80

- Hong Kong's Hang Seng futures are down -74 points (-0.29%), the cash market is currently estimated to open at 25,619.95

UK and Europe:

- UK's FTSE 100 index rose 24.34 points (0.34%) to close at 7,150.12

- Europe's Euro STOXX 50 index rose 3.04 points (0.07%) to close at 4,181.12

- Germany's DAX index fell -45.19 points (-0.28%) to close at 15,860.66

- France's CAC 40 index rose 12.17 points (0.18%) to close at 6,676.48

Wednesday US Close:

- The Dow Jones Industrial rose 39.24 points (0.11%) to close at 35,405.50

- The S&P 500 index rose 9.96 points (0.23%) to close at 4,496.19

- The Nasdaq 100 index rose 11.239 points (0.07%) to close at 15,368.92

Learn how to trade indices

US Indices edge higher

Pfizer are now seeking approval for vaccine booster injections, claiming the additional dose (on top of the double dose) increases antibodies against COVID-19 by three times. Earlier this week the FDA fully approved the vaccine.

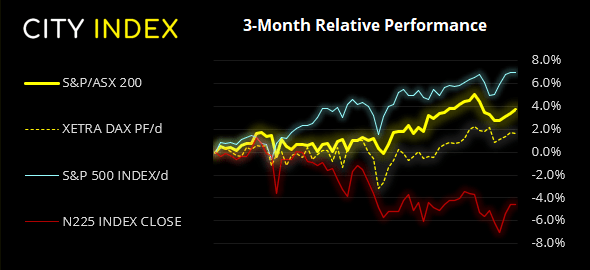

US inched higher again overnight during another session of light trade. Trading higher until lunch then giving back gains in the last hour, the S&P 500 briefly traded above 4500 before closing 0.22% up in the day. Financial and energy sectors outperformed whilst consumer staples and real estate investment trusts weigh on the broader index. Penn National Gaming (PENN) and Western Digital Corp (WDC) were top performers, rising 8.7% and 7.8% respectively. US yields were higher overnight as traders sold bonds ahead of the Jackson Hole meeting.

ASX 200 Market Internals:

ASX 200: 7531.9 (0.39%), 25 August 2021

- Information Technology (1.86%) was the strongest sector and Telecomm Services (-1.54%) was the weakest

- 4 out of the 11 sectors closed higher

- 3 out of the 11 sectors closed lower

- 120 (60.00%) stocks advanced, 73 (36.50%) stocks declined

- 69% of stocks closed above their 200-day average

- 68.5% of stocks closed above their 50-day average

- 61% of stocks closed above their 20-day average

Outperformers:

- + 28.5% - WiseTech Global Ltd (WTC.AX)

- + 8.73% - Appen Ltd (APX.AX)

- + 8.49% - Hub24 Ltd (HUB.AX)

Underperformers:

- - 10.8% - Reece Ltd (REH.AX)

- - 9.73% - Nine Entertainment Co Holdings Ltd (NEC.AX)

- - 7.56% - Seven Group Holdings Ltd (SVW.AX)

Forex: AU Capex up next

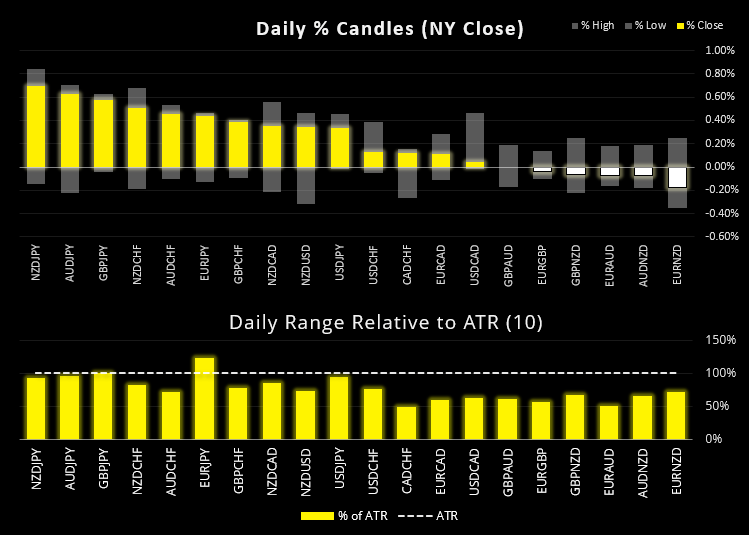

The US dollar index (DXY) made a false break above Tuesday’s high and erased all earlier gains to form a bearish outside day, closing near Tuesday’s low. Given the dollar and gold dropped together it suggests traders are squaring up their positions ahead of Powell’s speech in the early hours of tomorrow.

The Yen and Swiss franc were again the weakest currencies as money flowed out of safe havens and into risker currencies such as AUD, GBP ad NZD. The New Zealand and US dollar are the strongest majors month to date.

USD/CAD made a minor effort to rally early on yet closed effectively flat, sitting around the support zone highlighted in yesterday’s European Open report.

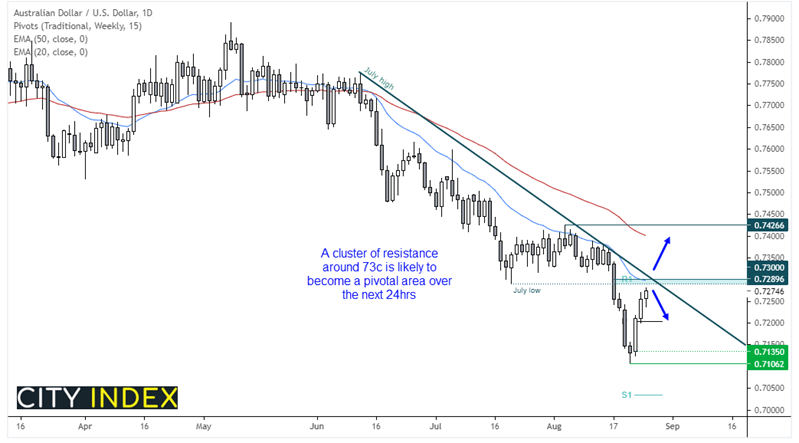

AUD/USD rallied for a third day, a streak of wins not cobbled together in two months. Yet it is approaching a key resistance zone which is likely to become a pivotal area leading into Powell’s speech at Jackson Hole. The combination of the July low, 20-day eMA and weekly R1 pivot places a resistance zone between 0.7289 – 0.7300. A descending trendline from the July high also provides an extra layer of potential resistance around key events. The bias remains bearish whilst prices remain beneath the resistance cluster, but should that level hold it could see some decent bullish follow-through.

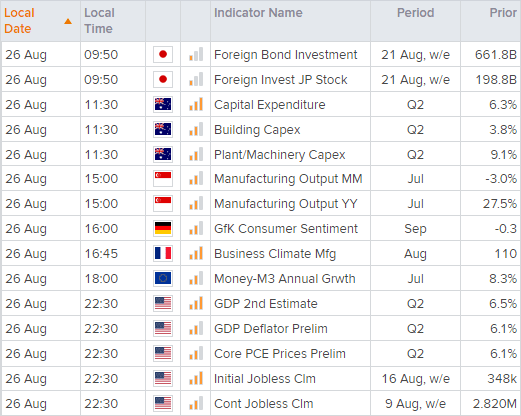

The Key event to watch out for today (if you’re still up) is Jerome Powell’s keynote speech at 02:00 AEST tomorrow (15:00 BST or 10:00 EST). But at 11:30 today Australia releases CAPEX data for Q3. Given the extended lockdowns and expectations for GDP to contract, a surprise upside CAPEX report would be welcomed by the RBA. But, as it rose unexpectedly in Q2, then perhaps that is wishful thinking given the given the circumstances.

Learn how to trade forex

Commodities:

Oil prices rallied for a third day as the EIA report showed demand hit its highest levels since March 2020. However, momentum is waning as the daily range is the smallest of three and a Doji formed below the 50-day eMA. With all eyes on the dollar over the next 24-hours we doubt we’ll see much action across commodities until the dollar makes it moves, with Powell being the likely catalyst. WTI now sits around the midway of 66 support and 70 resistance.

Gold prices fell around -1% to a two-day low, invalidating the bull-flag breakout and taking it back below the 50-day eMA and 1800. Perhaps the market has topped, although we’d prefer to wait for a break below 1773.2 before jumping to that assumption.

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.